How to import Shoes from China? From this article ,you will know how to save the costs of shoes and get more competitive prices.Shoes are a part of our lives and we wear them every day, as shoes accompany us throughout our lifetime.The market for shoes is extremely huge and the competition for shoes is also very fierce, especially in terms of price. By now, China is still the world’s largest manufacturer of shoes. As a businessman, if you want to import shoes from China, you must understand “Made in China” and how to import shoes from China step by step. First ,we should consider which is our target markets , such as locally, ecommerce stores, Shopify sites, or platforms like Amazon and ebay ? Before importing shoes from China, you must learn more about shoes like materials (upper and sole). The classification of shoes includes men’s, women’s, and children’s styles.

The main reasons for importing shoes from China are cost advantages. China offers lower labor costs and a mature supply chain, resulting in strong price competitiveness. Additionally, China’s production capacity and scale are unmatched. As the “world’s factory,” China can mass-produce shoes to meet diverse demands. In terms of quality, while Chinese products were once perceived as cheap, they have now improved significantly, with mid-to-high-end products becoming competitive. For example, many global brands like Nike and Adidas manufacture their shoes in China.

China boasts a complete industrial chain, from raw materials to finished products, along with efficient logistics and fast delivery. The product diversity ranges from sports shoes to fashionable footwear, catering to various markets. OEM/ODM services are also available, allowing foreign brands to collaborate flexibly. Key considerations when importing shoes from China include price, quality, custom branding, supplier services, and delivery timelines.

Before importing shoes from China, you must thoroughly understand your local market. What shoe styles are popular locally? Is the demand for low-end, mid-range, or high-end products? What is the local consumption level? These are critical factors to analyze. After market research, you can explore how to import shoes from China.

As a foreigner, researching online to understand shoe pricing and manufacturers from internet. First, searching shoe manufacturers from google.com or these wholesale websites like Alibaba.com, 1688.com, GlobalSources.com, Yiwugou.com, and Made-in-China.com. Among these, 1688.com is highly recommended. Although it currently supports only Chinese, its prices are lower than others due to it mainly targets the domestic market in China. Many middle-businessman source products from 1688.com and resell them on Alibaba at higher prices. Click here to learn more about How to buy it from 1688.com?

Preliminary preparations

Importing shoes from China must do the prior preparation works first, and it is necessary to learn more about the process of importing shoes and sourcing suppliers with competitive price. As a foreigner, importing shoes from China, the following are the preliminary preparations and points to note:

1. Market Research

Target Market Demand: Understand the demand, trends, consumer preferences, and price ranges in your domestic shoe market. Identify the types, styles, and tiers of shoes to import. Confirm target market requirements, including styles, sizes, colors, and materials.

Competitor Analysis: Study competitors’ products, pricing, and market share.

2. Define Product Specifications

Product Type: Specify the shoe categories (such as men’s, women’s, children’s, sport shoes).

Size Range: Determine common sizes in the target market.

Material Requirements: Clarify materials for uppers, soles, linings, etc.

Packaging Requirements: Ensure packaging meets shipping and retail standards.

3. Supplier Selection

Supplier Sourcing: Use B2B platforms (such as Alibaba, 1688.com,google.com), attend trade fairs, or conduct on-site visits.

Background Checks: Verify suppliers’ business licenses, production capacity, and quality control systems.

Factory Audit: Visit factories in person or commission third-party audits.

Sample Testing: Request samples for quality inspection.

4. Contract Negotiation

Price Negotiation: Set reasonable pricing based on market research.

Payment Terms: Recommend phased payments (such as 30% deposit, 20% during production, 50% upon delivery).

Quality Clauses: Define quality standards and inspection responsibilities.

Delivery Timeline & Quantity: Ensure suppliers meet order deadlines and volume requirements.

Minimum Order Quantity (MOQ): Understand the minimum order quantity of suppliers and select suppliers that meet the budget

5. Logistics Arrangements

Shipping Methods: Choose sea, air, express or land freight based on cargo volume, weight, and urgency.

Logistics Partners: Select reliable logistics providers to ensure safe transportation.

6. Customs Clearance Preparation

Regulatory Compliance: Familiarize yourself with the target country’s import regulations and standards.

Documentation: Prepare commercial invoices, packing lists, certificates of origin, quality certificates, etc.

Duties & Taxes: Calculate tariffs, VAT, consumption taxes, and other fees.

Customs clearance agent: Search your local customs clearance agent from google.com .The customs clearance agent can help you to caculate the import duties according to the HS codes.The customs clearance agent is very helpful to us.

7. Quality Control

Inspections: Hire third-party inspection agencies to monitor production and conduct final product checks.

Sample Testing: Conduct detailed tests to ensure compliance with quality standards.

8. After-Sales Service

Return/Exchange Policy: Negotiate clear terms with suppliers.For quality issues, suppliers must bear the round-trip shipping costs and return or exchange of goods.

Customer Support: Establish a robust after-sales service system.

9. Financial Preparation

Cost Estimation: Calculate total costs, including procurement, shipping, tariffs, VAT, and agent fees. Ensure sufficient funds to support import operations.

10. Payment Terms

Negotiate secure payment methods with suppliers, such as:

Letter of Credit (L/C)

Telegraphic Transfer (T/T)

Wise/Payoneer

Bank transfers (Like 30% prepayment, with the remaining 70% paid after receiving product photos or videos).

11. Marketing Strategy

Pricing Strategy: Set prices considering costs, tariffs, and market competition.

Sales Channels & Promotion: Plan distribution channels and marketing campaigns to boost brand awareness and market share.

Where are the shoe manufacturers located in China?

China is the world’s largest footwear manufacturer, with shoe manufacturing mainly concentrated in the following regions, each featuring distinctive product styles:

These regions have become the core areas of China’s shoe production, thanks to their mature industrial chains, abundant labor resources, and well-developed supply chain systems. They have become the main bases for the shoe industry due to China’s advantages in labor, raw materials, and transportation. The following are the main regions for shoe production in China:

1.Fujian Province

Main production areas: Jinjiang, Quanzhou, Putian.

Styles:

Sports Shoes: Jinjiang is China’s largest sports shoe production base, home to many well-known brands such as Nike,Addidas Anta, 361°, and Hongxing’erke, producing over 1.3 billion pairs of sports shoes annually.

Casual Shoes: Putian is known for producing high-quality casual and sports shoes.

2.Guangdong Province

Main production areas: Guangzhou, Dongguan, Huizhou.

Styles:

High-end Leather Shoes: Guangzhou is known for producing high-end leather shoes, mainly for OEM and custom-made orders.

Export Shoes: Dongguan, known as the “World’s Factory,” mainly produces export shoes for international brands such as Nike and Adidas.

PU Leather Shoes: Huizhou specializes in producing PU leather shoes.

3.Zhejiang Province

Main production areas: Wenzhou, Taizhou.

Styles:

Mid-range Leather Shoes: Wenzhou, known as “China’s Shoe Capital,” mainly produces mid-to-high-end leather shoes and is home to well-known brands such as Hongqingtian and Aokang.

Casual Shoes: Taizhou specializes in producing casual shoes.

4.Sichuan Province

Main production areas: Chengdu, Chongqing.

Styles:

Women’s Shoes: Chengdu and Chongqing are important production bases for women’s shoes in China, home to well-known brands such as Belle and Staccato.

Casual and Sports Shoes: Some enterprises also produce casual and sports shoes.

5.Shandong Province

Main production areas: Gaomi.

Styles:

Safety Shoes: Shandong is one of China’s important production bases for safety shoes, with a wide range of products including anti-smash, puncture-resistant, anti-static, insulating, and heat-resistant functions.

6.Other Regions

Zhuzhou, Hunan Province: Mainly produces casual and sports shoes.

Hefei, Anhui Province: The shoe industry has developed rapidly in recent years, mainly producing mid-range shoes.

Changzhou, Jiangsu Province: Specializes in producing leather and casual shoes.

Types and styles of shoes

Men’s Shoes

- Casual Shoes

- Athletic Casual Shoes: Suitable for daily wear with a sporty style, such as casual styles from Nike and Adidas.

- Canvas Shoes: Lightweight and breathable, popular among young people, like Converse and Vans.

- Leather Casual Shoes: Simple and elegant, perfect for pairing with casual outfits, such as loafers and Derbys.

- Martin Boots: With a rugged style, ideal for autumn and winter seasons, like Dr. Martens.

- Work Boots: Durable and suitable for outdoor or work settings, such as Timberland.

- Formal Shoes

- Oxfords: Classic styles suitable for formal occasions, like business meetings.

- Derbys: With a more relaxed lacing design, perfect for pairing with casual formal outfits.

- Monkstraps: Unique double-strap design, suitable for business casual settings.

- Brogues: Formal shoes with decorative perforations, ideal for stylish combinations.

- Leather Boots: Suitable for autumn and winter, can be paired with suits or casual outfits.

- Sports Shoes

- Running Shoes: Focus on cushioning and support, suitable for running activities.

- Basketball Shoes: High-top design for ankle protection, suitable for basketball.

- Soccer Shoes: Lightweight and durable, suitable for soccer.

- Hiking Shoes: Waterproof and durable, suitable for outdoor hiking.

- Tennis Shoes: Lightweight and slip-resistant, suitable for tennis.

- Outdoor Shoes

- Hiking Shoes: Waterproof and breathable, suitable for long-distance hiking.

- Mountaineering Shoes: Sturdy and durable, suitable for mountain climbing.

- Wading Shoes: Waterproof and slip-resistant, suitable for water-crossing activities.

- Camping Shoes: Lightweight and comfortable, suitable for camping.

- Slippers/Sandals

- Flip-Flops: Simple and lightweight, suitable for the beach or home.

- Sandals: Good breathability, suitable for daily wear in summer.

- Slippers: Comfortable and soft, suitable for home or casual use.

Women’s Shoes

- Casual Shoes

- White Sneakers: Simple and versatile, suitable for daily wear.

- Canvas Shoes: Lightweight and stylish, such as Converse and Vans.

- Martin Boots: With a rugged style, suitable for autumn and winter.

- Snow Boots: Warm and comfortable, suitable for winter, like UGG.

- Loafers: No-lace design for easy wear.

- Formal Shoes

- High Heels: Enhance elegance, suitable for formal occasions.

- Stilettos: Elegant and stylish, suitable for banquets or business settings.

- Block Heels: Comfortable and stylish, suitable for daily wear.

- Flats: Comfortable and lightweight, suitable for long periods of walking.

- Mary Jane Shoes: Retro style, suitable for fashionable combinations.

- Sports Shoes

- Running Shoes: Focus on cushioning and support, suitable for fitness activities.

- Yoga Shoes: Soft and comfortable, suitable for yoga practice.

