There are many ways through which you can import your goods, products and or services from China to Kenya without any hustle. In fact, Provided you can present all the relevant documentation and any other pieces of information needed, you will be all good to go. In as much as importing your products to another foreign country to do business there, it can also be quite a demanding experience. For one, you need to do some extensive research on that country that you wish to export your goods to, Kenya, and ensure that you do appropriate preparation, have all the necessary paperwork, and plan the whole process in advance.

China and Kenya are good friend

FAQS:

- What are the fees for importing goods to Kenya?

- Files and documentation that you need to have for customs clearance in Kenya

- What are the prohibited items?

- What are the restricted items

- Motor vehicle import regulations in Kenya

- Animal import regulations in Kenya

- Where can I find a reliable international mover for my products?

1. What are the fees for importing goods to Kenya?

So, you have weighed all of your options and found that Kenya is the country with the most business potential. Then you decide that this is the country to start importing your goods to and hope to make some good bucks. So, you want to know about the customs duty and taxes that are likely to be levied on your goods before you import them to Kenya. You will be required to pay customs duty or taxes which you can do either as a private individual or as a commercial entity.

The method of valuation of the customs duty and tax in Kenya is CIF. Meaning that the overall sum of all the imported goods plus cost of shipping and insurance are subject to tax. Import duty and import goods are subject to Excise duty, Import Declaration, and Sales Tax fees.

I. Sales Tax

For Kenya, the duty rates range from 0% to 100%. The average duty rate, however, stands at 25%. The current Sales Tax stands at 16% when there no threshold on the goods.

II. Excise duty

Excise duty is only charged on products such as tobacco and alcoholic beverages. Here is a more detailed illustration of the Kenyan excise duty.

- A tax of Ksh. 10 per liter for fruit juices, vegetable juices, fermented or not and whether they contain added sugar or any other sweetener.

- A tax of 10% on all food supplements.

- A tax of Ksh. 5 per liter for all waters or any other non-alcoholic beverages excluding fruit and vegetable juices.

- A tax of Ksh. 100 per liter for all Mead, Perry, Cider, Opaque beer or any other mixtures of fermented drinks with non-alcoholic drinks. Spirituous drinks that their alcoholic strength don’t exceed 10% also fall in this category.

- A tax of Ksh. 100 per kg for all powdered beer.

- A tax of Ksh. 150 per liter for all wines and all other alcoholic drinks obtained by fermenting fruits.

- A tax of Ksh. 175 per liter for all spirits of undenatured ethyl alcohol plus any other spirituous drinks with an alcoholic strength above 10%.

- A tax of Ksh. 10,000 per kg for all cigars, cigarillos, cheroots that contain tobacco or tobacco substitutes.

- A tax of Ksh. 3,000 per unit for all electronic cigarettes.

- A tax of Ksh. 2,000 per unit for all cartridges for electronic cigarettes.

- A tax of Ksh. 2,500 per mile for all cigarettes that contain tobacco or tobacco substitutes.

- A tax of Ksh. 7,000 per kg for any other manufactured tobacco or tobacco substitutes; reconstructed or homogeneous.

- A tax of Ksh. 150,000 per unit for all motor vehicles less than 3 years old from the date of their first registration or Ksh. 200,000 for the older ones.

- A tax of Ksh. 10,000 per unit for all motorcycles of traffic 87.11 with an exception on motorcycle ambulances.

- A tax of Ksh. 120 per kg for all plastic shopping bags.

III. Import declaration fees

This fee is charged at all imports in Kenya at a rate of 2.25% of Ksh. 5,000 per import or of the CIF value; whichever is higher.

2. Files and documentation that you need to have for customs clearance in Kenya

You will find that every country and or state has its own laws, rules, and regulations when it comes to product and service importation into their lands. And Kenya is no different. As a matter of fact, there are some documentation and papers that you must have with you in the event that you want to import certain goods, products, or services into the country.

There are many important documents that you need to have on you when exporting your goods from China to Kenya.

Here is a list of all the necessary documents that you need to have on you at all times when importing your products into Kenya:

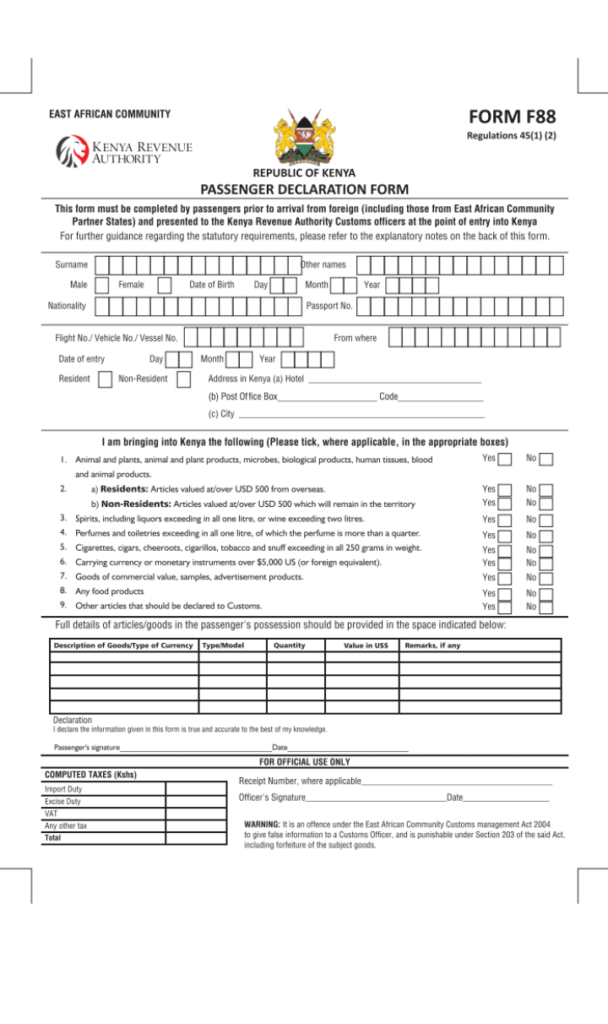

Import declaration form

Before you import your products into Kenya, you must apply and obtain an IDF from the Kenya Revenue Authority in Kenya for all the commercial importations. In such a case, you can consult a clearing and consulting agent to help you with this process. Once you have obtained this document, then you may be processed to prepare your cargo for inspection. Once everything has been completed, cargo can then be shipped. This document should contain the following information about your product;

- Quantity – this should be detailed and as accurate as possible. It is recommended that you identify and quantify each of the items that you wish to import differently instead of grouping them.

- The value of the cargo – this is necessary for tax calculation of the goofs. Ensure that you use the correct values so as to avoid any disputes.

- Classification of the cargo – ensure that you ask someone who knows this information if you as not sure about the classification of your cargo. Different cargo classifications have different taxation and that is the reason why you need to be sure about what you input.

- Quality – there are other control bodies in Kenya such as the Kenya Bureau of Standards, the Department of Agriculture, the Public Health Department, etc. can sometimes be asked to determine whether the expected standards of the cargo have been met.

Here is a little preview of what a customs import declaration form is supposed to look like.

Certificate of Conformity

Certain agents such as the SGS, the Bureau Veritas, INTERTEK, etc. have been appointed by the country to monitor and ensure the conformity inspection of all the commodities that need to be inspected before approving their importations into the country. You can find the full list of all the on this website: http://www.kebs.org/?opt=qai&view=pvoc

Commercial invoice

You must have a detailed commercial invoice that conforms exactly with the packing list. The consignment must also be clearly indicated on the commercial invoice. In fact, to make everything match with your packing list, you can simply copy and paste the information so as to avoid any inconsistencies in these two pieces of documents. This document will also contain the total items costs, insurance amounts, and freight charges which must all be broken down on all of the commercial invoices.

Packing list

You must also ensure that the distribution of all the goods on the packing list that you intend to import into Kenya match with your commercial invoice. The packing list also needs to have your package description, number, weight in metric tons, length width and height in meters, and the cubic measurements of all the packages.

Exemption letter

In cases where your imports involve goods and products for charities, governmental organizations, major projects, diplomatic missions, etc. you can apply for an exemption letter which should exempt you from any duties and or VAT charges. If accepted, then the Treasury will instruct the customs office not to collect any waived portions on that particular consignment.

Dispatch all documents on time

It is vital that you dispatch all the necessary documentation and papers on time, at least seven days prior to the cargo arriving at the port of Kenya or by air.

3. What are the prohibited items?

Before you acquire and or sign any documentation of the products, good and or services that you wish to import into Kenya, however, you need to ensure that you check and even double check whether the country allows or prohibits the importation of such items or services. Here is a list of some of the products and or services that are prohibited in Kenya:

- Pornography and or any other subversive materials

- Gambling machines

- Explosive and or ammunition and weaponry

- Narcotics or any other illegal drugs

- Political literature

- Precious stones and metals

- Counterfeit currency and securities

- Animal skins, traps, tasks, ivory, game trophies, etc.

These are some of the prohibited items that you are not allowed to import into Kenya.