- Basketball Shoes: Suitable for female basketball enthusiasts.

- Hiking Shoes: Waterproof and durable, suitable for outdoor activities.

- Gym Shoes: Lightweight and breathable, suitable for gym wear.

- Outdoor Shoes

- Hiking Shoes: Waterproof and breathable, suitable for outdoor hiking.

- Wading Shoes: Lightweight and slip-resistant, suitable for water-crossing activities.

- Camping Shoes: Comfortable and soft, suitable for camping.

- Slippers/Sandals

- Flip-Flops: Simple and lightweight, suitable for the beach or home.

- Sandals: Diverse styles, suitable for daily wear in summer.

- Slippers: Comfortable and soft, suitable for home or casual use.

- Heeled Sandals: Elegant and stylish, suitable for banquets or parties.

Children’s Shoes

- Infant Shoes

- Cloth Shoes: Soft and comfortable, suitable for babies learning to walk.

- Soft-Sole Shoes: Lightweight and breathable, suitable for indoor wear.

- Crawling Shoes: Slightly harder soles for support, suitable for initial walking.

- Toddler Shoes

- Sports Shoes: Lightweight and breathable, suitable for daily activities.

- Canvas Shoes: Stylish and lightweight, suitable for kindergarten or outdoor activities.

- Leather Shoes: Suitable for formal occasions, such as school activities or festivals.

- Youth Shoes

- Running Shoes: Focus on cushioning and support, suitable for sports.

- Basketball Shoes: Suitable for children’s basketball activities.

- Hiking Shoes: Suitable for outdoor activities, waterproof and durable.

- Casual Shoes: Diverse styles, suitable for daily wear.

- Special-Function Shoes

- Orthopedic Shoes: Suitable for children with foot development issues.

- Waterproof Shoes: Suitable for rainy days or outdoor activities.

- Insulated Shoes: Suitable for winter, warm and comfortable.

About the size of shoes

The Chinese shoe sizing system adopts the international standard sizing, which measures the size of shoes in millimeters or centimeters. For example, if the foot length is 250 millimeters, the corresponding shoe size is size 25; if the foot length is 23.5 centimeters, the shoe size is 23.5. This is directly determined according to the actual length of the foot, which is simple and intuitive, and the correspondence with the foot length is relatively clear.

The European sizing is the commonly used shoe sizing standard in the European region. The approximate conversion formula between European sizing and foot length is: Shoe size = Foot length (in centimeters) × 2 – 10. For instance, if the foot length is 25 centimeters, calculating according to the formula, the European size is 25 × 2 – 10 = size 40. However, there may be some slight differences in actual production. European sizing is quite common in shoes of some European brands as well as in the footwear products of internationally renowned brands.

The US sizing is divided into US men’s shoe sizing and US women’s shoe sizing.

Men’s shoes: The approximate relationship between US sizing and foot length (in inches) is: US size = Foot length (in inches) – 13 + 0.5. For example, if the foot length is 10 inches, the corresponding US size is 10 – 13 + 0.5 = size 7.5.

Women’s shoes: US size = Foot length (in inches) – 12 + 0.5. If the foot length is 9 inches, then the US size is 9 – 12 + 0.5 = size 6.5.

The UK sizing is similar to the US sizing, but it also has its unique conversion method. Generally, the UK sizing is about 1 size smaller than the US sizing.

Men’s shoes: UK size = Foot length (in inches) – 13. For example, if the foot length is 10 inches, the UK size is 10 – 13 = size 7.

Women’s shoes: UK size = Foot length (in inches) – 12. If the foot length is 9 inches, the UK size is 9 – 12 = size 6.

The Japanese sizing is quite close to the Chinese sizing, and it also represents the foot length in centimeters. Generally speaking, the centimeter values of the Japanese sizing and the Chinese sizing are basically the same, except that there may be some differences in some minor size divisions. For example, if the foot length is 24 centimeters, the corresponding Japanese size is size 24.

Here are the conversions for different sizes of men’s shoes:

| Chinese(mm) | EU | US | UK | JP |

|---|---|---|---|---|

| 250 | 40 | 8.5 | 8 | 250 |

| 255 | 41 | 9 | 8.5 | 255 |

| 260 | 42 | 9.5 | 9 | 260 |

| 265 | 43 | 10 | 9.5 | 265 |

| 270 | 44 | 10.5 | 10 | 270 |

| 275 | 45 | 11 | 10.5 | 275 |

| 280 | 46 | 11.5 | 11 | 280 |

The size conversion for women’s shoes is usually 1-2 sizes smaller than men’s shoes. The conversion is as follows (for women’s shoes):

| Chinese(mm) | EU | US | UK | JP |

|---|---|---|---|---|

| 230 | 36 | 6.5 | 6 | 230 |

| 235 | 37 | 7 | 6.5 | 235 |

| 240 | 38 | 7.5 | 7 | 240 |

| 245 | 39 | 8 | 7.5 | 245 |

| 250 | 40 | 8.5 | 8 | 250 |

Note: It’s better to buy samples from suppliers first ,then you will know the size of shoes if it’s standard size or NOT.

What are the requirements and certifications for shoes when importing?

I listed the requirements and certifications for importing shoes . If Import Customs required certificate for shoe imports, we must obtain it from the supplier. If the supplier cannot provide it, we will not be able to import the shoes. First, we need to understand the requirements and certifications for importing shoes in our country. If you are unfamiliar with the import process, you can also consult a local customs clearance agency and they can help you out for this .

1.United States

CPSIA Regulations: All children’s shoes must comply with the Consumer Product Safety Improvement Act (CPSIA) regulations set by the U.S. Consumer Product Safety Commission (CPSC) to ensure product safety.

Chemical Restrictions: Must meet U.S. environmental requirements, restricting harmful substances such as formaldehyde and azo dyes.

2.European Union

CE Certification: All shoes entering the EU market must comply with CE certification, including physical and chemical tests.

REACH Regulations: Restricts chemical substances and heavy metals in shoes, such as lead, cadmium, and azo dyes.

PPE Regulations: Protective shoes must comply with the Personal Protective Equipment (PPE) regulations, which are categorized into three risk levels.

3.United Kingdom

UKCA Certification: Similar to CE certification, used for the UK market to ensure products meet UK safety and environmental requirements.

REACH Regulations: Similar to the EU, restricts the use of chemical substances.

4.Canada

CCPSA Regulations: Children’s shoes must comply with the Canadian Consumer Product Safety Act (CCPSA).

Chemical Restrictions: Must meet Canadian environmental requirements, restricting harmful substances.

5.Australia

AS/NZS Standards: Must comply with the safety standards of Australia and New Zealand.

Chemical Restrictions: Must meet REACH regulations or similar standards.

6.Japan

JIS Standards: Must comply with the Japanese Industrial Standards (JIS).

Chemical Restrictions: Must meet Japanese environmental requirements, restricting harmful substances.

7.India

BIS Mandatory Certification (ISI Mark): Shoes exported to India must pass the mandatory certification from the Bureau of Indian Standards (BIS), covering three categories: leather shoes, protective shoes, and rubber/polymer material shoes. The certification process includes factory inspection, product testing, and subsequent supervision, with a duration of approximately 4-6 months.

Certification Requirements: The ISI mark must be affixed to the product; otherwise, customs clearance or sale will not be possible.

8.Saudi Arabia

SABER Certification: Shoes exported to Saudi Arabia must pass the SABER certification from the Saudi Standards, Metrology, and Quality Organization (SASO).

9.Uganda

COC Certification: A Certificate of Conformity (COC) must be applied for, reviewed by an authorized institution of the Uganda National Bureau of Standards (UNBS).

10.Indonesia

Import Quota (PI): Since 2023, Indonesia has included shoes under import quota management. An application for PI quota approval must be submitted in advance, along with relevant documents (such as invoices, packing lists, SNI certification, etc.).

SNI Certification: All imported shoes must pass the Indonesian National Standard (SNI) certification.

International Shoe Exhibition

1.MICAM Milano (International Footwear Show)

- Location: Italy, Milan, Fiera Milano Rho Exhibition Center

- Event Date: Typically every February and September

- Website: https://www.themicam.com

Description: MICAM is one of the largest footwear exhibitions in the world, gathering global footwear brands, manufacturers, and retailers. The show features various types of shoes including casual shoes, sports shoes, formal shoes, children’s shoes, and more, attracting numerous international buyers and industry professionals.

2.Foire de Paris – International Footwear Show

- Location: France, Paris, Paris Expo Porte de Versailles

- Event Date: Every September (exact dates may vary)

- Website: https://www.foiredeparis.fr

Description: This is one of the largest consumer exhibitions in France, covering various product categories including footwear. It attracts many footwear brands, designers, and distributors from around the world each year.

3.Global Footwear & Leather Show (GFS)

- Location: Turkey, Istanbul, Istanbul Expo Center

- Event Date: Every February and October

- Website: https://www.gfsistanbul.com

Description: The Global Footwear & Leather Show (GFS) is one of the largest footwear exhibitions in Turkey and the surrounding region, covering all areas of the footwear industry including materials, shoe design, and production technology.

4.The International Shoe Fair (GDS)

- Location: Germany, Düsseldorf, Messe Düsseldorf Exhibition Center

- Event Date: Typically every March and September

- Website: https://www.gds.de

Description: GDS is an international footwear and leather goods exhibition held in Germany, featuring a wide range of stylish shoes and innovative designs. It attracts global brands, suppliers, and buyers from the footwear industry.

5.Shanghai International Footwear Fair

- Location: China, Shanghai, Shanghai New International Expo Centre (SNIEC)

- Event Date: Every March and September

- Website: http://www.shoesexpo.com.cn

Description: The Shanghai International Footwear Fair is one of China’s largest and most important footwear exhibitions, showcasing footwear brands, designers, and suppliers from both domestic and international markets, covering the entire supply chain from raw materials to finished products.

6.Sourcing at MAGIC

- Location: USA, Las Vegas, Las Vegas Convention Center

- Event Date: Every August and February

- Website: https://www.magiconline.com

Description: Sourcing at MAGIC is one of the largest footwear sourcing events in the USA, bringing together footwear manufacturers, brands, designers, and suppliers from around the world to showcase a variety of footwear products and the latest fashion trends.

7.China International Footwear Fair (CIFF)

- Location: China, Guangzhou, China Import and Export Fair Complex (Canton Fair Complex)

- Event Date: Typically every March and September

- Website: http://www.chinafootwearfair.com

Description: The China International Footwear Fair is one of China’s most recognized footwear exhibitions, showcasing a wide range of footwear products, including sports shoes, fashion shoes, formal shoes, and children’s footwear, attracting numerous buyers from around the world.

8.Copenhagen International Fashion Fair (CIFF)

- Location: Denmark, Copenhagen, Bella Center

- Event Date: Every February and August

- Website: https://www.ciff.dk

Description: CIFF is an important footwear exhibition in the Nordic region, displaying leading footwear brands and designs from around the world, attracting buyers and professionals from Europe and other regions.

9.India International Footwear Fair (IIFF)

- Location: India, Noida, India Expo Centre

- Event Date: Every August

- Website: https://www.iiff.in

Description: The India International Footwear Fair is one of the largest and most important footwear exhibitions in India, showcasing a wide range of footwear products including leather shoes, sports shoes, casual shoes, and children’s footwear, attracting a large number of international buyers.

10.The Shoes and Leather Vietnam

- Location: Vietnam, Ho Chi Minh City, Saigon Exhibition and Convention Center (SECC)

- Event Date: Every August

- Website: https://www.shoesleathervietnam.com

Description: The Shoes and Leather Vietnam exhibition is an important footwear and leather show in Southeast Asia, featuring the entire footwear industry chain and attracting global manufacturers, brands, and suppliers.

11.Seoul International Shoe Expo

- Location: South Korea, Seoul, COEX Exhibition Center

- Event Date: Every May and October

- Website: http://www.shoeexpo.or.kr

Description: The Seoul International Shoe Expo is one of South Korea’s key footwear exhibitions, showcasing various types of footwear and the latest fashion trends. It attracts global footwear brands and professionals.

12.Foire de Paris (FFa)

- Location: France, Paris, Paris Expo Porte de Versailles

- Event Date: Every April or May

- Website: https://www.foiredeparis.fr

Description: Foire de Paris is one of France’s largest consumer exhibitions, with a section dedicated to footwear, featuring various shoe types and accessories. It attracts both international and local visitors.

13.Taipei International Shoe Exhibition

- Location: Taiwan, Taipei, Taipei World Trade Center

- Event Date: Every April

- Website: https://www.shoetaiwan.com.tw

Description: The Taipei International Shoe Exhibition is one of Taiwan’s most important footwear exhibitions, featuring footwear brands, technologies, and designs from Taiwan and around the world. It attracts a large number of buyers and industry professionals.

14.Shoes & Leather Guangzhou

- Location: Guangzhou,China (Canton Fair Exhibition Hall Zone D)

- Event Date: Every May

- Website: https://www.toprepute.com.cn

Description: As an important exhibition for the global footwear and leather industry, it attracts professional buyers and exhibitors from all over the world

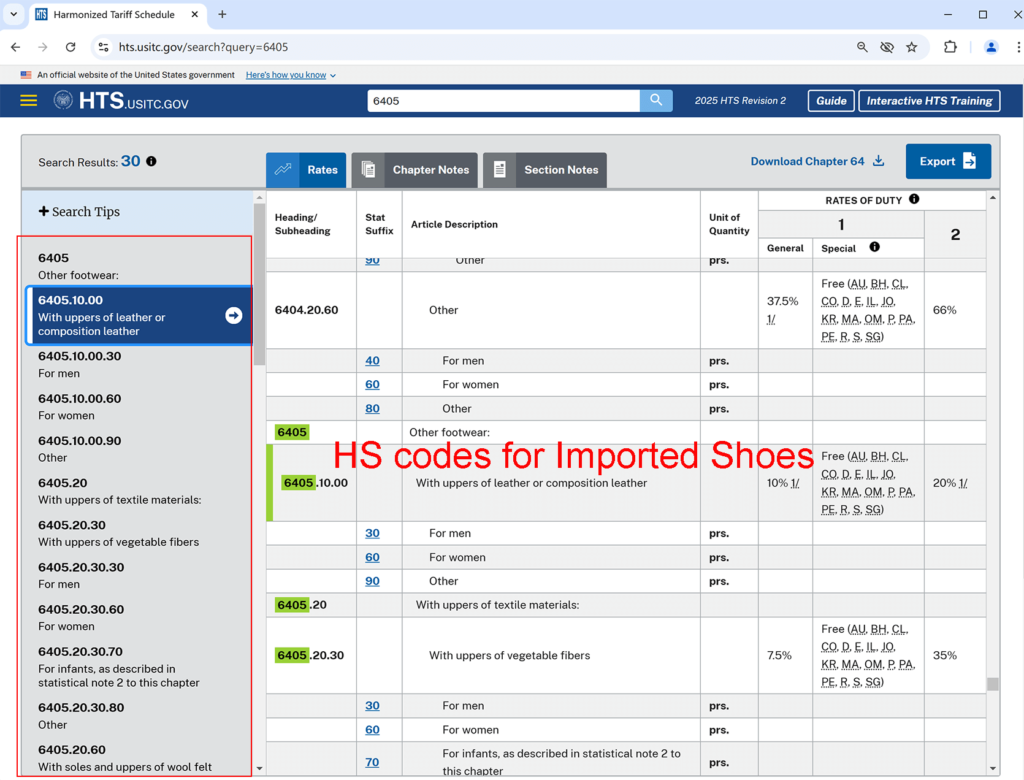

HS Codes for Each Type of Imported Shoes

The following is a detailed explanation of Harmonized System (HS) Codes for importing shoes from China. The HS Code is an internationally standardized system for classifying goods, developed by the World Customs Organization (WCO), used to identify and categorize traded products. The first 6 digits are globally uniform, while countries may extend them to 8 or 10 digits (like U.S., EU) as needed. HS codes for shoes are primarily found in Chapter 64 (“Footwear, Gaiters, and Similar Articles”), with specific codes depending on the shoe’s material (upper and outer sole), purpose (such as sports, formal, protective), and structure (such as ankle coverage). Below is an overview of HS codes for imported shoes, along with a detailed list of common classifications.

HS Code Classification for Shoes (Chapter 64: Footwear, Gaiters, and Similar Articles)

HS Chapter 64 covers all footwear and parts thereof. Below are the main categories and their 6-digit codes:

HS Code Overview

- Scope of Chapter 64: Covers all footwear and parts thereof, such as uppers, outer soles, insoles, etc.

- Classification Criteria:

- Upper Material: Rubber, plastic, leather, textile, etc.

- Outer Sole Material: Rubber, plastic, leather, or composition leather.

- Purpose: Everyday wear, sports, protective, special use (Like skiing).

- Structure: Whether it covers the ankle, has toe protection, etc.

- Code Length:

-

- Globally standard: 6 digits (like 6404.11).

- Country-specific: Extended to 8 or 10 digits (such as U.S. 6404.11.9000, EU 6404.11.00.00).

Common HS Codes for Shoes (6 Digits)

Below are the main shoe categories and their HS codes, applicable to typical shoes imported from China:

6401 – Waterproof Footwear (Outer Soles and Uppers of Rubber or Plastics)

- 6401.10: Waterproof footwear with metal toe-caps

- Example: Steel-toe safety boots.

- 6401.92: Waterproof footwear covering the ankle but not the knee

- Example: PVC rain boots.

- 6401.99: Other waterproof footwear

- Example: Rubber shoes not covering the ankle.

6402 – Footwear with Outer Soles and Uppers of Rubber or Plastics (Non-Waterproof)

- 6402.12: Ski boots and similar sports footwear

- Example: Rubber-soled ski boots.

- 6402.19: Other sports footwear

- Example: Rubber-soled running shoes.

- 6402.20: Footwear with upper straps fixed to the sole

- Example: Plastic flip-flops.

- 6402.91: Other footwear covering the ankle

- Example: Rubber-soled high-top shoes.

- 6402.99: Other footwear not covering the ankle

- Example: Rubber-soled low-top casual shoes.

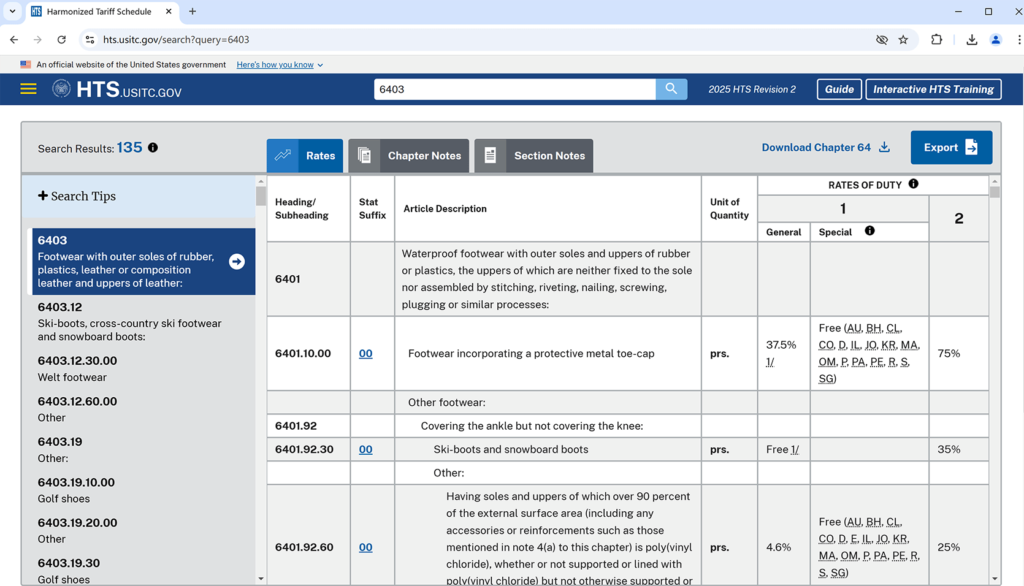

6403 – Footwear with Outer Soles of Rubber, Plastics, Leather, or Composition Leather and Uppers of Leather

- 6403.12: Ski boots and similar sports footwear

- Example: Leather ski boots.

- 6403.19: Other sports footwear

- Example: Leather basketball shoes.

- 6403.20: Footwear with leather upper straps

- Example: Leather sandals.

- 6403.40: Footwear with metal toe-caps

- Example: Leather safety boots.

- 6403.51: Leather outer soles, covering the ankle

- Example: Leather high-top boots.

- 6403.59: Leather outer soles, not covering the ankle

- Example: Leather dress shoes.

- 6403.91: Rubber or plastic outer soles, covering the ankle

- Example: Leather combat boots.

- 6403.99: Rubber or plastic outer soles, not covering the ankle

- Example: Leather athletic shoes.