4. What are the restricted items?

Aside from prohibited products and or services that you are banned from importing into Kenya, there are certain products and services that all importers are restricted from importing into the country. Some of these products and services require you to have special authorizations and or payments of taxes and duties for the Kenyan customs authority to clear them into the country. These items may include, but not limited to;

- Plants, bulbs, seeds, fresh fruits and vegetables; unless you acquire a permit from the Ministry of Agriculture in Kenya

- Firearms, plastic toy guns, and airsoft guns; unless you have a firearms certificate acquired from the Kenya Firearms Bureau

- Birds, bird eggs, or any related materials. You need a Sanitary Import Permit from the Director of Veterinary Services for these items

- Alcohol – limited to only one bottle which is duty-free

- Computers – these are subject to tax plus duties

- Tobacco – limited to only 200 cigarettes or 50 cigars

- New items may need you to provide an import permit plus tax and duties also apply

- Perfume – limited to only one pint

- Electronics and appliances – you must provide the relevant invoices or receipts plus serial numbers for these

- Fabrics – are also subject to tax and duties

5. Motor vehicle import regulations in Kenya

For motor vehicles and other automobiles that you intend to import into Kenya, you will need to get some help from experienced international shippers who can apply their extensive knowledge and experience on overseas automobile shipping laws plus custom regulations. There are certain documentation which you need to have and present to the relevant customs authority in Kenya before they can clear your automobiles into the country. Here is a short list of some of them;

- Authority to import the said vehicle

- An Import Declaration Form

- Original bill of lading of the vehicle

- A C-15 form plus PIN certificate of the vehicle

- Clean vehicle/s logbook written in English

- Certificate of road worthiness

- Original title and registration of the vehicle

Import Vehicles to Kenya

Failure to submit all and or any of these documents can result in the rejection of your request to import your automobile/s into Kenya. It is, therefore, vital that you start compiling all of these documents long before the time comes for the importations of your automobiles.

6. Animal import regulations in Kenya

In situations where you want to transport your animals and or pets from China to Kenya, you also need to ensure that they clear customs first without any trouble. Kenya has some requirements that you must meet before you can successfully import any animals into the country. Here are some of those regulations;

- Health certificate issued by a licensed veterinarian

- Vaccination certificate issued within a year prior to the import

- Import permit which needs to be applied at least one month prior to the importation

- Avail all documents before the import occurs – issued at the point of origin, China

Animal and other related products

All in all, you can safely import your animals or pets into Kenya safely and without any pressure as long as you meet all the requirements and documentation at customs.

7. Where can I find a reliable international mover for my products?

It is a fact that the imports and exports business of products and services is a daunting task. In the real sense, it is a very complex venture. This always calls for the need to have an experienced and trustworthy moving company to help ferry your products from China to Kenya. Remember that you are also looking for a moving company that will handle your precious cargo without damaging them. This calls for the need to look for the best overseas moving company that ships goods from China to Kenya. Do all the necessary checks on the overseas moving company that you intend to hire before hiring them. You can create a shortlist of these companies then choose from the best one that suits your preferences.

identify the port of loading

These processes simply mean that there is more to importing goods to Kenya than just ferrying them. You need to ensure that you have everything covered especially the documentation and regulations too. Failure to follow all or any of these laws can result in fines and penalties that you didn’t plan for.

The short version

Here is a summary version of the things you can do and steps you can follow to ensure you have a smooth experience transporting your goods to Kenya from China.

- You just need to know what you are importing into Kenya.

- Do some research on whether the country allows for the importation of the said goods.

- If so, then you can go ahead and start planning how you can acquire all the necessary documentation.

- After that, you can proceed to do some basic search on a good overseas moving company to ferry your goods. Overseas couriers that ferry goods to Kenya from China include DHL, EMS, and Salihiya Cargo.

- You must also ensure that you know exactly how much you are going to spend throughout the transportation process.

- Identify the port of loading your goods. Remember, China has a lot of loading ports. Choose the one that best suits your preferences. Shenzhen, Ningbo, Shanghai, Tianjin, Dalian, and Qingdao are among the few ports of China.

- Collect your goods at the Kenyan port. Mombasa is the only port located in Kenya.

If you do manage to successfully pass through these stages, then the next step is to harness your inner entrepreneurial skills to sell your goods in the country.

Ship about to dock at the port of Mombasa

Welcome to Kenya, hope you enjoy your stay and have a splendid time.

Summary

As you have noticed from the above article, importing goods from China to Kenya is relatively an easy process. You only need to be diligent, patient, and keen on all the regulations and also provide the necessary documentation and everything s pretty much sorted out. In fact, you can end up having some good experiences ferrying your goods into Kenya as long as you abide by their laws. Nothing works better and smooth as a transition which involves agreements between two parties. In this case, you or your business and Kenya. That being said, we hope you have a fantastic experience ferrying your goods to Kenya and have your own good story to tell.

For any further questions and/or queries, feel free to leave a message below or email me here: [email protected]

hi,

I wanted to buy a ZNEN scooter from Znen motors China but they said they don’t ship to one user.

Please assist me buy the said scooter and help shipping here to Kenya.

Thanks.

Samuel.

nice to be here.

thanks for the information. am interested in doing business in computers and other electronics.

Hi Patrick ,Kindly provide your order details & information to us