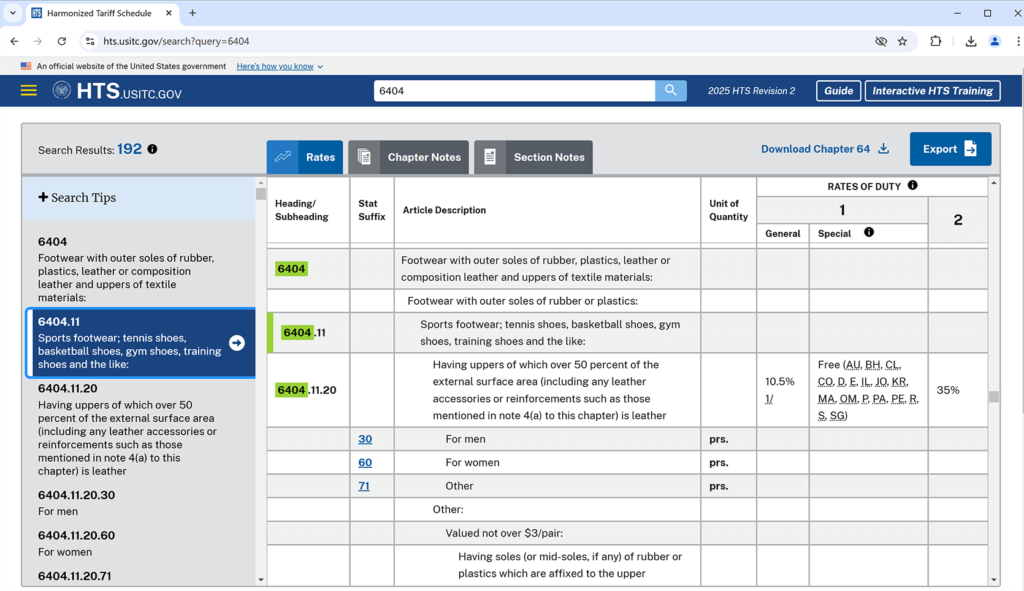

6404 – Footwear with Outer Soles of Rubber, Plastics, Leather, or Composition Leather and Uppers of Textile Materials

- 6404.11: Sports footwear (such as tennis shoes, running shoes)

- Example: Canvas running shoes.

- 6404.19: Other footwear

- Example: Canvas casual shoes.

- 6404.20: Outer soles of leather or composition leather

- Example: Textile shoes with leather soles.

6405 – Other Footwear (Not Covered by Above Combinations)

- 6405.10: Uppers of leather or composition leather

- Example: Synthetic leather casual shoes.

- 6405.20: Uppers of textile materials

- Example: Cloth shoes (such as traditional fabric shoes).

- 6405.90: Other materials

- Example: Wooden-soled shoes, cork shoes.

6406 – Parts of Footwear

- 6406.10: Uppers and parts thereof (excluding outer soles)

- Example: Pre-assembled uppers.

- 6406.20: Outer soles and heels (rubber or plastics)

- Example: Rubber soles.

- 6406.90: Other parts

- Example: Insoles, gaiters.

How to Determine the Specific HS Code

- Identify Shoe Characteristics:

- Material: Upper (leather, textile, plastic) and outer sole (rubber, leather).

- Purpose: Athletic, dress, safety shoes.

- Structure: Ankle coverage, special features (such as waterproof).

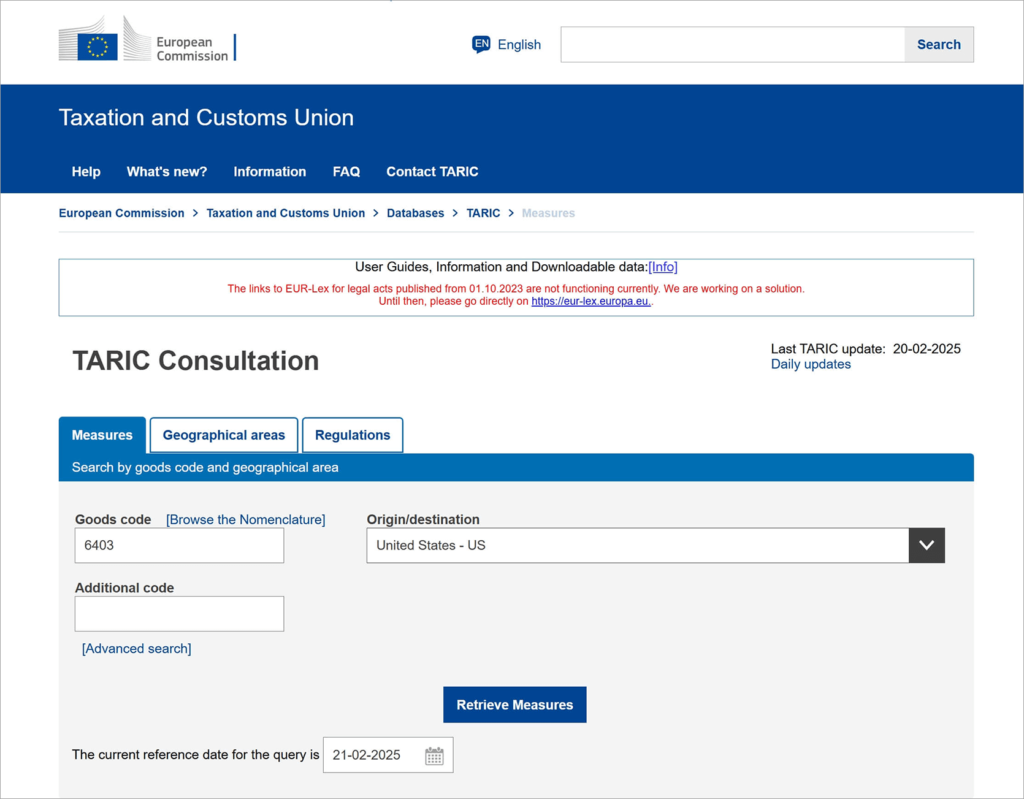

- Consult Customs Databases:

- U.S.: USITC HTS (https://hts.usitc.gov), 10-digit codes (such as 6404.11.9000).

- EU: TARIC (https://ec.europa.eu/taxation_customs), 10-digit codes (such as 6404.11.00.00).

- Other Countries: such as New Zealand Customs Tariff, Australia ABF Tariff.

- Seek Professional Advice:

- Contact a customs broker or authority to confirm the code and applicable duty rate.

Example: HS Codes for Athletic Shoes in Different Countries

For “athletic shoes with rubber soles and textile uppers”:

- Global 6-Digit: 6404.11

- U.S. 10-Digit: 6404.11.9000 (other athletic shoes, duty rate 9% + possible Section 301 tariffs).

- EU 10-Digit: 6404.11.00.00 (athletic shoes, duty rate 12%).

- New Zealand 8-Digit: 6404.11.00 (possibly duty-free under NZ-China FTA).

- Brazil 10-Digit: 6404.11.00.00 (duty rate 20%).

Notes

- Duty Rate Variations:

- The same HS code may have different tariff rates across countries. For example, the EU applies a uniform 12%, while the U.S. may add extra tariffs.

- Extended Codes:

- The 6-digit code is the base; actual imports require the target country’s 8- or 10-digit code.

- For instance, U.S. 6404.11.50 (tennis shoes) and 6404.11.90 (other athletic shoes) have different rates.

- Policy Impacts:

- Some countries may impose anti-dumping duties on Chinese shoes (such as EU’s 2006-2011 case, now expired).

- FTAs (such as NZ-China FTA) may reduce or eliminate tariffs.

- Parts of Footwear:

- For importing soles or insoles separately, use the 6406 category, which typically has lower duty rates.

Summary

HS codes for shoes are mainly distributed across 6401-6406, with specific codes determined by material, purpose, and structure. When importing shoes from China, select the appropriate 6-digit code based on the shoe’s features, then consult the target country’s extended code and tariff rate. For example, athletic shoes often use 6404.11, while leather dress shoes may fall under 6403.59. If you don’t know how to check your HS codes ,then you can find a customs clearance agent to help you out .

Calculating Tariffs and Other Fees for Importing Shoes from China to the U.S.

As an American importing shoes from China, you need to account for several key costs: tariffs, Merchandise Processing Fee (MPF), Harbor Maintenance Fee (HMF, applicable only for ocean shipments), and customs broker fees. Unlike other countries, the U.S. does not impose a value-added tax (VAT) on imports at the federal level, though some states may apply sales tax at the point of sale, which is not part of the import cost. Additionally, due to U.S.-China trade relations, shoes from China may incur an extra Section 301 tariff.

Below, I’ll outline the detailed calculation process and considerations, illustrated with two specific examples.

Calculation Method

1.Customs Value (CIF)

Tariffs and related fees are based on the CIF value, calculated as:

CIF = Cost (FOB Price) + Freight + Insurance

- Cost (FOB): The price of the goods at the factory, excluding shipping and insurance.

- Freight: International transportation costs (such as ocean or air freight).

- Insurance: Cost of insuring the shipment.

2.Tariff

Tariffs are calculated based on the CIF value and the Harmonized System (HS) Code of the goods. Shoe HS Codes typically fall under Chapter 64 (such as leather shoes under 6403.xx, athletic shoes under 6404.xx). The tariff rate includes:

- Base Tariff: Determined by the U.S. International Trade Commission’s Harmonized Tariff Schedule (HTS).

- Section 301 Tariff: An additional tariff on Chinese goods, typically ranging from 7.5% to 25%.

Formula:

Tariff = CIF × (Base Tariff Rate + Section 301 Tariff Rate)

3.Merchandise Processing Fee (MPF)

A fee charged by U.S. Customs Service, calculated as:

MPF = CIF × 0.3464%

Minimum: $26.22; Maximum: $508.38.

4.Harbor Maintenance Fee (HMF)

Applicable only for ocean shipments:

HMF = CIF × 0.125%

5.Customs Broker Fee

If you hire a customs broker to handle clearance, fees typically range from $100 to $200, depending on the service.

6.Total Import Cost

Total Cost = CIF + Tariff + MPF + HMF + Customs Broker Fee

Key Considerations

- HS Code: Rates vary by shoe type (material, purpose); confirm the exact code.

- Policy Changes: Section 301 tariffs may shift with U.S.-China trade negotiations.

- Exemptions: Imports valued under $800 are duty-free (19 CFR 10.151), suitable for small personal shipments.

Example 1: Importing Regular Shoes

Assumptions

- Description: Regular shoes (such as leather shoes)

- FOB Value: $10,000

- Freight: $500

- Insurance: $100

- HS Code: 6403.19 (leather shoes, assumed base tariff 10%)

- Section 301 Tariff: 15%

- Shipment Method: Ocean

- Customs Broker Fee: $150

Calculation

1.CIF Value:

CIF = $10,000 + $500 + $100 = $10,600

2.Tariff: Total rate = 10% (base) + 15% (Section 301) = 25%

Tariff = $10,600 × 25% = $2,650

3.MPF:

MPF = $10,600 × 0.3464% = $36.72

4.HMF:

HMF = $10,600 × 0.125% = $13.25

5.Total Clearance Fees:

Total Clearance Fees = $36.72 + $13.25 + $150 = $199.97

6.Total Import Cost:

Total Cost = $10,600 + $2,650 + $199.97 = $13,449.97

Results

- Tariff: $2,650

- Clearance Fees: $199.97

- Total Cost: $13,449.97 (a ~34.5% increase over FOB value)

Example 2: Importing Athletic Shoes

Assumptions

- Description: 1,000 pairs of athletic shoes (rubber sole, textile upper)

- FOB Value: $20,000 ($20/pair)

- Freight: $800

- Insurance: $200

- HS Code: 6404.11 (athletic shoes, base tariff 9%)

- Section 301 Tariff: 15%

- Shipment Method: Ocean, arriving at Los Angeles port

- Customs Broker Fee: $120

Calculation

1.CIF Value:

CIF = $20,000 + $800 + $200 = $21,000

2.Tariff: Total rate = 9% (base) + 15% (Section 301) = 24%

Tariff = $21,000 × 24% = $5,040

3.MPF:

MPF = $21,000 × 0.3464% = $72.74

4.HMF:

HMF = $21,000 × 0.125% = $26.25

5.Total Clearance Fees:

Total Clearance Fees = $72.74 + $26.25 + $120 = $218.99

6.Total Import Cost:

Total Cost = $21,000 + $5,040 + $218.99 = $26,258.99

7.Cost per Pair:

Cost per Pair = $26,258.99 ÷ 1,000 = $26.26

Results

- Tariff: $5,040

- Clearance Fees: $218.99

- Total Cost: $26,258.99 (increase of ~$6.26/pair)

Cost Comparison and Analysis

| Item | Example 1 (Regular Shoes) | Example 2 (Athletic Shoes) |

| FOB Value | $10,000 | $20,000 |

| CIF Value | $10,600 | $21,000 |

| Tariff | $2,650 (25%) | $5,040 (24%) |

| MPF | $36.72 | $72.74 |

| HMF | $13.25 | $26.25 |

| Broker Fee | $150 | $120 |

| Total Clearance | $199.97 | $218.99 |

| Total Cost | $13,449.97 | $26,258.99 |

- Tariff Proportion: Tariffs are the largest expense (19%-20% of total cost), varying with value and rate.

- Clearance Fees: Relatively minor, scaling linearly with CIF, though broker fees fluctuate by provider.

Detailed Explanation and Notes

1.HS Code Lookup:

Tariff rates differ by shoe type (like leather vs. textile). Check the USITC HTS website (https://hts.usitc.gov) with your shoe description.

2.Section 301 Tariffs:

As of February 2025, these additional tariffs apply to Chinese goods and may change with trade talks. Monitor updates from the U.S. Trade Representative (USTR).

3.Additional Costs:

- Warehousing: Delays at the port may incur $50-$200.

- Inland Transport: From port to warehouse (like Los Angeles to Chicago, ~$500-$1,000).

- Sales Tax: Applied at sale in some states (like 8.5% in California), paid by consumers.

4.Cost-Saving Options:

- De Minimis Exemption: Imports under $800 are duty-free.

- Transshipment: Routing through a non-China origin (such as Vietnam) may avoid Section 301 tariffs, if origin rules are met.

5.Recommendations:

Contact U.S. Customs and Border Protection (CBP) or a licensed broker for precise rates and compliance.

Use a freight forwarder to streamline logistics and customs.

Tips:

Importing shoes from China to the U.S. significantly increases costs due to tariffs and clearance fees. In Example 1 (regular shoes), the cost rises from $10,000 to $13,449.97; in Example 2 (athletic shoes), from $20,000 to $26,258.99. Real-world costs depend on shoe type, shipment size, and current policies.

How to Calculate Tariffs, Taxes, and Customs Clearance Fees for Importing Shoes from China to Europe

As a European importing shoes from China to the European Union (EU), you need to account for customs duties, Value Added Tax (VAT), and customs clearance fees. Unlike the U.S., the EU imposes both tariffs and VAT on imported goods, with specific rates and processes varying by member state.

Below is a detailed calculation method, followed by an example with specific computations.

Calculation Method

- Customs Value (CIF)

Tariffs and VAT are based on the CIF value:

CIF = Cost (FOB Price) + Freight + Insurance

- Cost (FOB): Factory price of the goods, excluding shipping and insurance.

- Freight: International transportation costs.

- Insurance: Cost of insuring the shipment.

- Customs Duty

Customs duty is calculated based on the CIF value and the Harmonized System (HS) Code. Shoe HS Codes typically fall under Chapter 64 (such as athletic shoes under 6404.xx). The rate is set by the EU Common Customs Tariff:

Duty = CIF × Duty Rate

- Rates vary by shoe type (material, purpose) and can be checked via the EU TARIC database.

- China, as a non-EU country, receives no tariff preferences.

- Value Added Tax (VAT)

VAT is applied to the duty-paid value, which is the CIF plus customs duty:

Duty-Paid Value = CIF + Duty

VAT = Duty-Paid Value × VAT Rate

- VAT rates differ across EU countries (such as 19% in Germany, 20% in France, 21% in the Netherlands).

- Customs Clearance Fees

Clearance fees include:

- Customs Processing Fee: Typically charged by logistics firms or customs, around €10-€50.

- Broker Fee: If using a customs agent, approximately €50-€150, depending on complexity.

- Other Fees: Port fees or storage costs (if applicable) vary by shipment method and delays.

- Total Import Cost

Total Cost = CIF + Duty + VAT + Clearance Fees

Example: Importing Athletic Shoes to Germany from China

Assumptions

- Description: 1,000 pairs of athletic shoes (rubber sole, textile upper)

- FOB Value: €20,000 (€20/pair)

- Freight: €800 (ocean shipment to Hamburg port)

- Insurance: €200

- HS Code: 6404.11 (athletic shoes, EU duty rate 12%)

- VAT Rate: 19% (Germany)

- Clearance Fees: €100 (customs processing €30 + broker fee €70)

- Date: February 20, 2025 (assuming rates remain unchanged)

Calculation Process

- CIF Value:

CIF = €20,000 + €800 + €200 = €21,000

- Customs Duty: Duty Rate = 12% (per EU TARIC, HS Code 6404.11)

Duty = €21,000 × 12% = €2,520

- Duty-Paid Value:

Duty-Paid Value = CIF + Duty = €21,000 + €2,520 = €23,520

- VAT: VAT Rate = 19% (Germany)

VAT = €23,520 × 19% = €4,468.80

- Total Clearance Fees:

Total Clearance Fees = €30 (processing) + €70 (broker) = €100

- Total Import Cost:

- Total Cost = CIF + Duty + VAT + Clearance Fees

Total Cost = €21,000 + €2,520 + €4,468.80 + €100 = €28,088.80

- Cost per Pair:

Cost per Pair = €28,088.80 ÷ 1,000 = €28.09

Results

- Customs Duty: €2,520

- VAT: €4,468.80

- Clearance Fees: €100

- Total Cost: €28,088.80 (increase of ~€8.09/pair)

Detailed Explanation and Notes

- HS Code and Duty Rate:

- This example uses HS Code 6404.11 with a 12% duty rate. Other shoe types (such as leather shoes under 6403.xx) may have higher rates (such as 16.8%).

- Check the latest rates via the EU TARIC database (https://ec.europa.eu/taxation_customs).

- VAT Rate:

- Germany’s VAT is 19%, but rates vary (such as 20% in France, 22% in Italy). The applicable rate depends on the entry country.

- Businesses with a VAT number can reclaim import VAT after payment, via tax filings.

- Clearance Fees:

- Fees vary by logistics provider and shipment size. Small imports may cost less; large ones may incur extra port fees.

- Ocean shipments might include terminal handling charges (€20-€50), excluded here for simplicity.

- Additional Costs:

- Storage Fees: Delays at the port could add €50-€200.

- Inland Transport: From Hamburg to a warehouse (such as Berlin), ~€200-€500.

- Anti-Dumping Duties: Some Chinese shoes may face anti-dumping duties, though athletic shoes are less affected—verify as needed.

- Cost-Saving Options:

- Free Trade Agreements: China has no FTA with the EU, so no duty reductions apply.

- Transshipment: Importing via an FTA country (such as Vietnam, under the EU-Vietnam FTA) could lower tariffs, if origin rules are met.

- De Minimis Exemption: Commercial imports under €150 are duty-free (VAT still applies), but this example exceeds the threshold.

- Recommendations:

- Contact the destination country’s customs authority (such as German Federal Customs) or a broker for accurate rates and compliance.

- Use a freight forwarder to streamline logistics and clearance.

Tips:

Importing shoes from China to the EU (such as Germany) significantly increases costs due to duties, VAT, and clearance fees. In this example, 1,000 athletic shoes rise from €20,000 to €28,088.80, with VAT (€4,468.80) and duty (€2,520) as the main expenses, and clearance fees (€100) minor. Actual costs vary by shoe type, country, and shipment size.

VAT & Tax Rates of Each EU Member State

The tariffs for importing shoes from China to EU member states are uniformly set by the European Union based on the HS Code. China does not benefit from any EU Free Trade Agreement (FTA), so the Most Favoured Nation (MFN) tariff rate applies. The Value Added Tax (VAT) is determined independently by each member state.

Universal Tariff (Using HS Code 6404.11 as an Example)

- Tariff Rate: 12% (According to the EU TARIC, the standard tariff rate for athletic shoes is approximately 12%, varying depending on the material and purpose of the shoes, typically ranging from 3% to 17%).

- Calculation Basis: CIF value (FOB value + freight + insurance).

VAT and Other Tax Rates of Each Member State

The following table lists the VAT rates for each EU member state:

| Country | VAT Rate |

| Austria | 20% |

| Belgium | 21% |

| Bulgaria | 20% |

| Croatia | 25% |

| Cyprus | 19% |

| Czech Republic | 21% |

| Denmark | 25% |

| Estonia | 22% (adjusted from 20% starting 2024) |

| Finland | 24% |

| France | 20% |

| Germany | 19% |

| Greece | 24% |

| Hungary | 27% (highest in the EU) |

| Ireland | 23% |

| Italy | 22% |

| Latvia | 21% |

| Lithuania | 21% |

| Luxembourg | 17% (lowest in the EU) |

| Malta | 18% |

| Netherlands | 21% |

| Poland | 23% |

| Portugal | 23% |

| Romania | 19% |

| Slovakia | 20% |

| Slovenia | 22% |

| Spain | 21% |

| Sweden | 25% |

Notes

- The tariff rate of 12% for HS Code 6404.11 (athletic shoes) is an example; actual rates may differ slightly based on specific shoe characteristics.

- VAT rates are subject to change based on national policies, and the rates provided reflect data up to 2023/2024, with Estonia’s adjustment noted for 2024.

- Additional customs clearance fees (such as processing or broker fees) may apply but are not included in this section as they vary by transaction and provider.

List the tariffs and HS codes of EU for shoes

HS codes for shoes imported from China to the EU range from 0% to 12%, with some sports shoes like ski boots at 4% and flip-flops at 0%. Common shoe types include waterproof boots, athletic shoes, and leather dress shoes, each with specific HS codes.A notable detail is that rubber flip-flops (HS 6402.20) have a 0% tariff, making them cheaper to import compared to most other shoes at 12%.

HS Codes and Tariff Rates

Below is a list of common shoe types, their HS codes, and the EU’s Most Favored Nation (MFN) tariff rates as of February 20, 2025. These rates apply since China has no free trade agreement with the EU.

- Tariff Calculation: Tariffs are based on the CIF value (FOB value + freight + insurance). VAT, which varies by EU country (such as Germany 19%, France 20%), is added separately and not included here.

- No Extra Duties: There are no current antidumping duties on Chinese shoes in the EU, simplifying the tariff structure.

| Shoe Type | HS Code | MFN Tariff Rate |

| Waterproof steel-toe safety boots | 6401.10 | 12% |

| Waterproof rain boots (ankle-high) | 6401.90 | 12% |

| Other waterproof shoes | 6401.90 | 12% |

| Rubber-soled ski boots | 6402.10 | 4% |

| Rubber-soled athletic shoes (upper of rubber/plastic) | 6402.30 or 6402.90 | 12% |

| Rubber-soled athletic shoes (upper of textile) | 6404.10 | 12% |

| Rubber flip-flops | 6402.20 | 0% |

| Rubber high-top shoes | 6402.30 or 6402.90 | 12% |

| Rubber low-top casual shoes | 6402.30 or 6402.90 | 12% |

| Leather ski boots (sole of rubber/plastic) | 6403.10 | 12% |

| Other leather sports shoes (sole of rubber/plastic) | 6403.10 | 12% |

| Leather sandals | 6403.20 | 12% |

| Leather steel-toe safety boots | 6403.40 | 12% |

| Leather high-top boots (sole of leather) | 6403.51 | 12% |

| Leather dress shoes (sole of leather) | 6403.59 | 12% |

| Rubber-soled leather high-tops | 6403.10 | 12% |

| Rubber-soled leather low-tops | 6403.10 | 12% |

| Textile athletic shoes | 6404.10 | 12% |

| Other textile shoes | 6404.10 or 6404.20 | 12% |

| Textile leather-soled shoes | 6404.20 | 12% |

| Synthetic leather shoes | 6405.10 | 12% |

| Cloth shoes | 6405.20 | 12% |

| Other material shoes (such as wooden) | 6405.90 | 12% |

Resources

For the latest tariff rates, check the EU TARIC database.

Detailed Analysis: HS Codes and Tariff Rates for Shoes Imported from China to the EU

This analysis provides a comprehensive overview of Harmonized System (HS) codes and corresponding tariff rates for shoes imported from China to the European Union (EU) as of February 20, 2025, based on the EU’s Common Customs Tariff (CCT) and the Most Favored Nation (MFN) principle. The report covers background, methodology, classification, tariff calculations, and policy implications, ensuring a thorough understanding for importers and policymakers.

The HS Code, developed by the World Customs Organization (WCO), is a standardized system for classifying traded products, with shoes falling under Chapter 64 (“Footwear, Gaiters, and Similar Articles”). The EU uses the Combined Nomenclature (CN), an 8-digit extension of the HS code, to determine tariff rates. China does not have a free trade agreement (FTA) with the EU for goods, so MFN tariff rates apply. Historically, the EU imposed antidumping duties on Chinese shoes from 2006 to 2012, but these were repealed following a WTO dispute (DS405, 2012), and as of 2025, no such duties are in place.

Data is sourced from the EU TARIC database and the WTO Tariff Data, assuming no major changes from 2023 to 2025. Tariff rates are based on the CIF value (FOB value + freight + insurance), with no additional measures like antidumping duties. The analysis uses 6-digit HS codes for global consistency, noting that the EU extends these to 8-digit CN codes for precise classification.

Shoe Classification and HS Codes

Below is a detailed list of common shoe types, their standard 6-digit HS codes, and corresponding 8-digit CN code examples, mapped to EU tariff rates:

| HS Code | Description | CN Code Example | Classification Notes |

| 6401.10 | Waterproof footwear with outer soles and uppers of rubber or plastics, with metal toecaps | 6401.10.00.00 | Safety boots, rubber or plastic, waterproof |

| 6401.90 | Other waterproof footwear with outer soles and uppers of rubber or plastics | 6401.90.00.00 | Includes rain boots, non-ankle-covering shoes |

| 6402.10 | Ski boots and cross-country ski footwear | 6402.10.00.00 | Rubber or plastic soles, sports use |

| 6402.20 | Footwear with upper fixed to the sole by means of plugs | 6402.20.00.00 | Such as flip-flops, rubber or plastic |

| 6402.30 | Footwear with upper fixed to the sole by stitching, riveting, nailing, etc. | 6402.30.00.00 | Includes high-top and low-top casual shoes |

| 6402.90 | Other footwear with outer soles and uppers of rubber or plastics | 6402.90.00.00 | Other rubber/plastic shoes |

| 6403.10 | Footwear with outer soles of rubber or plastics and uppers of leather | 6403.10.00.00 | Leather uppers, rubber/plastic soles |

| 6403.20 | Footwear with outer soles of leather or composition leather and uppers of leather, with leather straps | 6403.20.00.00 | Such as leather sandals |

| 6403.40 | Footwear with metal toecaps, leather | 6403.40.00.00 | Leather safety boots |

| 6403.51 | Footwear with outer soles of leather or composition leather and uppers of leather, covering the ankle | 6403.51.00.00 | Leather high-top boots |

| 6403.59 | Footwear with outer soles of leather or composition leather and uppers of leather, other | 6403.59.00.00 | Leather dress shoes |

| 6403.91 | Other footwear with outer soles of rubber, plastics, leather or composition leather and uppers of leather, covering the ankle | 6403.91.00.00 | Leather combat boots |

| 6403.99 | Other footwear with outer soles of rubber, plastics, leather or composition leather and uppers of leather, other | 6403.99.00.00 | Leather athletic shoes |

| 6404.10 | Footwear with outer soles of rubber or plastics and uppers of textile materials | 6404.10.00.00 | Such as textile running shoes, tennis shoes |

| 6404.20 | Footwear with outer soles of leather or composition leather and uppers of textile materials | 6404.20.00.00 | Textile leather-soled shoes |

| 6405.10 | Other footwear with uppers of leather or composition leather | 6405.10.00.00 | Synthetic leather casual shoes |

| 6405.20 | Other footwear with uppers of textile materials | 6405.20.00.00 | Cloth shoes, such as traditional fabric shoes |

| 6405.90 | Other footwear | 6405.90.00.00 | Such as wooden-soled, cork shoes |

Tariff Rate Analysis

The following table details each shoe type’s MFN tariff rate for the EU, based on the standard rates from the EU TARIC database, assuming no additional measures:

| Shoe Type | HS Code | MFN Tariff Rate |

| Waterproof steel-toe safety boots | 6401.10 | 12% |

| Waterproof rain boots (ankle-high) | 6401.90 | 12% |

| Other waterproof shoes | 6401.90 | 12% |

| Rubber-soled ski boots | 6402.10 | 4% |

| Rubber-soled athletic shoes (upper of rubber/plastic) | 6402.30 or 6402.90 | 12% |

| Rubber-soled athletic shoes (upper of textile) | 6404.10 | 12% |

| Rubber flip-flops | 6402.20 | 0% |

| Rubber high-top shoes | 6402.30 or 6402.90 | 12% |

| Rubber low-top casual shoes | 6402.30 or 6402.90 | 12% |

| Leather ski boots (sole of rubber/plastic) | 6403.10 | 12% |

| Other leather sports shoes (sole of rubber/plastic) | 6403.10 | 12% |

| Leather sandals | 6403.20 | 12% |

| Leather steel-toe safety boots | 6403.40 | 12% |

| Leather high-top boots (sole of leather) | 6403.51 | 12% |

| Leather dress shoes (sole of leather) | 6403.59 | 12% |

| Rubber-soled leather high-tops | 6403.10 | 12% |

| Rubber-soled leather low-tops | 6403.10 | 12% |

| Textile athletic shoes | 6404.10 | 12% |

| Other textile shoes | 6404.10 or 6404.20 | 12% |

| Textile leather-soled shoes | 6404.20 | 12% |

| Synthetic leather shoes | 6405.10 | 12% |

| Cloth shoes | 6405.20 | 12% |

| Other material shoes (such as wooden) | 6405.90 | 12% |

Policy Implications

- MFN Rates: Range from 0% (such as HS 6402.20, flip-flops) to 12% (most shoe types), with ski boots (HS 6402.10) at 4%. This reflects the EU’s relatively low tariff structure compared to the U.S.

- No Antidumping Duties: Based on the 2012 WTO ruling (DS405), no current antidumping duties on Chinese shoes, simplifying import costs.

- VAT Application: Each EU member state applies its own VAT rate (such as Germany 19%, France 20%) to the total value including customs duties, but this is not part of the tariff calculation.

- Clearance Fees: Additional costs include customs processing fees (€10-50) and broker fees (€50-150), varying by transaction and provider.

Limitations and Recommendations

This analysis assumes no major policy changes from 2023 to 2025. Importers should verify rates using the EU TARIC database for the latest updates, especially for 8-digit CN codes. For complex classifications, consult a customs broker or the EU’s Taxation and Customs Union Directorate.

How to Calculate Tariffs, Taxes, and Customs Clearance Fees for Importing Shoes from China to Canada

As a Canadian importing shoes from China, you need to account for customs duties, sales taxes (Goods and Services Tax, GST, or Harmonized Sales Tax, HST, depending on the province), and customs clearance fees. Canada imposes tariffs and taxes on imported goods, with amounts determined by the Harmonized System (HS) Code, value, and whether a free trade agreement applies (Canada has no FTA with China). Below is a detailed calculation method, followed by an example with specific computations.

Calculation Method

- Customs Value (CIF)

Tariffs and taxes are based on the CIF value:

CIF = Cost (FOB Price) + Freight + Insurance

- Cost (FOB): Factory price of the goods, excluding shipping and insurance.

- Freight: International transportation costs.

- Insurance: Cost of insuring the shipment.

- Customs Duty

Duty is calculated based on the CIF value and HS Code, with rates set by the Canada Border Services Agency (CBSA) Customs Tariff:

Duty = CIF × Duty Rate

- Shoe HS Codes typically fall under Chapter 64 (such as athletic shoes under 6404.xx).

- Chinese goods receive the Most Favoured Nation (MFN) rate, with no FTA benefits.

- Sales Tax (GST/HST)

Canada applies a federal GST (5%), while some provinces use HST (combining federal and provincial taxes, such as 13% in Ontario). The tax base is the duty-paid value:

Duty-Paid Value = CIF + Duty

GST/HST = Duty-Paid Value × GST/HST Rate

- The rate depends on the province of entry.

- Customs Clearance Fees

Clearance fees include:

- Customs Processing Fee: Charged by CBSA, typically low (around CAD 10-20).

- Broker Fee: If using a customs broker, approximately CAD 50-150, depending on complexity.

- Other Fees: Port or storage fees (if applicable).

- Total Import Cost

Total Cost = CIF + Duty + GST/HST + Clearance Fees

Notes

- Exemption Threshold: Commercial imports have no de minimis exemption; all goods are taxable. Personal mail under CAD 20 is duty-free, but this example is commercial and exceeds that.

- Exchange Rate: Costs must be converted to Canadian dollars (CAD) using the exchange rate on the invoice date.

Example: Importing Athletic Shoes to Ontario from China

Assumptions

- Description: 1,000 pairs of athletic shoes (rubber sole, textile upper)

- FOB Value: USD 20,000 (USD 20/pair)

- Freight: USD 800 (ocean shipment to Vancouver port)

- Insurance: USD 200

- HS Code: 6404.11 (athletic shoes, MFN duty rate 11.4%)

- GST/HST Rate: 13% HST (Ontario)

- Clearance Fees: CAD 100 (customs processing CAD 20 + broker fee CAD 80)

- Exchange Rate: Assumed on February 20, 2025, 1 USD = 1.35 CAD

Calculation Process

- Convert to CAD and Calculate CIF:

- FOB = USD 20,000 × 1.35 = CAD 27,000

- Freight = USD 800 × 1.35 = CAD 1,080

- Insurance = USD 200 × 1.35 = CAD 270

CIF = CAD 27,000 + CAD 1,080 + CAD 270 = CAD 28,350

- Customs Duty: Duty Rate = 11.4% (HS Code 6404.11, MFN)

Duty = CAD 28,350 × 11.4% = CAD 3,231.90

- Duty-Paid Value:

Duty-Paid Value = CIF + Duty = CAD 28,350 + CAD 3,231.90 = CAD 31,581.90

- HST: HST Rate = 13% (Ontario)

HST = CAD 31,581.90 × 13% = CAD 4,105.65

- Total Clearance Fees:

Total Clearance Fees = CAD 20 (processing) + CAD 80 (broker) = CAD 100

- Total Import Cost:

- Total Cost = CIF + Duty + HST + Clearance Fees

Total Cost = CAD 28,350 + CAD 3,231.90 + CAD 4,105.65 + CAD 100 = CAD 35,787.55

- Cost per Pair:

Cost per Pair = CAD 35,787.55 ÷ 1,000 = CAD 35.79

Results

- Customs Duty: CAD 3,231.90

- HST: CAD 4,105.65

- Clearance Fees: CAD 100

- Total Cost: CAD 35,787.55 (increase of ~CAD 8.79/pair)

Detailed Explanation and Notes

- HS Code and Duty Rate:

- This example uses HS Code 6404.11 with an 11.4% rate. Other shoes (such as leather under 6403.xx) may have rates up to 17%-18%.

- Check rates via the CBSA Customs Tariff (https://www.cbsa-asfc.gc.ca/trade-commerce/tariff-tarif).

- GST/HST Rate:

- Ontario uses 13% HST. Other provinces may apply only 5% GST (such as Alberta) or different HST rates (such as 15% in New Brunswick).

- Commercial importers can reclaim HST via tax filings but must pay upfront.

- Clearance Fees:

- Fees vary by broker and shipment size. Ocean imports may incur additional port fees (CAD 50-100), excluded here for simplicity.

- Additional Costs:

- Storage Fees: Port delays could add CAD 50-200.

- Inland Transport: From Vancouver to Toronto, ~CAD 500-1,000.

- Special Measures: Shoes currently face no anti-dumping duties, but monitor CBSA’s Special Import Measures (SIMA).

- Cost-Saving Options:

- Exemption: No de minimis for commercial imports; personal mail under CAD 20 is exempt.

- Origin: China has no FTA with Canada. Importing via an FTA country (such as Vietnam under CETA or CPTPP) could reduce duties if origin rules are met.

- Recommendations:

- Obtain a Business Number from the Canada Revenue Agency (CRA) for an import account.

- Contact CBSA or a customs broker for accurate rates and compliance.

Tips:

Importing shoes from China to Canada (such as Ontario) increases costs due to duties, HST, and clearance fees, raising the total from CAD 27,000 to CAD 35,787.55. HST (CAD 4,105.65) and duty (CAD 3,231.90) are the main expenses, with clearance fees (CAD 100) minor.

Importing Shoes from China to the UK (Calculate Tariffs, Taxes and Customs Clearance Fees)

As a British person importing shoes from China to the UK (post-Brexit, the UK operates under its own customs rules separate from the EU), you need to account for customs duties, Value Added Tax (VAT), and customs clearance fees. The UK imposes tariffs and VAT on imported goods, with amounts determined by the Harmonized System (HS) Code, value, and any applicable trade agreements (currently, there is no free trade agreement between the UK and China).

Calculation Method

- Customs Value (CIF)

Tariffs and VAT are based on the CIF value:

CIF = Cost (FOB Price) + Freight + Insurance

- Cost (FOB): Factory price of the goods, excluding shipping and insurance.

- Freight: International transportation costs.

- Insurance: Cost of insuring the shipment.

- Customs Duty

Duty is calculated based on the CIF value and HS Code, with rates set by the UK government’s UK Global Tariff (UKGT):

Duty = CIF × Duty Rate

- Shoe HS Codes typically fall under Chapter 64 (such as athletic shoes under 6404.xx).

- Chinese goods face standard rates, with no FTA benefits.

- Value Added Tax (VAT)

VAT is 20% for commercial imports, applied to the duty-paid value:

Duty-Paid Value = CIF + Duty

VAT = Duty-Paid Value × 20%

- VAT-registered businesses can reclaim it via filings but must pay upfront.

- Customs Clearance Fees

Clearance fees include:

- Customs Processing Fee: Typically charged by logistics firms or customs, around £10-50.

- Broker Fee: If using a customs agent, approximately £50-150.

- Other Fees: Port or storage fees (if applicable).

- Total Import Cost

Total Cost = CIF + Duty + VAT + Clearance Fees

Notes

- Exemption Threshold: Commercial imports with CIF below £135 are duty-free, but VAT still applies (this example involves bulk import, so it doesn’t qualify).

- Exchange Rate: All costs are in British pounds (GBP), converted using the invoice date’s exchange rate.

Example: Importing Athletic Shoes to the UK from China

Assumptions

- Description: 1,000 pairs of athletic shoes (rubber sole, textile upper)

- FOB Value: USD 20,000 (USD 20/pair)

- Freight: USD 800 (ocean shipment to Southampton port)

- Insurance: USD 200

- HS Code: 6404.11 (athletic shoes, UKGT duty rate 12%)

- VAT Rate: 20%

- Clearance Fees: £100 (customs processing £30 + broker fee £70)

- Exchange Rate: Assumed on February 20, 2025, 1 USD = 0.80 GBP

Calculation Process

- Convert to GBP and Calculate CIF:

- FOB = USD 20,000 × 0.80 = £16,000

- Freight = USD 800 × 0.80 = £640

- Insurance = USD 200 × 0.80 = £160

CIF = £16,000 + £640 + £160 = £16,800

- Customs Duty: Duty Rate = 12% (HS Code 6404.11, UKGT)

Duty = £16,800 × 12% = £2,016

- Duty-Paid Value:

Duty-Paid Value = CIF + Duty = £16,800 + £2,016 = £18,816

- VAT: VAT Rate = 20%

VAT = £18,816 × 20% = £3,763.20

- Total Clearance Fees:

Total Clearance Fees = £30 (processing) + £70 (broker) = £100

- Total Import Cost:

- Total Cost = CIF + Duty + VAT + Clearance Fees

Total Cost = £16,800 + £2,016 + £3,763.20 + £100 = £22,679.20

- Cost per Pair:

Cost per Pair = £22,679.20 ÷ 1,000 = £22.68

Results

- Customs Duty: £2,016

- VAT: £3,763.20

- Clearance Fees: £100

- Total Cost: £22,679.20 (increase of ~£6.68/pair)

Detailed Explanation and Notes

- HS Code and Duty Rate:

- This example uses HS Code 6404.11 with a 12% rate. Other shoes (such as leather under 6403.xx) may have higher rates (such as 16%).

- Check the UKGT via the government website (https://www.gov.uk/trade-tariff).

- VAT:

- VAT is 20% for all commercial imports. VAT-registered businesses can recover it but must pay initially.

- CIF below £135 is duty-free, but VAT applies (this example exceeds the threshold).

- Clearance Fees:

- Fees vary by logistics provider and shipment size. Ocean imports may incurs port fees (£20-50), excluded here for simplicity.

- Additional Costs:

- Storage Fees: Port delays could add £50-200.

- Inland Transport: From Southampton to London, ~£200-500.

- Special Measures: Shoes currently face no anti-dumping duties, but monitor HMRC updates.

- Cost-Saving Options:

- Exemption: CIF below £135 avoids duty, though bulk imports don’t qualify.

- Trade Agreements: No UK-China FTA exists; importing via an FTA country (such as Vietnam under the UK-Vietnam FTA) could reduce duties.

- Postponed VAT: Using “Postponed VAT Accounting” delays VAT payment until filing.

- Recommendations:

- Register for an EORI number (Economic Operators Registration and Identification) to import.

- Contact HMRC or a customs broker for accurate rates and compliance.

Importing shoes from China to the UK increases costs from £16,000 to £22,679.20, primarily driven by VAT (£3,763.20) and duty (£2,016), with clearance fees (£100) minor.

Importing Shoes from China to Australia (Calculate Tariffs, Taxes and Customs Clearance Fees)

Importing shoes from China to Australia, we need to understand for customs duties, Goods and Services Tax (GST), and customs clearance fees. Australia imposes tariffs and GST on imported goods, with amounts depending on the Harmonized System (HS) Code, value, and applicability of free trade agreements (in this case, the China-Australia Free Trade Agreement, ChAFTA).

Calculation Method

- Customs Value (CIF)

Tariffs and GST are based on the CIF value:

CIF = Cost (FOB Price) + Freight + Insurance

- Cost (FOB): Factory price of the goods, excluding shipping and insurance.

- Freight: International transportation costs.

- Insurance: Cost of insuring the shipment.

- Customs Duty

Duty is calculated based on the CIF value and HS Code, with rates set by the Australian Border Force (ABF) Customs Tariff:

Duty = CIF × Duty Rate

- Shoe HS Codes typically fall under Chapter 64 (such as athletic shoes under 6404.xx).

- Under the China-Australia Free Trade Agreement (ChAFTA), tariffs on most Chinese shoes have been phased out since 2015, potentially reaching 0% by 2025, provided a Certificate of Origin (COO) is submitted.

- Goods and Services Tax (GST)

GST is 10% and applies to all imports, based on the duty-paid value:

Duty-Paid Value = CIF + Duty

GST = Duty-Paid Value × 10%

- Commercial importers can reclaim GST via tax filings but must pay upfront.

- Customs Clearance Fees

Clearance fees include:

- Import Declaration Fee:

- CIF ≤ AUD 1,000: Free.

- CIF > AUD 1,000: AUD 152 (electronic) or AUD 192 (manual).

- Broker Fee: If using a customs broker, approximately AUD 80-200.

- Other Fees: Port service fees (around AUD 50-100, depending on shipping method).

- Total Import Cost

Total Cost = CIF + Duty + GST + Clearance Fees

Notes

- Exemption Threshold: Commercial imports with CIF below AUD 1,000 are exempt from duty and GST, though clearance fees may still apply.

- Exchange Rate: All costs are in Australian dollars (AUD), converted using the invoice date’s exchange rate.

Example: Importing Athletic Shoes to Australia from China

Assumptions

- Description: 1,000 pairs of athletic shoes (rubber sole, textile upper)

- FOB Value: USD 20,000 (USD 20/pair)

- Freight: USD 800 (ocean shipment to Sydney port)

- Insurance: USD 200

- HS Code: 6404.11 (athletic shoes)

- Duty Rate: 0% (assuming full ChAFTA exemption by 2025 with COO)

- GST Rate: 10%

- Clearance Fees: AUD 232 (import declaration fee AUD 152 + broker fee AUD 80)

- Exchange Rate: Assumed on February 20, 2025, 1 USD = 1.50 AUD

Calculation Process

- Convert to AUD and Calculate CIF:

- FOB = USD 20,000 × 1.50 = AUD 30,000

- Freight = USD 800 × 1.50 = AUD 1,200

- Insurance = USD 200 × 1.50 = AUD 300

CIF = AUD 30,000 + AUD 1,200 + AUD 300 = AUD 31,500

- Customs Duty: Duty Rate = 0% (ChAFTA exemption)

Duty = AUD 31,500 × 0% = AUD 0

- Duty-Paid Value:

Duty-Paid Value = CIF + Duty = AUD 31,500 + AUD 0 = AUD 31,500

- GST: GST Rate = 10%

GST = AUD 31,500 × 10% = AUD 3,150

- Total Clearance Fees:

Total Clearance Fees = AUD 152 (declaration fee) + AUD 80 (broker fee) = AUD 232

- Total Import Cost:

- Total Cost = CIF + Duty + GST + Clearance Fees

Total Cost = AUD 31,500 + AUD 0 + AUD 3,150 + AUD 232 = AUD 34,882

- Cost per Pair:

Cost per Pair = AUD 34,882 ÷ 1,000 = AUD 34.88

Results

- Customs Duty: AUD 0

- GST: AUD 3,150

- Clearance Fees: AUD 232

- Total Cost: AUD 34,882 (increase of ~AUD 4.88/pair)

Detailed Explanation and Notes

- HS Code and Duty Rate:

- This example uses HS Code 6404.11, assuming 0% duty under ChAFTA. Without a COO, the MFN rate (such as 5%) would apply—check the ABF tariff schedule (https://www.abf.gov.au).

- Leather shoes (6403.xx) may carry higher rates (such as 5%-10%).

- GST:

- GST is 10% nationwide. Commercial importers can recover it via the Australian Taxation Office (ATO) but must pay initially.

- CIF below AUD 1,000 is GST-exempt; this example exceeds the threshold.

- Clearance Fees:

- The import declaration fee is AUD 152 since CIF exceeds AUD 1,000. Broker fees vary by provider.

- Ocean shipments may incur port service fees (AUD 50-100), excluded here for simplicity.

- Additional Costs:

- Storage Fees: Port delays could add AUD 50-200.

- Inland Transport: From Sydney to Melbourne, ~AUD 200-500.

- Special Measures: Shoes currently face no anti-dumping duties, but monitor ABF updates.

- Cost-Saving Options:

- ChAFTA: Ensure a Certificate of Origin to secure 0% duty.

- Exemption: CIF below AUD 1,000 avoids duty and GST, though rare for commercial imports.

- Transshipment: Importing via another FTA country (such as Vietnam under AANZFTA) could optimize costs.

- Recommendations:

- Register as an importer with ABF and confirm rates with a broker.

- Use a freight forwarder to streamline the process.

Importing shoes from China to Australia, with ChAFTA’s duty exemption, increases costs from AUD 30,000 to AUD 34,882, driven by GST (AUD 3,150) and clearance fees (AUD 232), with no tariff. Without exemption, duties would raise costs further.

Importing Shoes from China to Brazil (Calculate Tariffs, Taxes and Customs Clearance Fees )

Importing shoes from China to Brazil, we must know more for import tariffs (Imposto de Importação, II), Industrialized Products Tax (Imposto sobre Produtos Industrializados, IPI), state VAT (ICMS), federal taxes (PIS/COFINS), and customs clearance fees (Despesas de Desembaraço Aduaneiro). Brazil’s tax system is complex, involving multiple cascading taxes.

Calculation Method

- Customs Value (CIF)

All taxes are based on the CIF value:

CIF = Cost (FOB Price) + Freight + Insurance

- Cost (FOB): Factory price of the goods, excluding shipping and insurance.

- Freight: International transportation costs.

- Insurance: Cost of insuring the shipment.

- Import Tariff (II)

The tariff is calculated based on the CIF value and HS Code, with rates set by Brazil’s Foreign Trade Chamber (CAMEX) Common External Tariff (TEC):

II = CIF × Tariff Rate

- Shoe HS Codes fall under Chapter 64 (such as athletic shoes under 6404.xx).

- Chinese goods receive standard rates, with no FTA benefits.

- Industrialized Products Tax (IPI)

IPI is an additional tax on industrial goods, based on CIF + II:

IPI Base = CIF + II

IPI = IPI Base × IPI Rate

- Shoe IPI rates are typically low (such as 5%-10%).

- State VAT (ICMS)

ICMS is levied by states, with the tax base including CIF + II + IPI + ICMS itself (requiring reverse calculation):

ICMS Base = (CIF + II + IPI) ÷ (1 – ICMS Rate)

ICMS = ICMS Base × ICMS Rate

- Rates vary by state (such as 17%-18% in São Paulo).

- Federal Taxes (PIS/COFINS)

PIS and COFINS are federal social contribution taxes, based on CIF + II + PIS/COFINS itself (reverse calculation):

PIS/COFINS Base = (CIF + II) ÷ (1 – PIS Rate – COFINS Rate)

PIS = PIS/COFINS Base × PIS Rate

COFINS = PIS/COFINS Base × COFINS Rate

- Standard rates: PIS 1.65%, COFINS 7.6%.

- Customs Clearance Fees

Include:

- Customs Processing Fee: Fixed or proportional (approx. BRL 200-500).

- Broker Fee: Approx. BRL 300-1000.

- Port Fees: Such as storage or handling (if applicable).

- Total Import Cost

Total Cost = CIF + II + IPI + ICMS + PIS + COFINS + Clearance Fees

Notes

- Exemption Threshold: No de minimis for commercial imports; personal mail under USD 50 may be exempt from II (but other taxes apply).

- Exchange Rate: Costs are in Brazilian reais (BRL), converted using the clearance date rate.

Example: Importing Athletic Shoes to São Paulo from China

Assumptions

- Description: 1,000 pairs of athletic shoes (rubber sole, textile upper)

- FOB Value: USD 20,000 (USD 20/pair)

- Freight: USD 800 (ocean shipment to Santos port)

- Insurance: USD 200

- HS Code: 6404.11 (athletic shoes, II rate 20%)

- IPI Rate: 10%

- ICMS Rate: 18% (São Paulo)

- PIS/COFINS Rates: PIS 1.65%, COFINS 7.6%

- Clearance Fees: BRL 600 (processing BRL 200 + broker BRL 400)

- Exchange Rate: Assumed on February 20, 2025, 1 USD = 5.50 BRL

Calculation Process

- Convert to BRL and Calculate CIF:

- FOB = USD 20,000 × 5.50 = BRL 110,000

- Freight = USD 800 × 5.50 = BRL 4,400

- Insurance = USD 200 × 5.50 = BRL 1,100

CIF = BRL 110,000 + BRL 4,400 + BRL 1,100 = BRL 115,500

- Import Tariff (II): II Rate = 20%

II = BRL 115,500 × 20% = BRL 23,100

- IPI: IPI Base = CIF + II = BRL 115,500 + BRL 23,100 = BRL 138,600 IPI Rate = 10%

IPI = BRL 138,600 × 10% = BRL 13,860

- ICMS: ICMS Rate = 18% ICMS Base = (CIF + II + IPI) ÷ (1 – ICMS Rate)

- ICMS Base = (BRL 115,500 + BRL 23,100 + BRL 13,860) ÷ (1 – 0.18)

- ICMS Base = BRL 152,460 ÷ 0.82 = BRL 185,951.22

ICMS = BRL 185,951.22 × 18% = BRL 33,471.22

- PIS/COFINS: PIS Rate = 1.65%, COFINS Rate = 7.6%, Total = 9.25% PIS/COFINS Base = (CIF + II) ÷ (1 – PIS Rate – COFINS Rate)

- PIS/COFINS Base = (BRL 115,500 + BRL 23,100) ÷ (1 – 0.0925)

- PIS/COFINS Base = BRL 138,600 ÷ 0.9075 = BRL 152,727.27

- PIS = BRL 152,727.27 × 1.65% = BRL 2,520.00

COFINS = BRL 152,727.27 × 7.6% = BRL 11,607.27

- Total Clearance Fees:

Total Clearance Fees = BRL 200 + BRL 400 = BRL 600

- Total Import Cost:

- Total Cost = CIF + II + IPI + ICMS + PIS + COFINS + Clearance Fees

Total Cost = BRL 115,500 + BRL 23,100 + BRL 13,860 + BRL 33,471.22 + BRL 2,520.00 + BRL 11,607.27 + BRL 600 = BRL 200,658.49

- Cost per Pair: