How to import power tools from China ? such as Circular Saw, Jigsaw, Reciprocating Saw (Sawzall), Table Saw, Miter Saw (Chop Saw), Band Saw, Tile Saw (Wet Saw), Scroll Saw, Plasma Cutter, Chainsaw, Cordless Drill, Hammer Drill, Impact Driver, Impact Wrench, Rotary Drill, Electric Screwdriver, Angle Drill, Magnetic Drill Press, Power Nailer (Nail Gun), Power Stapler, Angle Grinder, Bench Grinder, Die Grinder, Belt Sander, Orbital Sander, Disc Sander, Drum Sander, Oscillating Multi-Tool, Electric Planer, Wood Router, Router Table, Dremel Rotary Tool, Power Carver, Paint Sprayer, Heat Gun, Polisher (Buffer), Jackhammer (Demolition Hammer), Concrete Saw (Cut-Off Saw), Concrete Vibrator, Electric Hoist/Winch, Laser Level, Electric Pipe Threader, Rebar Cutter and Electric Caulking Gun.

China exports approximately $8 billion in power tools annually, accounting for 40% of the global market, driven by low costs, quality improvements, and efficient supply chains. The primary purposes of importing from China—reducing costs, accessing diverse products, and leveraging efficient supply chains—benefit markets like local wholesale, Amazon, eCommerce stores, and Shopify websites.

China’s power tool industry is the global manufacturing hub, with a total output value of approximately 150 billion RMB (about 22.5 billion USD) in 2021, and exports accounting for 40% of the global market. The industry is distributed across Guangdong (Dongguan, Shenzhen), Zhejiang (Ningbo, Wenzhou), Jiangsu (Suzhou), Shandong (Qingdao), and Fujian (Xiamen), benefiting from low labor costs (hourly wage about 4.5 USD) and a robust supply chain. Many international brands like Bosch, Makita, and DeWalt have factories in China. In recent years, cordless power tools (lithium battery-powered) and smart power tools (such as Wi-Fi-enabled drills) have grown rapidly, with the market size expected to reach 180 billion RMB by 2025.

Why Import Power Tools from China?

Importing power tools from China has become a key choice for global buyers, driven by factors such as cost advantages, product diversity, quality improvements, supply chain efficiency, innovation, and alignment with market demand.

- Significant Cost Advantage

The primary reason for importing power tools from China is its significant cost advantage, rooted in low labor and production costs.

- Labor Costs: China’s manufacturing hourly wage averages $4.5, compared to $22 in the U.S., $18 in Germany, and $20 in Australia. This gap directly reduces power tool prices—such as a basic drill may cost $10 ex-factory in China vs. $40 in Europe.

- Economies of Scale: China’s vast manufacturing base lowers unit costs through bulk production.

- Raw Material Costs: As the world’s largest steel and plastic producer, China offers cheaper inputs—such as steel at $600/ton in 2022 vs. $1,200/ton in the U.S., reducing power tool manufacturing costs.

- Market Impact:

- Local Wholesale: Low-cost sourcing allows wholesalers to distribute at competitive prices—such as $15 purchase, $25 sale, 66% margin.

- Amazon: Affordable tools attract price-sensitive buyers—such as a $20 Chinese drill outsells a $30 Western brand.

- Online Stores: Low costs boost margins—such as $10 purchase, $30 sale, 200% profit.

- Shopify Websites: Cheap tools optimize pricing—such as $25 sales retain high profits.

- Rich Product Diversity and Availability

Chinese manufacturers offer a broad range of power tools to meet diverse needs.

- Product Range: From basic drills and saws to advanced laser cutters and custom power tools.

- Customization: Factories adjust designs per client needs—such as a U.S. wholesaler can order 500W drills with specific colors and logos.

- Stock Availability: Suppliers maintain high inventory—Most of power tool suppliers claim 10,000 drills ready for immediate shipment, ideal for urgent orders.

- Market Impact:

- Local Wholesale: Diverse products meet retailer demands—such as sourcing drills and sanders together.

- Amazon: Wide tool variety attracts varied customers—such as DIY users and pros—boosting sales.

- Online Stores: Diverse lines increase traffic—such as offering saws, drills, and grinders.

- Shopify Websites: Custom power tools target niches—such as specialized sanders for woodworking enthusiasts.

- Quality Improvement and Technological Innovation

China’s power tool quality has improved significantly, with innovation enhancing competitiveness.

- Quality Enhancement: Many manufacturers meet ISO 9001 standards

- Technological Innovation: Firms develop smart tools—such as Roborock adapts robotics tech for Bluetooth-enabled drills with app-controlled speed.

- Battery Tech: Cordless tools feature high-performance lithium batteries—such as Ego’s 56V battery offers 1-hour runtime, rivaling Western brands.

- Market Impact:

- Local Wholesale: High-quality tools build retailer trust—such as 2-year warranty drills.

- Amazon: Reliable products boost ratings—such as 4.5-star Chinese saws.

- Online Stores: Innovative tools retain customers—such as smart drills enhance experience.

- Shopify Websites: High-tech tools differentiate—such as fast-charging tools stand out.

- Efficient Supply Chain and Logistics System

China’s advanced supply chain and logistics ensure timely delivery.

- Port Advantage: China hosts the world’s busiest ports—such as Shanghai handles over 40 million TEUs annually, connecting 200+ countries.

- Logistics Efficiency: 40-foot container shipping from Shanghai to Los Angeles takes 14-21 days; air freight takes 5-7 days—such as COSCO, OOCL or Maersk offer multiple weekly sailings to North America.

- Freight Forwarders: DHL , Fedexand UPS provide door-to-door service, streamlining customs.

- Market Impact:

- Local Wholesale: Fast delivery reduces stockouts—such as 30-day restocking.

- Amazon: Timely restocking maintains ratings—such as weekly FBA replenishment.

- Online Stores: Efficient shipping boosts satisfaction—such as 7-day delivery cuts returns.

- Shopify Websites: Optimized logistics lower costs—such as $1/unit sea freight.

- Trade Convenience and Policy Support

Trade agreements with China reduce import barriers.

- Free Trade Agreements: The China-New Zealand FTA (since 2008) sets power tool tariffs at 0%, cutting costs.

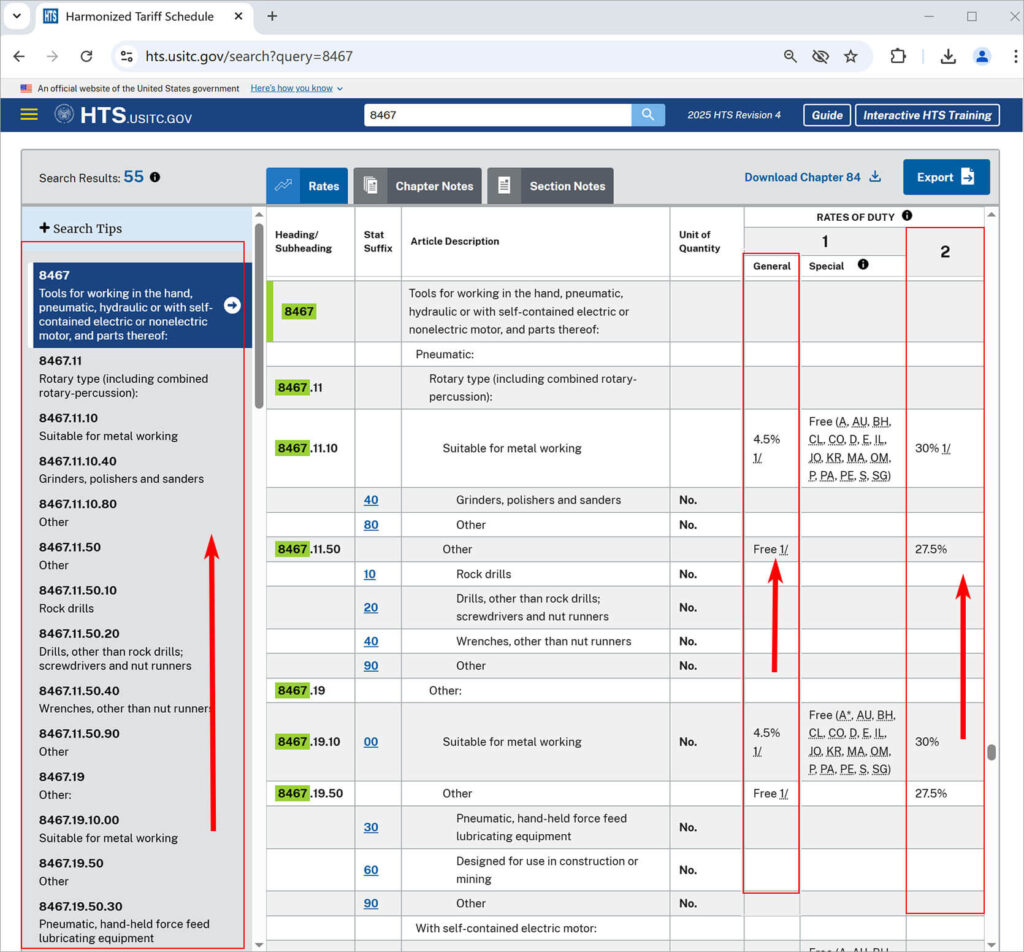

- WTO Framework: Without FTAs, WTO Most Favored Nation status keeps tariffs low—such as U.S. tariffs on HS 8467 tools from China are 2.8% vs. 10% for non-WTO nations.

- Market Impact:

- Local Wholesale: Low tariffs boost profits—such as 5% savings.

- Amazon: Reduced costs optimize pricing—such as $25 sales remain profitable.

- Online Stores: Lower taxes ease margins—such as hundreds saved on duties.

- Shopify Websites: Reduced costs enhance competitiveness.

- Market Demand Alignment and Scalable Production

China meets global demand with scalable production.

- Demand Matching: Tools align with DIY trends and construction growth—such as U.S. DIY market grew 10% in 2022, met by Chinese supply adjustments.

- Market Impact:

- Local Wholesale: Supports bulk purchases—such as 10,000-unit orders.

- Amazon: Meets high sales—such as 5,000 drills monthly.

- Online Stores: Supplies bulk stock—such as 1,000-unit minimums.

- Shopify Websites: Ensures stable supply—such as custom tools on demand.

Reasons to import power tools from China include low costs, diverse products, improved quality, efficient supply chains, trade benefits, demand alignment, and after-sales support, making it ideal for local wholesale, Amazon, online stores, and Shopify websites.

What Needs to Be Done Before Importing Power Tools from China?

Importing power tools from China is a complex business endeavor, requiring meticulous pre-import preparations across multiple stages: market research, supplier selection, legal compliance review, cost calculation, payment and contract arrangements, logistics planning, and quality control. This report, based on the latest information provides an exhaustive guide to each step, ensuring importers can execute the process efficiently and securely.

- Market Research

Market research of importing power tools is the foundational step to clarify demand and shape procurement strategies.

- Target Market Analysis: Identify the specific needs of the target market (such as USA, Europe, or Australia). For instance, DIY users may prefer compact drills, while construction firms need high-power saws. Analyze consumption habits—such as U.S. consumers favor multi-functional tools.

- Market Scale Assessment: Study market size and growth potential. Per Statista, the global power tool market was valued at $35 billion in 2022, projected to reach $45 billion by 2027. Determine your target market’s share.

- Competitor Analysis: Investigate key competitors (such as Bosch, Makita, DeWalt) for product lines, pricing, and positioning. For example, Makita drills range from $50-$150, targeting premium segments.

- Trend Insights: Track technological trends—cordless power tools account for 60% of the market (per industry reports), and smart tools (such as Wi-Fi-enabled drills) are gaining traction.

- Customer Segmentation: Define whether the target is retailers (such as Home Depot), wholesalers, or e-commerce platforms (such as Amazon), influencing tool types and volumes. Amazon sellers may need small, diverse batches.

- Seasonal Demand: Analyze seasonal fluctuations, such as increased DIY tool demand before Christmas.

- Supplier Selection

Selecting reliable suppliers is critical to import success, requiring systematic evaluation.

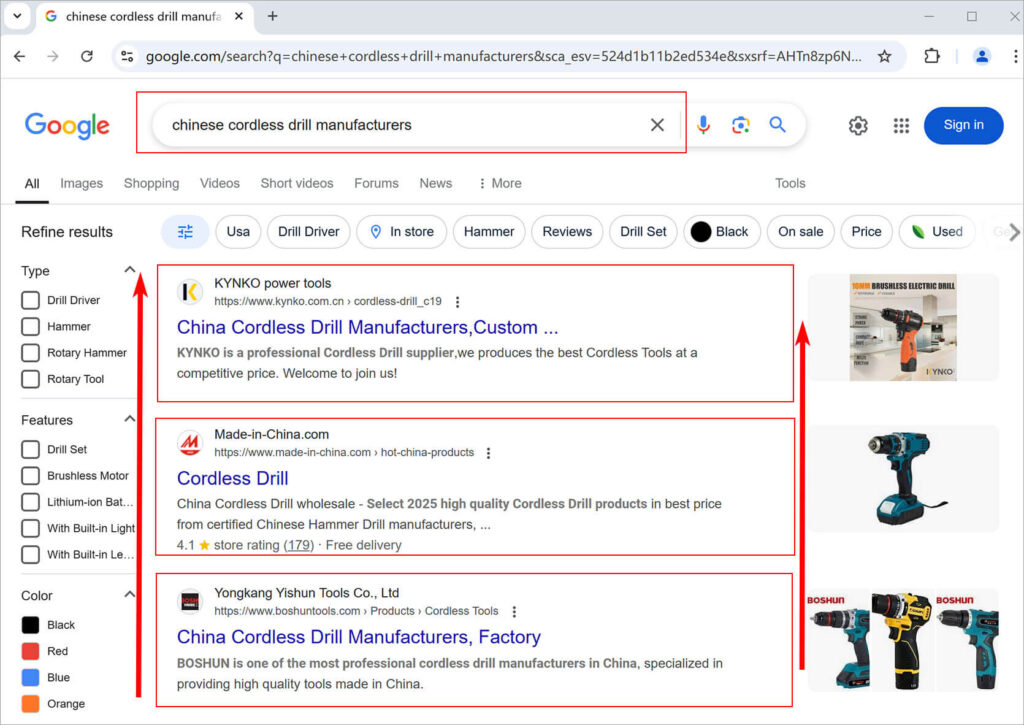

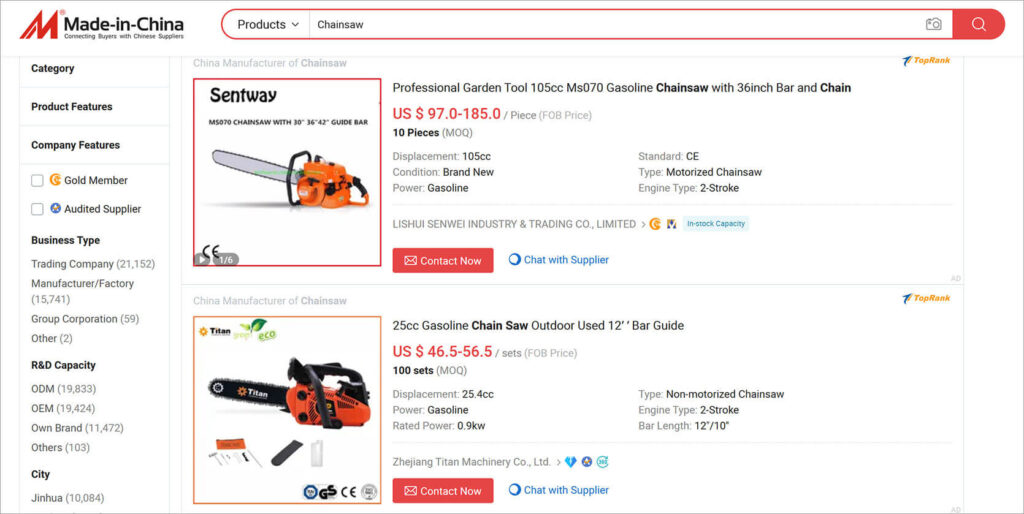

- Search Channels: Use online platforms like Google.com, Alibaba, 1688.com, Made-in-China, or attend trade fairs (such as Canton Fair) to find manufacturers. Search keywords like “power tools manufacturers or Chinese electric tools.”

- Background Check: Review suppliers’ registration years, export history, and customer feedback. Prioritize firms with over 5 years of experience and exports to Europe or the U.S.

- Certifications: Verify if suppliers hold ISO 9001 certification or other standards (such as TUV, SGS).

- Sample Testing: Request samples (such as drills, sanders) to test functionality, durability, and safety. For example, check a drill’s RPM and battery life.

- Production Capacity: Inquire about monthly output (such as 100,000 drills), minimum order quantity (MOQ, typically 500-1,000 units), and lead time (such as 30-45 days).

- Factory Visit: If budget allows, visit factories in person or via an agent to inspect equipment, production lines, and worker training. Confirm automation levels.

- Communication: Test suppliers’ English proficiency or prepare Chinese translation tools (such as Google Translate) for clarity.

- IP Verification: Ensure suppliers have rights to sell the tools, especially branded ones, to avoid legal issues. Request patent certificates.

- Legal and Regulatory Compliance

Ensuring power tools compliance with the importing country’s laws and standards prevents fines or seizures.

- Import Regulations: Contact the target country’s customs or trade authority. For example, U.S. Customs Service (CBP) requires UL compliance for power tools.

- Safety Standards: Research specifics like EU’s EN 60745 (hand-held tool safety), covering electrical safety, noise, and vibration limits.

- Certifications: Ensure suppliers provide documents like CE (Europe), UL (U.S.), or AS/NZS (Australia/New Zealand). UL requires electrical safety tests.

- Labeling & Manuals: Check for required labels (such as “Made in China,” voltage info) and multilingual manuals. The U.S. mandates English instructions.

- Battery Regulations: For lithium-battery tools, comply with transport rules (such as UN38.3) and local recycling laws.

- Restrictions: Verify tools aren’t on import ban/restriction lists—such as high-power laser cutters may be restricted.

- Customs Documents: Prepare commercial invoices, packing lists, and Certificates of Origin (Form A) to meet customs requirements.

- Cost Calculation

Thorough cost calculation ensures import profitability.

- Ex-Works Price (EXW): Negotiate per-unit prices with suppliers. A drill might cost $10-$20, depending on specs.

- Freight Costs: Estimate based on shipping method. A 20-foot container (33 cubic meters) from Shanghai to Los Angeles costs $3,000-$4,000; air freight is $5-$8/kg.

- Insurance: Typically 1.5% of cargo value—such as $150 for $10,000 worth of goods.

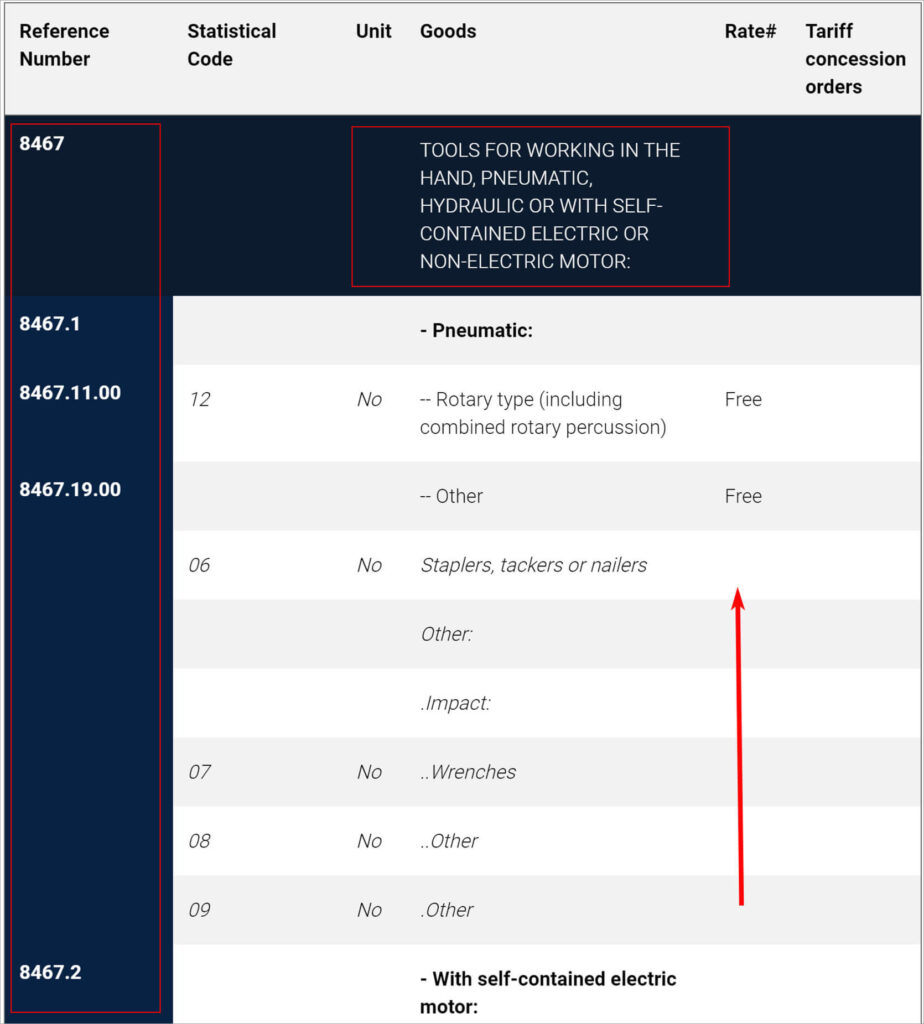

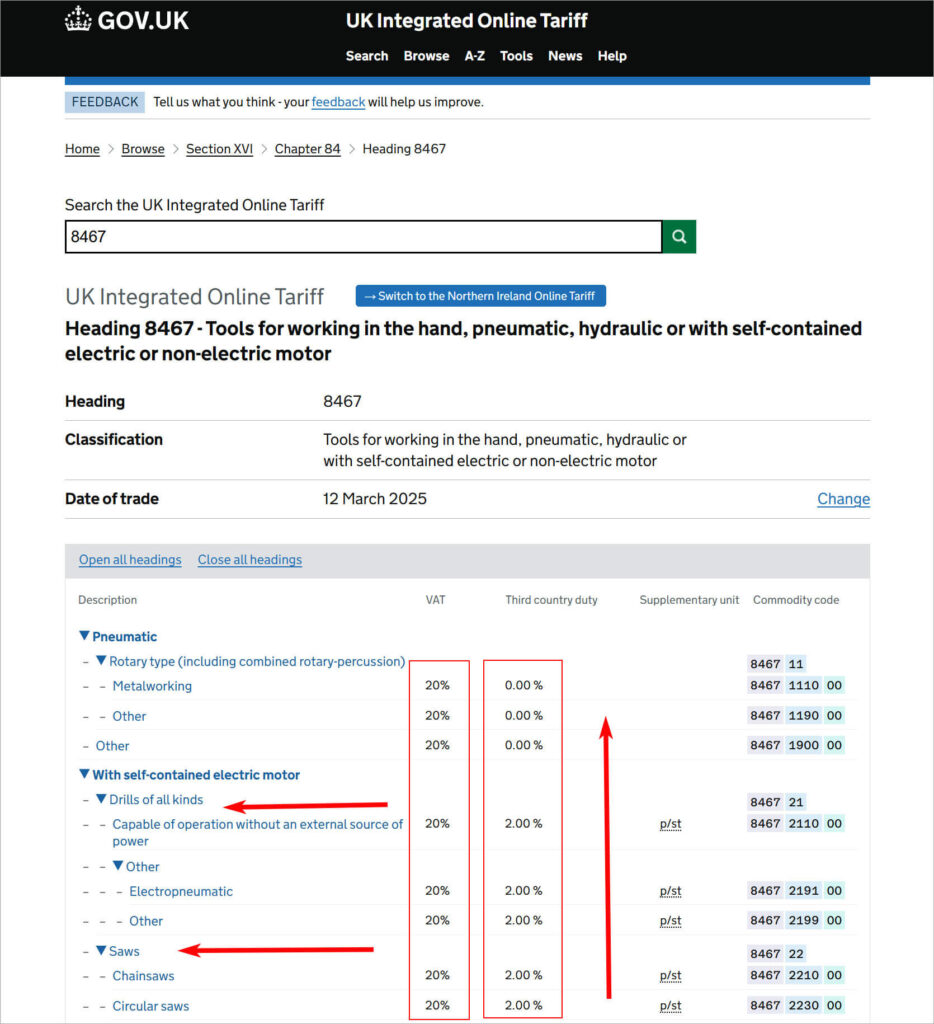

- Tariffs: Check HS 8467 rates for the target country. For the U.S., tariffs on Chinese power tools are 2.8% , calculated as CIF value × 2.8%.

- Port Fees: Include unloading ($200/container), terminal handling ($100-$300), and storage (if delayed).

- Inland Transport: From port to warehouse—such as 50 km from Los Angeles costs ~$500.

- Total Cost Formula: Total = EXW + Freight + Insurance + Tariffs + Port Fees + Inland Transport.

- Profit Analysis: Calculate landed cost per unit and compare to market price—such as $15 landed cost vs. $30 sale price yields 100% margin.

- Payment and Contract Terms

Secure payment and clear contracts protect both parties.

- Payment Methods:

- Letter of Credit (L/C): Bank-guaranteed, ideal for large orders (> $10,000), with ~1% bank fees.

- Telegraphic Transfer (T/T): 30% deposit, 70% before shipment—lower risk but requires trust.

- PayPal: For small orders (< $5,000), ~4% fees.

- Wise: For small orders ,and Wise offer different currency for your Chinese suppliers.

- Payoneer: Most of amazon or Shopify seller like to use Payoneer for small orders .

- Western Union: It’s same for small orders and fast ,it takes few minutes to get the payment .

- Contract Terms:

- Specifications: List model, power (such as 500W), color, and accessories.

- Quantity: Specify order size—such as 1,000 drills.

- Price: State currency (USD/CNY) and unit price.

- Delivery Date: Set a timeline—such as 45 days.

- Quality Standards: Require compliance with target market certifications (such as CE).

- Penalty Clause: 1% order value per week for delays.

- Dispute Resolution: Specify arbitration (such as Hong Kong) or applicable law (such as Chinese law).

- Incoterms: Choose FOB (seller handles pre-shipment), CIF (includes freight/insurance), or DDP (delivered duty paid).

- Logistics Planning

Efficient logistics ensure timely delivery.

- Shipping Options:

- Sea Freight: Ideal for bulk—20-foot container holds ~1,000 drills, costs low, takes 30-40 days.

- Air Freight: For small/urgent orders, 5-7 days, $5-$8/kg.

- Freight Forwarder: Hire agents like DHL, FedEx, or Maersk for shipping and documentation.

- Documents: Prepare commercial invoices, packing lists, bills of lading, and Certificates of Origin—ensure correct formats.

- Customs Clearance: Engage a customs broker, provide HS 8467 and documents, pay tariffs/VAT if applicable.

- Tracking: Use forwarders’ online tools to monitor shipment status in real-time.

- Quality Control

Ensuring quality prevents customer complaints.

- Third-Party Inspection: Hire third party like SGS, Intertek, or Bureau Veritas for pre-shipment checks.

- Inspection Standards:

- Functionality: Verify power tools work—such as drill meets RPM specs.

- Durability: Test lifespan—such as 1-hour continuous use without failure.

- Appearance: Check for scratches or damage.

- Packaging: Ensure sturdy, moisture/shock-resistant packing.

- Sampling: Use AQL standards—such as for 1,000 units, inspect 80, allow 2 defects.

- Issue Resolution: Negotiate returns/discounts for defects—such as 5% defective items warrant a 10% discount.

- Additional Preparations

- Communication: Account for China’s 8-12 hour time difference with the West—use email or apps like WhatsApp, with tools like Google for translation. Note: You must use VPN if you want to use Google in China.

- Funding: Reserve 20% extra capital for unexpected costs like freight hikes.

- Currency Management: Monitor CNY/USD exchange rates, use forex services to lock rates if paying in USD.

Table: Detailed Pre-Import Steps

| Step | Specific Tasks | Tools/Resources |

| Market Research | Analyze demand, competitors, trends, customer segments | Statista, Google Trends |

| Supplier Selection | Search platforms, background checks, sample testing, factory visits | Google, Alibaba, Made-in-China and Trade shows |

| Legal Compliance | Check regulations, confirm standards, prepare certifications/documents | CBP, EU Standards, AS/NZS |

| Cost Calculation | Calculate EXW, freight, insurance, tariffs, port fees, total cost | Freightos, USITC HTS |

| Payment & Contracts | Select payment method, draft contract (specs, quantity, price, delivery, quality), set Incoterms | Bank, ICC Incoterms |

| Logistics Planning | Choose shipping, hire forwarder, prepare documents, clear customs | DHL, Maersk, FedEx |

| Quality Control | Arrange inspections, define standards, sample checks, resolve issues | SGS, Intertek, AQL Standards |

| Extra Preparations | Communication, funding reserve, currency management | Google Translate, WhatsApp, Email |

Pre-import preparations for power tools from China involve market research, supplier selection, legal compliance, cost calculation, payment and contract arrangements, logistics planning, quality control, and additional steps. Thorough execution ensures a smooth, cost-effective, and quality-assured import process.

What certifications and compliance requirements must be met when importing power tools from China?

We must understand the certifications and requirements needed for power tools to successfully complete the import process. This is a crucial step. Importing power tools from China requires compliance with each country’s certifications, requirements, and plug specifications to ensure electrical safety, mechanical safety, environmental standards, and market compatibility. We detail these for major countries across North America, Europe, Asia, Australasia, Latin America, and Africa, including regulations, documentation, procedures, and plug types.

North America

- United States

- Certification: UL (Underwriters Laboratories) recommended but not mandatory, often required by retailers (such as Home Depot), UL 60745 tests electrical safety.

- Regulatory Requirements:

- CPSC Regulations: Per 16 CFR Part 1210, ensures no electrical or fire hazards.

- Labeling: English, with manufacturer name, model, voltage (120V), origin (Made in China), safety warnings.

- Plug Specifications:

- Type: NEMA 1-15 (ungrounded 2-pin) or NEMA 5-15 (grounded 3-pin), Type A or B.

- Voltage/Frequency: 120V, 60Hz.

- Details: NEMA 5-15 is standard, with round grounding pin and parallel flat pins.

- Documentation: Commercial invoice, packing list, bill of lading, UL test report, Declaration of Conformity.

- Additional Requirements:

- Laser Tools: FDA 21 CFR 1040 laser safety standards.

- Noise Tools: OSHA 29 CFR 1910.95, noise <90 dB.

- Battery Tools: UN38.3 transport standards, requires SDS.

- Procedure: Cleared via CBP, 2.8% tariff (HS 8467).

- Canada

- Certification: CSA (Canadian Standards Association) recommended, CSA C22.2 No. 60745 tests electrical safety.

- Regulatory Requirements:

- Regulations: Per Electrical Safety Authority Act, prevents leakage.

- Labeling: English and French, with manufacturer info, model, voltage, warnings.

- Plug Specifications:

- Type: NEMA 1-15 or NEMA 5-15, Type A or B, same as U.S.

- Voltage/Frequency: 120V, 60Hz.

- Details: NEMA 5-15 standard, grounding pin for safety.

- Documentation: Commercial invoice, packing list, bill of lading, CSA report.

- Additional Requirements:

- Noise Limits: OHSA standards, <85 dB.

- Battery Tools: Canadian Environmental Protection Act, requires recycling plan.

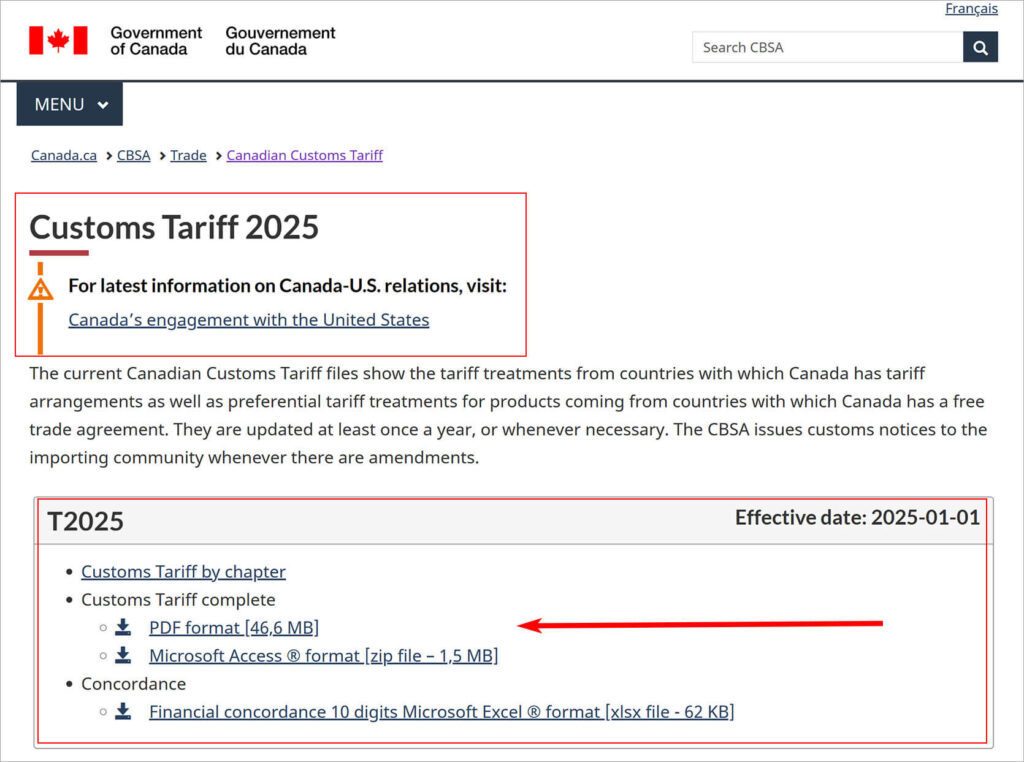

- Procedure: Cleared via CBSA, 2-5% tariff (CUSMA).

- Mexico

- Certification: NOM (Norma Oficial Mexicana), NOM-003-SCFI-2014 requires accredited lab testing.

- Regulatory Requirements:

- Safety Standards: Ensures electrical and mechanical safety.

- Labeling: Spanish, with manufacturer info, model, warnings.

- Plug Specifications:

- Type: NEMA 1-15 or NEMA 5-15, Type A or B, compatible with U.S./Canada.

- Voltage/Frequency: 127V, 60Hz.

- Details: 127V slightly higher than U.S., same plug design.

- Documentation: Commercial invoice, packing list, bill of lading, NOM report, Certificate of Origin.

- Additional Requirements:

- Battery Tools: LGEEPA, requires battery management plan.

- Procedure: Mexican customs clearance, 3-5% tariff (HS 8467).

Europe

- European Union

- Certification: CE marking, per Machinery Directive (2006/42/EC), EMC (2014/30/EU), RoHS (2011/65/EU), Low Voltage Directive (2014/35/EU).

- Regulatory Requirements:

- Technical Documentation: Includes blueprints, risk assessments, test reports, retained 10 years.

- Labeling: Member state languages (such as German, French), with CE mark, manufacturer info.

- Plug Specifications:

- Type: CEE 7/16 (ungrounded 2-pin, Type C) or CEE 7/7 (grounded, Type E/F hybrid).

- Voltage/Frequency: 230V, 50Hz.

- Details: CEE 7/7 fits France (E, round grounding pin) and Germany (F, side grounding strips).

- Documentation: Commercial invoice, packing list, bill of lading, Declaration of Conformity, technical files.

- Additional Requirements:

- Battery Tools: REACH (EC 1907/2006), restricts chemicals.

- Noise/Vibration: EN 60745, vibration <2.5 m/s².

- Procedure: EU customs clearance, 2.7% tariff (HS 8467).

- United Kingdom

- Certification: UKCA marking, per BS EN 60745 standards.

- Regulatory Requirements:

- Safety Standards: Similar to EU, ensures electrical safety.

- Labeling: English, with UKCA mark, manufacturer info.

- Plug Specifications:

- Type: BS 1363 (Type G, three rectangular pins).

- Voltage/Frequency: 230V, 50Hz.

- Details: Fused (3A/5A/13A), rectangular pin design.

- Documentation: Commercial invoice, packing list, bill of lading, Declaration of Conformity.

- Additional Requirements:

- Battery Tools: UK REACH regulations.

- Procedure: UK customs clearance, 2-3% tariff (HS 8467).

Asia

- Japan

- Certification: PSE certification, per Electrical Appliance and Material Safety Law, tested by JET or TUV.

- Regulatory Requirements:

- JIS Standards: JIS C 9335, ensures safety.

- Labeling: Japanese, with PSE mark, manufacturer info.

- Plug Specifications:

- Type: JIS C 8303 (Type A, ungrounded 2-pin).

- Voltage/Frequency: 100V, 50/60Hz (East 50Hz, West 60Hz).

- Details: Flat pins, similar to U.S. Type A but lower voltage.

- Documentation: Commercial invoice, packing list, bill of lading, PSE report.

- Additional Requirements:

- Noise/Vibration: Labor Safety and Health Law, <85 dB.

- Battery Tools: UN38.3 standard.

- Procedure: Japanese customs clearance, 0-2% tariff (Japan-China FTA).

- South Korea

- Certification: KC marking, per Electrical Appliances Safety Control Law, tested by KTL.

- Regulatory Requirements:

- Safety Standards: Prevents fire risks.

- Labeling: Korean, with KC mark, manufacturer info.

- Plug Specifications:

- Type: CEE 7/16 (Type C) or KS C 8305 (Type F, grounded).

- Voltage/Frequency: 220V, 60Hz.

- Details: Type F common, similar to German Schuko.

- Documentation: Commercial invoice, packing list, bill of lading, KC report.

- Additional Requirements:

- Battery Tools: Battery Safety Transport Regulations.

- Procedure: Korean customs clearance, 5% tariff (HS 8467).

- India

- Certification: BIS certification, some require CRO (such as IS 745).

- Regulatory Requirements:

- Safety Standards: Ensures electrical safety.

- Labeling: English and Hindi, with BIS mark.

- Plug Specifications:

- Type: IS 1293 (Type D/M, three round pins).

- Voltage/Frequency: 230V, 50Hz.

- Details: Type D (5A) small, Type M (15A) large, round pins.

- Documentation: Commercial invoice, packing list, bill of lading, BIS certificate.

- Additional Requirements:

- Battery Tools: Environmental Management Rules.

- Procedure: Indian customs clearance, 15% tariff (HS 8467).

Australasia

- Australia and New Zealand

- Certification: AS/NZS 60745 standards, no mandatory certification.

- Regulatory Requirements:

- Electrical Safety: Per Electrical Safety Acts.

- Labeling: English, with manufacturer info.

- Plug Specifications:

- Type: AS/NZS 3112 (Type I, three flat pins).

- Voltage/Frequency: 230V, 50Hz.

- Details: Flat V-shaped pins, grounding pin downward.

- Documentation: Commercial invoice, packing list, bill of lading, technical files.

- Additional Requirements:

- Battery Tools: Battery Disposal Regulations.

- Procedure: Australia 5% tariff, New Zealand 0% (China-NZ FTA).

Latin America

- Brazil

- Certification: INMETRO certification, per Portaria 371/2009.

- Regulatory Requirements:

- Safety Standards: Electrical and mechanical safety.

- Labeling: Portuguese, with INMETRO mark.

- Plug Specifications:

- Type: NBR 14136 (Type N, two or three round pins).

- Voltage/Frequency: 127V/220V, 60Hz (varies by region).

- Details: Round pins, three-pin grounded version standard.

- Documentation: Commercial invoice, packing list, bill of lading, INMETRO certificate.

- Additional Requirements:

- Battery Tools: Lei 12.305/2010 recycling law.

- Procedure: Brazilian customs clearance, 14% tariff (HS 8467).

Africa

- South Africa

- Certification: SABS certification, per SANS 60745.

- Regulatory Requirements:

- Safety Standards: Electrical and mechanical safety.

- Labeling: English and/or Afrikaans, with SABS mark.

- Plug Specifications:

- Type: SANS 164-1 (Type M, three round pins).

- Voltage/Frequency: 230V, 50Hz.

- Details: Large round pins, similar to India’s Type M.

- Documentation: Commercial invoice, packing list, bill of lading, SABS certificate.

- Additional Requirements:

- Noise Tools: OHS Act, <85 dB.

- Battery Tools: Environmental Management Act.

- Procedure: South African customs clearance, 10% tariff (HS 8467).

Table: Detailed Certifications, Requirements, and Plug Specifications

| Country/Region | Certification | Regulatory Standards | Label Language | Plug Specification | Voltage/Frequency |

| USA | UL (Rec.) | CPSC, OSHA | English | NEMA 1-15/5-15 (A/B) | 120V, 60Hz |

| Canada | CSA (Rec.) | Electrical Safety Act, OHSA | English/French | NEMA 1-15/5-15 (A/B) | 120V, 60Hz |

| Mexico | NOM | NOM-003-SCFI | Spanish | NEMA 1-15/5-15 (A/B) | 127V, 60Hz |

| EU | CE | 2006/42/EC, etc. | Member Languages | CEE 7/16/7 (C/E/F) | 230V, 50Hz |

| UK | UKCA | BS EN 60745 | English | BS 1363 (G) | 230V, 50Hz |

| Japan | PSE | JIS C 9335 | Japanese | JIS C 8303 (A) | 100V, 50/60Hz |

| South Korea | KC | Electrical Safety Law | Korean | CEE 7/16, KS C 8305 (C/F) | 220V, 60Hz |

| India | BIS+CRO | IS 745 | English/Hindi | IS 1293 (D/M) | 230V, 50Hz |

| Australia/NZ | AS/NZS 60745 | Electrical Safety Acts | English | AS/NZS 3112 (I) | 230V, 50Hz |

| Brazil | INMETRO | Portaria 371/2009 | Portuguese | NBR 14136 (N) | 127/220V, 60Hz |

| South Africa | SABS | SANS 60745 | English/Official | SANS 164-1 (M) | 230V, 50Hz |

Importing power tools from China requires meeting country-specific certifications, requirements, and plug specifications for safety and compatibility. Importers should verify the latest policies and ensure plug compliance.

Distribution of Power Tool Manufacturers in China

As the global leader in power tool manufacturing, China’s production hubs are concentrated in economically developed, industrially robust eastern coastal regions. We listed the key provinces and cities, power tool manufacturers, detailing the types of power tools each city produces, along with production scale, and technological features.

Power tools (such as drills, saws, sanders, HS code 8467) are essential for construction, DIY, and industrial use. China’s dominance stems from its low-cost labor, robust supply chains, and port access. According to the 2024 China Association of Machinery Industry data, Guangdong, Zhejiang, Jiangsu, Shandong, and Fujian account for over 80% of national output, leveraging industrial clusters and export-driven economies to form distinct regional production profiles.

Key Provinces and Cities and Their Primary Power Tool Types

- Guangdong Province

- Dongguan:

- Primary Power Tool Types: General-purpose tools, including drills (corded and cordless), saws (circular, jigsaws), sanders (orbital, belt), and grinders.

- Production Scale: Monthly output reaches millions, with up to 500,000 drills from a single line.

- Technological Features: Utilizes large-scale assembly lines, focusing on standardization and cost control, producing mid-to-low-end models with basic features (such as 500W drills, 1500 RPM).

- Economic Context: Located in the Pearl River Delta near Shenzhen and Hong Kong, Dongguan boasts dense industrial zones (such as Chang’an, Humen), a supply chain spanning plastics, metals, and electronics, and advanced logistics, contributing ~40% of Guangdong’s power tool exports annually.

- Market Positioning: Exports primarily to North America and Europe, meeting bulk demands from retailers (such as Amazon sellers) and wholesalers.

- Shenzhen:

- Primary Power Tool Types: High-tech and innovative tools, including cordless drills (lithium-powered), smart saws (with Bluetooth/Wi-Fi), and multi-tools (such as rotary cutters).

- Production Scale: Monthly output ~1 million units, with cordless tools comprising over 60%.

- Technological Features: Emphasizes R&D, featuring high-performance lithium batteries (18V or 36V), brushless motors, and smart controls (such as app-monitored RPM).

- Economic Context: Shenzhen, China’s electronics hub near tech giants (such as Huawei), leverages skilled talent and automated lines, integrating power tool production with cutting-edge tech.

- Market Positioning: Targets premium DIY and professional markets, such as tech-savvy consumers in North America and Japan.

- Dongguan:

- Zhejiang Province

- Ningbo:

- Primary Power Tool Types: General-purpose tools, including drills (impact, hammer), angle grinders, and impact wrenches.

- Production Scale: Monthly output ~3 million units, with drills at 50% and grinders at 30%.

- Technological Features: Focuses on durability and practicality, producing mid-power tools (such as 800W grinders, 125mm disc), suitable for extended use, often ISO 9001 certified.

- Economic Context: A key Yangtze River Delta port city with Beilun Port (annual throughput >100 million tons), Ningbo’s industrial zones (such as Cixi) host numerous mid-sized factories, driving over 50% of Zhejiang’s power tool exports.

- Market Positioning: Serves international markets, including U.S., Europe, and Australian construction and retail sectors.

- Wenzhou:

- Primary Power Tool Types: Small, lightweight tools, including mini drills (200-300W), rotary tools (such as engravers), and compact sanders.

- Production Scale: Monthly output ~2 million units, with small tools at 80%.

- Technological Features: Simple production processes prioritize low cost and portability, with compact designs (such as mini drills 15cm long, 0.5kg).

- Economic Context: Known for its small-commodity economy, Wenzhou’s industrial towns (such as Yongjia, Yueqing) feature agile SMEs and a nationwide logistics network.

- Market Positioning: Targets domestic DIY markets and smaller overseas importers, such as Southeast Asia and Africa.

- Ningbo:

- Jiangsu Province

- Suzhou:

- Primary Power Tool Types: High-quality and professional-grade tools, including drills (brushless), saws (chainsaws, reciprocating), and garden tools (such as pruning shears).

- Production Scale: Monthly output ~4 million units, with premium tools at 70%.

- Technological Features: Precision manufacturing with high-performance components (such as brushless motors, 1000+ hour lifespan), meeting global standards (such as CE, UL), often with 2-3 year warranties.

- Economic Context: In the Yangtze River Delta near Shanghai, Suzhou’s industrial parks host advanced manufacturing, attracting foreign investment and skilled labor.

- Market Positioning: Serves global premium brands and professional markets, such as Europe, North America, and Australia’s construction and gardening sectors.

- Suzhou:

- Shandong Province

- Qingdao:

- Primary Power Tool Types: Industrial-grade and heavy-duty tools, including heavy-duty drills (1200W+), industrial saws (band, table), and large grinders.

- Production Scale: Monthly output ~1.5 million units, with heavy tools at 60%.

- Technological Features: Focuses on high power and ruggedness (such as heavy drills with metal gearboxes), designed for harsh conditions, with noise/vibration control meeting industrial norms.

- Economic Context: A Shandong Peninsula industrial hub with Qingdao Port (annual throughput >200 million tons), near steel and machinery clusters.

- Market Positioning: Targets industrial users and large construction projects, such as domestic infrastructure and Middle Eastern markets.

- Qingdao:

- Fujian Province

- Xiamen:

- Primary Power Tool Types: General-purpose tools, including drills (basic 500W), saws (handheld), and sanders.

- Production Scale: Monthly output ~1.2 million units, with general tools at 90%.

- Technological Features: Standard production with simple, practical designs, ideal for bulk exports, offering stable quality but limited innovation.

- Economic Context: A special economic zone on the southeast coast, Xiamen’s industrial districts (such as Jimei, Haicang) benefit from proximity to Xiamen Port and export logistics.

- Market Positioning: Serves emerging markets, such as Southeast Asia, the Middle East, and Africa.

- Xiamen:

Regional Production Characteristics and Economic Drivers

- Guangdong (Dongguan, Shenzhen): Pearl River Delta manufacturing core; Dongguan excels in mass-produced general power tools, while Shenzhen leverages electronics for high-tech tools, driving over 50% of national exports.

- Zhejiang (Ningbo, Wenzhou): Yangtze River Delta port economy; Ningbo focuses on exported general tools, Wenzhou on small power tools for domestic and low-end markets.

- Jiangsu (Suzhou): High-end manufacturing hub, producing premium power tools with foreign investment and precision industry support.

- Shandong (Qingdao): Heavy industry base, crafting industrial-grade power tools for construction and engineering.

- Fujian (Xiamen): Export-driven economy, producing general power tools for emerging markets.

Table: Provinces, Cities, and Primary Power Tool Types

| Province | City | Primary Power Tool Types | Technological Features | Economic Context | Market Positioning |

| Guangdong | Dongguan | Drills, Saws, Sanders, Grinders | Mass assembly, standardized | Pearl River Delta, robust supply chain | North America, Europe retail/wholesale |

| Guangdong | Shenzhen | Cordless Drills, Smart Saws, Multi-tools | High-tech, brushless, smart | Electronics hub, R&D-driven | Premium DIY, professional markets |

| Zhejiang | Ningbo | Drills, Angle Grinders, Impact Wrenches | Durable, mid-power | Port city, export-focused | U.S., Europe construction/retail |

| Zhejiang | Wenzhou | Mini Drills, Rotary Tools, Small Sanders | Compact, low-cost | Small-commodity economy, SMEs | Domestic DIY, small importers |

| Jiangsu | Suzhou | High-Quality Drills, Saws, Garden Tools | Precision, high-performance | Yangtze Delta, foreign investment | Global premium/professional markets |

| Shandong | Qingdao | Heavy Drills, Industrial Saws, Grinders | High-power, rugged | Heavy industry, port access | Industrial, construction projects |

| Fujian | Xiamen | Drills, Saws, Sanders | Simple, practical, bulk | Special zone, export logistics | Southeast Asia, Middle East markets |

Chinese Power tool manufacturers are primarily located in Guangdong (Dongguan, Shenzhen), Zhejiang (Ningbo, Wenzhou), Jiangsu (Suzhou), Shandong (Qingdao), and Fujian (Xiamen). Each city’s economic backdrop and industrial strengths dictate its production of distinct tool types, meeting diverse global demands from DIY to ind

International Power Tool Trade Shows

Power tool trade shows are vital platforms for showcasing the latest power tool technologies and fostering global trade partnerships. These events cover a broad spectrum, from DIY home tools to industrial-grade equipment, attracting manufacturers, distributors, and buyers. This is a detailed list of power tool-related trade shows globally and in China, including names, countries, official website links, addresses, annual timing, and in-depth introductions to their unique features.

Trade Show Details

- International Hardware Fair (IHF)

- Country: Germany

- Official Website: https://www.eisenwarenmesse.de/en/

- Address: Koelnmesse GmbH, Messeplatz 1, 50679 Cologne, Germany

- Annual Timing: Biennial, typically the first full week of March (such as March 3-6, 2026)

- Highlights: The premier global hardware event, attracting over 2,800 exhibitors and 47,000 professionals across 144,000 square meters. The power tool section features drills, saws, and grinders for home and industrial use. Unique features include the “EISEN Award” for innovative tools, a “Trend Forum” with market insights and tech talks, and an “International Buyers’ Day” for one-on-one supplier meetings. Ideal for those seeking European market opportunities and cutting-edge trends.

- National Hardware Show (NHS)

- Country: USA

- Official Website: https://www.nationalhardwareshow.com/

- Address: Las Vegas Convention Center, 3150 Paradise Rd, Las Vegas, NV 89109, USA

- Annual Timing: First full week of May (such as May 6-8, 2025)

- Highlights: One of North America’s oldest hardware shows, drawing 1,500 exhibitors and 30,000 attendees over 70,000 square meters. The power tool zone showcases cordless drills to chainsaws, tailored for retailers and DIY markets. Features include a “New Product World” for launches, an “Inventors Spotlight” for startups, and a “Retailer Education Summit” on marketing strategies. Perfect for those targeting North American retail channels.

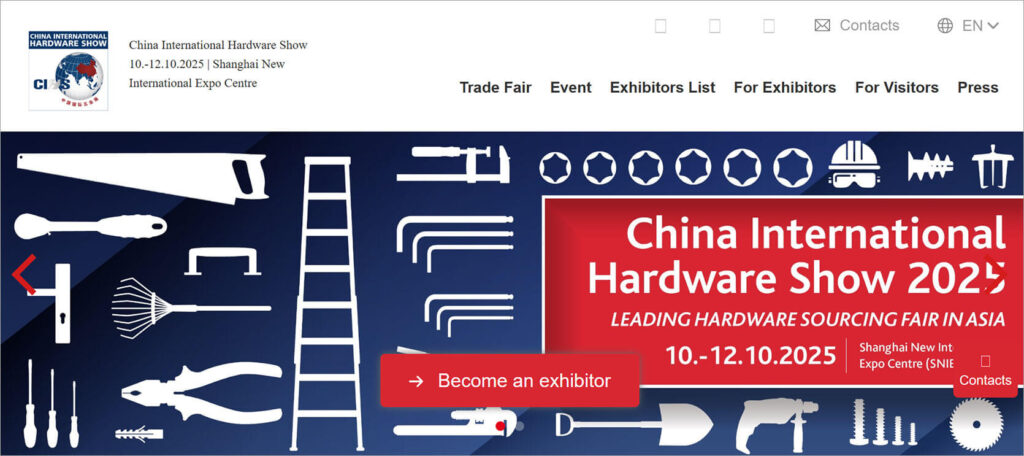

- China International Hardware Show (CIHS)

- Country: China

- Official Website: http://www.cihs.com.cn/

- Address: National Exhibition and Convention Center (Shanghai), 333 Songze Avenue, Qingpu District, Shanghai, China, Postal Code 201702

- Annual Timing: Mid-October (such as October 21-23, 2025)

- Highlights: China’s largest hardware tool exhibition, hosting 3,000+ exhibitors and 60,000 visitors across 160,000 square meters. The power tool section includes drills, sanders, and impact wrenches, focusing on export-ready products. Features include the “Asia Hardware Forum” on industry trends, an “Export Buyer Matchmaking Session” with translation, and a “New Product Launch” area. Ideal for global buyers sourcing from China.

- ToolTech Asia

- Country: Singapore

- Official Website: https://www.tooltechasia.com/

- Address: Singapore Expo, 1 Expo Drive, Singapore 486150

- Annual Timing: Last full week of March (such as March 25-27, 2025)

- Highlights: An emerging Asian industrial tool show, attracting 300 exhibitors and 15,000 visitors over 20,000 square meters. The power tool area features impact drills and smart saws, emphasizing industrial applications. Highlights include a “Tech Innovation Zone,” industry seminars with experts, and a “Southeast Asia Buyer Program” offering free lodging and transport. Suited for those eyeing Southeast Asian industrial markets.

- Power Tool World Expo

- Country: UK

- Official Website: https://www.powertoolworldexpo.co.uk/

- Address: National Exhibition Centre (NEC), North Ave, Marston Green, Birmingham B40 1NT, UK

- Annual Timing: Second full week of October (such as October 14-16, 2025)

- Highlights: Dedicated to power tools, drawing 200 exhibitors and 12,000 attendees across 15,000 square meters. Exhibits include drills, chainsaws, and sanders for construction and DIY. Features include a “Sustainable Tools Display” on eco-friendly tech, a “Live Demo Zone” for tool testing, and “Buyer Matching Services.” Great for those focused on European sustainability trends.

- China Tool Exhibition (CTE)

- Country: China

- Official Website: http://www.chinatoolfair.com/

- Address: Shenzhen World Exhibition & Convention Center, No. 1 Zhancheng Road, Fuhai Street, Baoan District, Shenzhen, China, Postal Code 518128

- Annual Timing: First full week of April (such as April 1-3, 2025)

- Highlights: A key Southern China tool show, hosting 1,200 exhibitors and 40,000 visitors over 80,000 square meters. The power tool section features saws, grinders, and cordless tools. Highlights include a “Smart Manufacturing Forum” on digitalization, an “International Trade Matchmaking Event” with multilingual support, and a “Tech Experience Zone” for hands-on trials. Ideal for South China manufacturers and tech-focused buyers.

- China International Power Tool and Hardware Expo (CPTHE)

- Country: China

- Official Website: http://www.cpthe.com/

- Address: Ningbo International Conference & Exhibition Center, 181 Huizhan Road, Yinzhou District, Ningbo, Zhejiang, China, Postal Code 315040

- Annual Timing: First full week of November (such as November 4-6, 2025)

- Highlights: A regional power tool-focused event, attracting 600 exhibitors and 25,000 visitors over 40,000 square meters. Exhibits include drills, garden tools, and impact wrenches, showcasing Zhejiang’s manufacturing prowess. Features include a “Quality Certification Seminar,” an “Innovation Product Zone,” and a “Cross-Border E-commerce Matchmaking” session. Suited for export-focused buyers and e-commerce sellers.

- Guangzhou International Hardware Exhibition (GIHE)

- Country: China

- Official Website: http://www.gzhardwareexpo.com/

- Address: China Import and Export Fair Complex (Area A), 1515 Yuejiang West Road, Haizhu District, Guangzhou, China, Postal Code 510308

- Annual Timing: Third full week of March (such as March 18-20, 2025)

- Highlights: A major South China hardware event, drawing 1,000 exhibitors and 50,000 visitors across 90,000 square meters. The power tool area includes saws to sanders for export and domestic markets. Features include a “Global Procurement Summit” for tailored buyer-supplier meetings, a “DIY Experience Zone” for home users, and a “Supply Chain Forum” on logistics optimization. Perfect for sourcing from South China and targeting DIY markets.

Table: Power Tool Trade Show Overview

| Trade Show Name | Country | Official Website | Address | Annual Timing | Key Highlights |

| International Hardware Fair (IHF) | Germany | eisenwarenmesse.de | Koelnmesse, Messeplatz 1, 50679 Cologne, Germany | 1st full week of Mar | EISEN Award, Trend Forum, Buyers’ Day |

| National Hardware Show (NHS) | USA | nationalhardwareshow.com | Las Vegas Convention Center, 3150 Paradise Rd, Las Vegas, NV 89109 | 1st full week of May | New Product World, Inventors Spotlight |

| China International Hardware Show (CIHS) | China | cihs.com.cn | NECC, 333 Songze Ave, Qingpu, Shanghai, China | Mid-October | Asia Forum, Export Matchmaking, New Launches |

| ToolTech Asia | Singapore | tooltechasia.com | Singapore Expo, 1 Expo Drive, Singapore 486150 | Last full week of Mar | Tech Zone, Seminars, SEA Buyer Program |

| Power Tool World Expo | UK | powertoolworldexpo.co.uk | NEC, North Ave, Marston Green, Birmingham B40 1NT, UK | 2nd full week of Oct | Sustainability Display, Demos, Buyer Matching |

| China Tool Exhibition (CTE) | China | chinatoolfair.com | Shenzhen World Exhibition Center, 1 Zhancheng Rd, Baoan, Shenzhen | 1st full week of Apr | Smart Forum, Trade Matchmaking, Tech Trials |

| China Int’l Power Tool Expo (CPTHE) | China | cpthe.com | Ningbo Int’l Exhibition Center, 181 Huizhan Rd, Yinzhou, Ningbo | 1st full week of Nov | Quality Seminar, Innovation Zone, E-commerce |

| Guangzhou Int’l Hardware Exhibition (GIHE) | China | gzhardwareexpo.com | Canton Fair Complex (Area A), 1515 Yuejiang W Rd, Haizhu, Guangzhou | 3rd full week of Mar | Procurement Summit, DIY Zone, Supply Chain |

Global and Chinese power tool trade shows include the International Hardware Fair, National Hardware Show, China International Hardware Show, ToolTech Asia, Power Tool World Expo, and China’s China Tool Exhibition, China International Power Tool and Hardware Expo, and Guangzhou International Hardware Exhibition. Each event offers unique features, from innovation showcases to market matchmaking, catering to diverse needs across the industry.

How to Source Chinese Power Tool Manufacturers or Factories?

China, as the global leader in power tool manufacturing, possesses a vast supplier ecosystem ranging from small workshops to large factories. Sourcing a suitable power tool manufacturer requires a systematic approach, combining the broad search capabilities of online platforms with the thorough verification of offline methods to ensure product quality, supply capability, and partnership reliability. We listed six methods for sourcing Chinese power tool suppliers: Google search, 1688.com, Alibaba, Global Sources, Made-in-China, and trade shows. Each method includes a step-by-step operational guide. More info check this Chinese Wholesale websites

Method 1: Google Search

Operational Steps:

- Keyword Strategy and Search Input:

- Enter keywords into the Google search bar, such as “Chinese power tool manufacturers,” “Zhejiang power tool factory,” or specific products like “Guangdong cordless drill supplier.”

- Use advanced search syntax: add quotes “” to define phrases (such as “China power tools”), minus – to exclude irrelevant terms (such as “-trading -distributor”), site restriction “site:.cn | site:.com -inurl:(alibaba 1688)” to lock onto standalone Chinese factory websites.

- Example: Enter “cordless power tools manufacturer China -alibaba -1688” to target independent manufacturer websites.

- Tools: Google Chrome (built-in translation and developer tools F12), Keyword Planner (free keyword suggestions).

- Search Result Filtering and Recording:

- Browse the first 20 pages (about 200-300 results), prioritize websites with “.cn” or “.com” domains, avoid “.org,” “.net,” or “.edu” (mostly non-commercial sites).

- Check webpage titles and descriptions, exclude ad links (marked “Ad”), blogs, or irrelevant content (such as news aggregation sites).

- Record 10-15 potential websites in an Excel table, including URL, company name, and initial impressions (such as “has factory pictures and contact information”).

- Example: Record “website link, Company name, shows production line photos.”

- Tools: Excel (with filtering and note columns), Wayback Machine (view website history to judge duration, free).

- Deep Website Content Analysis:

- Visit each website and check item by item:

- Product Pages: Detailed specifications (such as drill: 18V, 2000 RPM, torque 50 Nm, battery capacity 2000mAh), pictures (multi-angle, >3, clarity >1080p).

- Company Profile: Founding year (>5 years preferred, such as before 2018), registered capital (>1 million RMB), factory area (>5000 sqm), number of employees (>50 people).

- Certification Information: ISO 9001, CE, UL, RoHS (with certificate numbers, such as “CE12345,” verifiable), test reports (such as SGS certification).

- Factory Showcase: Production line pictures (>5, including equipment and workers), equipment list (such as CNC machines, injection molders, quality inspection tools).

- Check if there’s an English version page (indicating export capability), record contact methods (email, phone, WeChat, WhatsApp, Skype).

- Example: Website shows “Founded in 2008, factory 8000 sqm, CE certification, English page, phone +86-574-12345678,” added to candidates.

- Tools: Browser developer tools (right-click “Inspect” to view code update time, assess website maintenance status), Google Translate (translate Chinese pages).

- Visit each website and check item by item:

- Credibility and Background Investigation:

- Search the company name on Google with “review,” “scam,” “complaints,” or Chinese “评价” (reviews), “骗局” (scam), check feedback on external platforms like Trustpilot (ratings), Reddit (discussions), X (user comments), TianYanCha (Chinese enterprise credit inquiry, requires registration, about $10/month).

- Use Whois.com to check domain registration time (>5 years more credible, such as before 2015), registrant information (company name preferred over individual).

- Example: Search “Zhejiang ABC Tools scam,” if no negative records and domain registered in 2014, high credibility.

- Initial Contact and Information Collection:

- Send an email (template: “Dear Sir/Madam, I am looking for power tool suppliers, such as cordless drills. Please provide a product catalog, minimum order quantity (MOQ), sample cost, and delivery time. Are you a manufacturer? Can you provide a factory video?”).

- Call the website’s phone number (+86 prefix, use Skype to save on international fees, about $0.02/minute), ask key questions:

- Production capacity (such as “How many chainsaws can you produce monthly?”).

- Whether a factory (such as “Do you have your own production line?”).

- Sample policy (such as “How much is a drill sample? Including shipping?”).

- Request sample quotes (drill about $20-50, shipping $30-80) and factory video (5-10 minutes, including production line and equipment).

- Example reply: “We are a factory, 12 years established, MOQ 500 units, sample $30, shipping $50, video available,” high credibility.

- Tools: Gmail (track email delivery and read status, free), Skype or WhatsApp (real-time voice communication, Skype call fee about $0.02/minute), recording software (such as Audacity, free, record call details).

- Factory Identity Verification:

- Arrange a Zoom video call (30 minutes, pre-scheduled, such as Monday 10:00 Beijing time), request a showcase:

- Production line (such as drill assembly line with worker operations).

- Warehouse (such as inventory and packaging area).

- Quality inspection area (such as testing equipment like tachometers, torque testers).

- Request a business license copy (scanned, including company name, registered address, capital, unified social credit code), verify:

- Registered capital (>0.5 million RMB more reliable).

- Address matches website.

- Commission third-party verification:

- SGS (factory audit, about $300-500, including on-site photos and report).

- Or use third-party inspection company such as China Sourcing Agent

- Example: Business license shows “registered capital 5 million RMB, address Yinzhou District, Ningbo, Zhejiang,” video shows “20 injection molders, 50 workers assembling drills,” confirmed reliable.

- Tools: Zoom (video conferencing, free basic version)

- Arrange a Zoom video call (30 minutes, pre-scheduled, such as Monday 10:00 Beijing time), request a showcase:

Notes:

- Risks: Google results may mix traders or fake websites, requiring factory pictures, certifications, and videos to filter out; some websites may be unmaintained with no response.

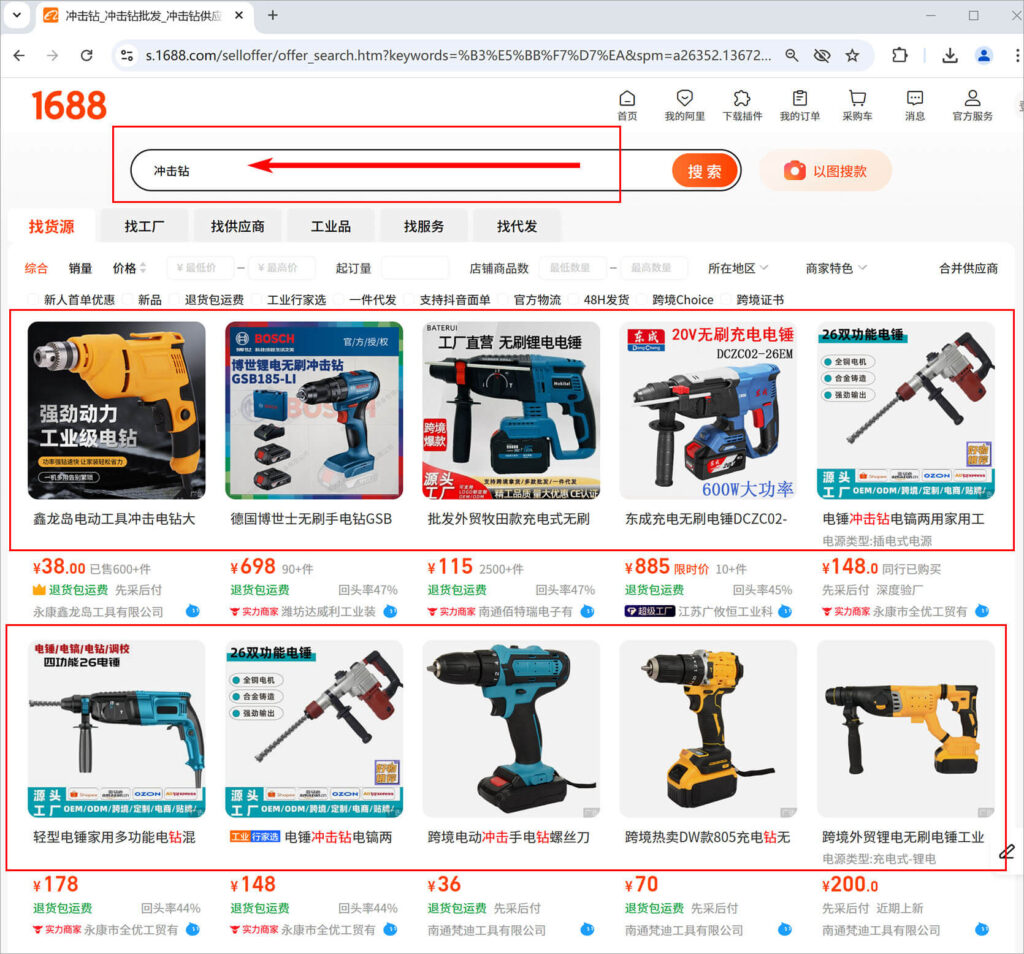

Method 2: Using 1688.com

Operational Steps:

- Account Registration and Platform Access:

- Open 1688.com, click “Free Registration” in the top right, register using a Chinese phone number (borrow from a friend or buy a virtual number, about $1-5) or email (such as [email protected]), enter verification code to activate.

- Set up Chrome browser translation plugin (right-click “Translate to English”), familiarize with the interface:

- Search bar (top).

- Filter options (left).

- Wangwang chat icon (shop pages).

- Example: Register with “[email protected],” receive verification code “123456,” complete in 5 minutes.

- Tools: Chrome (translation function), Taobao account (universal login for 1688, free), virtual phone number service (such as Hushed, $1.99/number).

- Keyword Search and Category Positioning:

- Enter Chinese keywords in the search bar, such as “power tools wholesale,” “drill manufacturer,” “grinder supplier,” or specific models like “18V cordless drill,” “600W sander.”

- Click the “Category” dropdown menu, select “Hardware Tools > Power Tools,” browse product lists (such as saws, sanders, impact wrenches).

- Example: Search “drill manufacturer,” results show 600+ shops, including wholesale and manufacturing.

- Tools: Screenshot tool (such as Windows Snipping Tool, free), Google Translate (translate Chinese to English, free).

- Screening Quality Suppliers:

- Click “Filter,” set the following conditions:

- “Location”: Guangdong (hardware hub, such as Dongguan), Zhejiang (tool base, such as Ningbo, Yongkang).

- Sort: Select “Comprehensive” (overall strength) or “Transaction Amount” (high to low).

- Tags: Check “Gold Supplier” (paid certification, high credibility), “Strength Merchant” (on-site verified).

- “Transaction Amount”: Filter >500,000 RMB (about $70,000).

- Check “Service Assurance” tags (such as “7-day no-reason return,” “48-hour shipping”).

- Example: After filtering, a shop shows “monthly transaction 1.2 million RMB, Gold Supplier, Ningbo, Zhejiang,” prioritized.

- Tools: Excel (record shop name, rating, transaction amount, location), calculator (convert RMB to USD, 1 RMB about $0.14).

- Click “Filter,” set the following conditions:

- Supplier Qualifications and Product Assessment:

- Enter the shop page, check item by item:

- Company Profile: Years established (>5 years, such as before 2019), registered capital (>500,000 RMB), factory address (specific to street, such as “No. 123某某路, Yinzhou District, Ningbo”).

- Main Products: Focused on power tools (such as drills, impact wrenches), detailed specs (such as “18V cordless drill, 2000 RPM, with 2Ah battery”), pictures (>5, including products and production line).

- Buyer Reviews: Rating >4.5/5, comment count >100, check positive (such as “good quality, fast shipping”) and negative (such as “not factory direct, inflated prices”).

- Check for “On-site Verified” badge (platform on-site inspection mark, higher credibility).

- Example: Shop shows “Established 2012, 6000 sqm factory, rating 4.8, on-site verified, monthly sales 1000 drills,” high credibility.

- Tools: TianYanCha (check enterprise credit, about $10/month, includes business info), screenshot tool.

- Enter the shop page, check item by item:

- Contact and Initial Communication:

- Click the “Wangwang” chat icon, send a message (such as “Hello, I need 500 drills, are you a factory direct supplier? Please provide a quote, sample cost, and delivery time, can you send a factory video?”).

- If no Chinese ability, use Google to translate (such as “Hi, I need 500 drills, are you a manufacturer? Please provide quote, sample cost, lead time, and factory video”), copy and paste.

- Record response time (<24 hours preferred) and content (such as “sample 150 RMB, MOQ 200 units, 15-day delivery”).

- Example: Supplier replies “We are a factory, sample 150 RMB, MOQ 300 units, video available,” worth following up.

- Tools: Ali Wangwang client (PC version, free download, requires registration), Whatsapp (add for further communication, free).

- Time: 1 hour (10 contacts, 6 minutes each).

- Cost: Free.

- Verification and Sample Procurement:

- Ask for specific factory address (such as “No. 123某某路, Yinzhou District, Ningbo, Zhejiang”), request a video showcasing the production line (10-15 minutes, including equipment like injection molders and worker operations).

- Request business license and on-site verification report (PDF format), verify:

- Company name matches shop.

- Registered capital (>500,000 RMB).

- Address matches.

- Pay sample fee through the platform (about 100-300 RMB, about $14-42, using Alipay or WeChat), arrange shipping (such as EMS, shipping $20-50), test quality (such as drill battery life, speed stability).

- Example: Video shows “10 injection molders, 50 workers assembling drills,” business license “registered capital 2 million RMB,” confirmed reliable.

- Tools: Alipay (payment, requires Chinese account, may need agent, agent fee about $50/time), Zoom (video verification, free), shipping service (such as DHL,Fedex, or UPS).

Notes:

- Risks: 1688.com mainly serves the Chinese domestic market, international buyers need agents (about $50-100/time) or translation support; some suppliers unfamiliar with English may delay communication.

- More details: about 1688.com ,please check here: How to buy from 1688.com

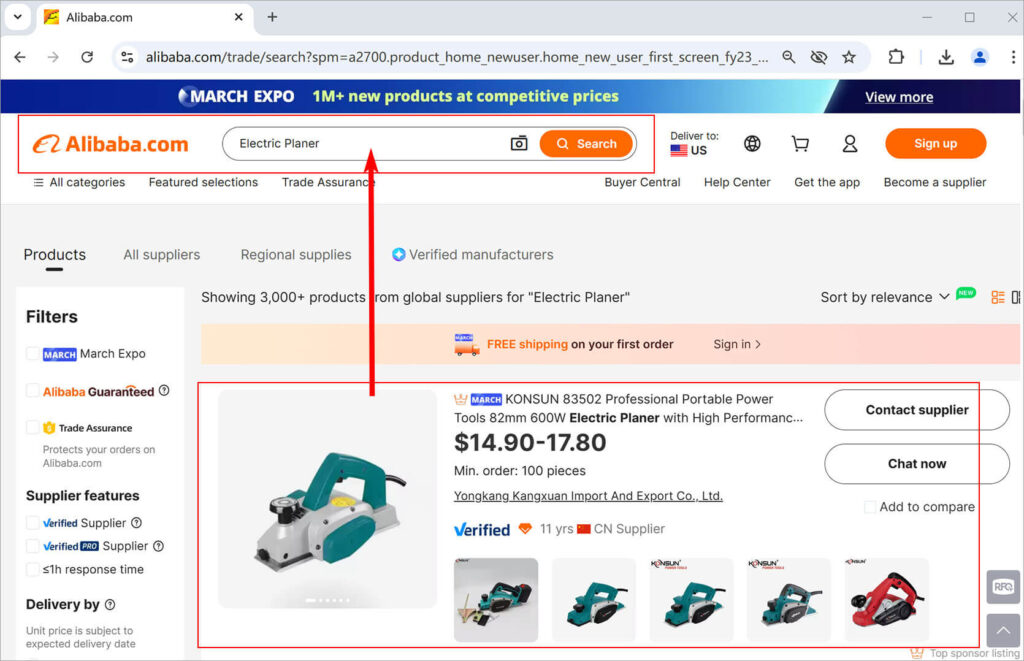

Method 3: Using Alibaba

Operational Steps:

- Account Registration and Login:

- Visit Alibaba.com, click “Join Free,” enter email (such as [email protected]), password, company name (such as “ABC Trading”), verify email and log in.

- Set language to English, save preferences (such as “Power Tools” category).

- Example: Register with “[email protected],” receive verification code “987654,” complete in 5 minutes.

- Tools: Chrome (sync account, free)

- Product and Supplier Search:

- Enter “power tools manufacturer China” in the search bar, or specific products like “cordless drill 18V supplier,” “angle grinder factory.”

- Click “Tools & Hardware > Power Tools” category, browse the first 10 pages (about 100-150 results).

- Example: Search “cordless drill manufacturer,” shows 60+ suppliers.

- Tools: Browser bookmarks (save searches, free), Google Sheets (online recording, free).

- Advanced Screening and Prioritization:

- Set in the left sidebar:

- “Supplier Location”: China.

- “Trade Assurance”: Check (offers refund protection).

- “Verified Supplier”: Check (on-site verified).

- Filter conditions:

- Response Rate >80%.

- Years on Alibaba >5 years.

- Transaction Level >3 diamonds (platform credibility metric).

- Example: After filtering, 20 remain, prioritize “5+ years Gold Supplier, 90% response rate, 4 diamonds.”

- Tools: Excel (record filter conditions and results), calculator (compare MOQ and prices).

- Set in the left sidebar:

- Detailed Supplier Review:

- Click shop page, check:

- Company Profile: Established time (>2015, such as 2010), export countries (>5, such as USA, Germany, Australia), employee count (>50).

- Certifications: ISO 9001, CE (with number, such as “CE98765”), SGS report (with test date).

- Products: Specs (such as chainsaw: 1200W, chain speed 15m/s, chain length 400mm), pictures (>5, multi-angle real shots).

- Feedback: Rating >4.5/5, comment count >50, check positive (such as “fast shipping, good quality”) and negative (such as “slow response”).

- Example: Supplier “Established 2012, exports to Europe and America, rating 4.7, CE certified, monthly sales 500 drills,” high credibility.

- Click shop page, check:

- Sending Inquiries and Communication:

- Click “Contact Supplier,” fill inquiry template (such as “Hello, I need 1000 18V cordless drills, please provide specs, MOQ, FOB price, and sample cost, can you send a factory video?”).

- Ask about factory status (“Can you show your production line via video?”), request sample (about $40-100) and video (5-10 minutes).

- Record replies (such as “MOQ 500 units, sample $40, 20-day delivery”), compare 3-5 suppliers.

- Example: Supplier replies “Factory direct, sample $45, 15-day delivery, video available,” worth following up.

- Tools: Alibaba TradeManager (instant chat tool, free)

- Verification and Trial Order:

- Request business license, export license (scanned copies), verify:

- Company name matches shop.

- Registered capital (>1 million RMB).

- Address matches.

- Pay sample fee via “Trade Assurance” (about $40-100, shipping $30-80), test power tool quality (such as drill speed, battery cycles).

- Commission third-party verification:

- Intertek (about $350/inspection, includes on-site report).

- Alibaba “Onsite Check” (about $200, platform service).

- Example: Business license “registered capital 3 million RMB, address Dongguan, Guangdong,” video “50 machines, 100 workers,” confirmed reliable.

- Tools: PayPal (alternative payment, 2.9% fee + $0.3), Wise ,Payoneer, Zoom (video verification, free).

- Request business license, export license (scanned copies), verify:

Notes:

- Risks: May encounter fake “Gold Suppliers,” need to verify transaction records and certificates; newly registered suppliers may be unstable, require caution.

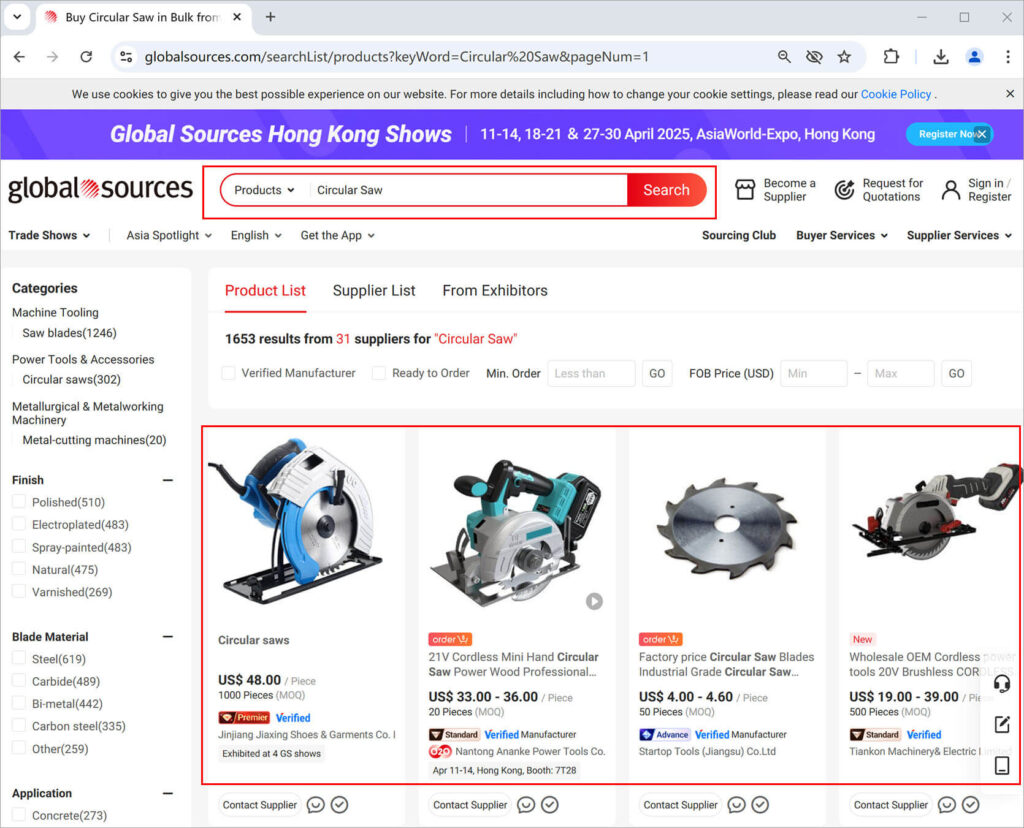

Method 4: Using Global Sources

Operational Steps:

- Platform Access and Account Setup:

- Open GlobalSources.com, click “Sign Up,” register a free account with email (such as [email protected]).

- Set search preferences (such as “Power Tools” category), adjust language to English.

- Example: Register with “[email protected],” complete in 3 minutes.

- Tools: Google Chrome (lightweight browser, free)

- Search and Initial Screening:

- Enter “power tools manufacturer China,” select “Hardware & Tools > Power Tools” category.

- Use “Advanced Search,” set “Country” to “China,” browse first 5 pages (about 50-70 results).

- Example: Search “impact wrench supplier,” shows 25 manufacturers.

- Tools: Notepad++ (record keywords, free), Google Keep (save notes, free).

- Condition Optimization and Sorting:

- Set filters:

- “Supplier Type”: Manufacturer.

- “Verified Supplier”: Check (on-site verified).

- “Export Experience”: >5 Years.

- Sort by “Product Listings” (>50 products preferred), check “Response Time” (<24 hours optimal).

- Example: After filtering, 12 remain, prioritize “10 years export experience, 60+ products, response <12 hours.”

- Tools: Excel (organize filtered data), Time Converter (coordinate China-US time difference, free).

- Time: 1.5 hours (filtering 1 hour, sorting 30 minutes).

- Cost: Free.

- Set filters:

- Supplier Qualification Assessment:

- View “Company Overview”:

- Factory area (>3000 sqm), production lines (>3), employee count (>50).

- Certifications: UL, CE, ISO 9001 (with number, such as “UL56789”).

- Export volume (>500,000 USD/year).

- Check “Product Showcase”: Specs (such as sander: 600W, 12000 OPM, with dust bag), pictures (>5, factory real shots).

- Example: Supplier “5000 sqm factory, CE certified, exports to USA, annual sales 800,000 USD, rating 4.6,” high credibility.

- Tools: LinkedIn (verify company staff, free).

- View “Company Overview”:

- Request Quotes and Communication:

- Click “Request for Quotation” (RFQ), fill in requirements (such as “500 cordless saws, 1200W, please provide specs, MOQ, and sample cost”), submit.

- Or email contact (“Hi, I’m sourcing grinders. Can you send specs, MOQ, sample terms, and factory video?”), request video (5-10 minutes).

- Record replies (such as “MOQ 300 units, sample $50, 20-day delivery”).

- Example: Supplier replies “Factory direct, 15-day delivery, sample $60, video available,” worth following up.

- Tools: Outlook (email management, free) or Gmail, WhatsApp (instant communication, free).

- Verification and Procurement:

- Request factory video (10-20 minutes), observe equipment (such as injection molders, assembly lines) and worker operations.

- Request business license and SGS report (PDF format), verify:

- Company name consistent.

- Registered capital (>1 million RMB).

- Pay sample fee via platform (about $50-150, shipping $30-50), test performance (such as sander smoothness, noise).

- Commission TUV (verification about $400/inspection, includes detailed report).

- Example: Video “20 machines, 100 workers,” business license “registered capital 2 million RMB,” confirmed reliable.

Notes:

- Risks: Small suppliers may outsource production, need video confirmation; some suppliers have limited coverage, require cross-platform comparison.

Method 5: Using Made-in-China

Operational Steps:

- Platform Registration and Access:

- Open Made-in-China.com, click “Sign Up,” register with email (such as [email protected]).

- Set language to English, familiarize with interface (such as “Search,” “Supplier List”).

- Example: Register with “[email protected],” complete in 3 minutes.

- Tools: Chrome browser (low memory usage, free)

- Search and Positioning:

- Enter “power tools factory China,” select “Power Tools” subcategory.

- Browse first 10 pages (about 100-120 results), record potential suppliers.

- Example: Search “cordless drill manufacturer,” shows 35 factories.

- Tools: Screenshot (such as Windows screenshot tool, free),

- Screening and Optimization:

- Set filters:

- “Supplier Type”: Manufacturer.

- “Audited Supplier”: Check (on-site verified).

- “Export Years”: >5 Years.

- Sort by “Company Scale” (employees >50), check “Response Rate” (<48 hours).

- Example: After filtering, 15 remain, prioritize “10 years export, 100 employees, response <24 hours.”

- Tools: Excel (record screening results), World Clock (check time difference, free).

- Set filters:

- Supplier Information Review:

- View “Company Info”:

- Registered capital (>1 million RMB), factory area (>4000 sqm), years established (>5 years, such as before 2018).

- Certifications: ISO 9001, CE (with number, such as “CE45678”).

- Export markets (>3 countries, such as UK, Japan).

- Check “Products”: Specs (such as chainsaw: 1200W, chain length 400mm, with guard), pictures (>5, real shots).

- Browse “Customer Feedback”: Rating >4.5/5, comment count >30, check reviews (such as “reliable supplier”).

- Example: Supplier “Established 2008, rating 4.6, exports to Europe, CE certified, monthly sales 300 units,” high credibility.

- Tools: Google (supplemental search, free)

- View “Company Info”:

- Contact and Inquiry:

- Click “Contact Now,” send message (such as “Hello, I need 800 sanders, please provide specs, MOQ, and sample cost, can you send a factory video?”).

- Request factory video (5-10 minutes) and sample (about $40-120).

- Record replies (such as “MOQ 400 units, sample $50, 15-day delivery”).

- Example: Supplier replies “Factory direct, sample $45, video available,” worth considering.

- Tools: WhatsApp (quick response, free)

- Verification and Procurement:

- Request business license, production license (scanned copies), verify:

- Company name consistent.

- Registered capital (>1 million RMB).

- Address matches.

- Pay sample fee via platform (about $40-120, shipping $30-80), test quality (such as chainsaw cutting efficiency, noise).

- Example: Video “30 machines, rating 4.7,” business license “registered capital 1.5 million RMB,” confirmed reliable.

- Request business license, production license (scanned copies), verify:

Notes:

- Risks: Some “Audited Suppliers” may be traders, need video and certificate verification; competition is high, premium suppliers may respond slowly.

Method 6: Attending Trade Shows

Operational Steps:

- Trade Show Selection and Travel Planning:

- Select relevant trade shows:

- China International Hardware Show (CIHS, October, Shanghai).

- Guangzhou International Hardware Expo (GIHE, March, Guangzhou).

- National Hardware Show (NHS, May, Las Vegas).

- Visit official websites (such as CIHS: http://www.cihs.com.cn/), check:

- Dates (such as October 21-23, 2025).

- Location (such as Shanghai National Exhibition and Convention Center).

- Ticket price (about $20-50).

- Book:

- Flights (such as USA to Shanghai round trip $800-1500).

- Hotel (such as Shanghai 4-star $100/night, 3 nights $300).

- Example: Plan CIHS in October, budget travel cost $2000.

- Tools: Google Flights (flight comparison, free), Booking.com (hotel booking, free), Google Calendar (schedule planning, free).

- Select relevant trade shows:

- Obtaining Exhibitor List and Screening:

- Download “Exhibitor List” PDF (such as from CIHS website), or email organizer (such as [email protected]) to request full list.

- Search “Power Tools” or “电动工具” in PDF, screen 20-30 relevant exhibitors.

- Example: List shows “Ningbo ABC Tools Company, main products drills and saws, booth A123.”

- Online Pre-Research and Preparation:

- Visit exhibitor websites, check:

- Products (such as drill: 18V, 2000 RPM; sander: 600W, 12000 OPM).

- Company profile (established >5 years, employees >50).

- Contact info (email, phone, WeChat, WhatsApp).

- Prepare question list (such as “What’s the MOQ?” “Sample cost?” “Delivery time?”), print business cards (about $20/100, including company name, phone, email).

- Example: Exhibitor “Ningbo ABC Tools, established 2010, exports to Europe and America, phone +86-574-12345678,” added to targets.

- Visit exhibitor websites, check:

- On-Site Participation at the Trade Show:

- Arrive at venue (such as Shanghai National Exhibition and Convention Center), bring:

- Camera (phone, 12MP+).

- Notebook (for recording).

- Power bank (10000mAh, about $20).

- Visit target booths (20-30), take product photos (such as saw cutting demo), test power tools (drill feel, noise, weight), collect business cards.

- Record booth numbers, product features (such as “drill lightweight, durable battery, 18V”), initial impressions.

- Example: Booth A123 shows “18V cordless drill, MOQ 500, sample $40, smooth testing.”

- Tools: Camera (such as phone)

- Arrive at venue (such as Shanghai National Exhibition and Convention Center), bring:

- Face-to-Face Negotiation and Information Collection:

- Talk to exhibitors, ask:

- Production capacity (such as “Monthly output 100,000 drills?”).

- Sample policy (such as “Sample $40, including shipping?”).

- Delivery time (such as “20 days?”).

- Request factory video (5-10 minutes, including production line) or arrange on-site factory visit (such as “Can I visit your factory tomorrow?”).

- Example: Exhibitor replies “Factory in Ningbo, monthly output 150,000 units, sample $50, welcome to visit,” builds initial trust.

- Talk to exhibitors, ask:

- Follow-Up and Verification:

- After the show, organize business cards (20-30), send emails (such as “Thank you for meeting at CIHS, please provide product catalog, MOQ, and sample terms, can we arrange a video check?”).

- Pay sample fee (about $30-100, shipping $30-80), receive via courier (such as DHL, shipping $30-80), test quality (such as saw cutting wood efficiency, battery life).

- Verify factory via Zoom video (30 minutes, check equipment and workers), or commission SGS (about $500/inspection, includes on-site report).

- Example: Sample “drill torque meets standard, 18V,” video “50 machines, 100 workers,” confirmed reliable.

Notes:

- Risks: Language barriers require translation support (on-site translation about $100/day); crowded shows need pre-booked key exhibitors; some exhibitors may be traders, not factories.

Table: Comparison of Methods for Finding Chinese Power Tool Suppliers

| Method | Suitable For | Language Requirement | Advantages | Disadvantages |

| Google Search | Beginners | None/English | Free search, broad coverage, high flexibility | Mixed with traders, complex verification |

| 1688.com | Chinese Speakers | Chinese/Translation | Low prices, rich domestic resources | Difficult for international orders, language barrier |

| Alibaba | International Buyers | English | Trade assurance, many suppliers, internationalized | Fraud risk, requires trial order |

| Global Sources | Asia/Europe/US Buyers | English | Export-oriented, fast response, quality control | Smaller coverage, slightly higher cost |

| Made-in-China | Small/Medium Buyers | English | Easy verification, many small/medium factories, user-friendly | Identity needs verification, high competition |

| Trade Shows | Long-term Partners | English/Translation | Face-to-face trust, high reliability, direct experience | High cost, requires travel and planning |

Through Google search, 1688.com, Alibaba, Global Sources, Made-in-China, and trade shows, you can comprehensively and efficiently find Chinese power tool manufacturers. Each method offers unique advantages tailored to different needs:

- Google Search: Suitable for initial exploration and flexibility.

- 1688.com: Ideal for low prices and domestic resources.

- Alibaba: Best for international procurement and assurance.

- Global Sources: Great for export markets and quick responses.

- Made-in-China: Perfect for small/medium buyers and verification ease.

- Trade Shows: Optimal for building long-term partnerships and hands-on experience. Combining online screening (search, assessment, contact) with offline verification (video, samples, third-party audits) ensures reliable factories are identified, with attention needed for language communication, qualification checks, and quality testing.

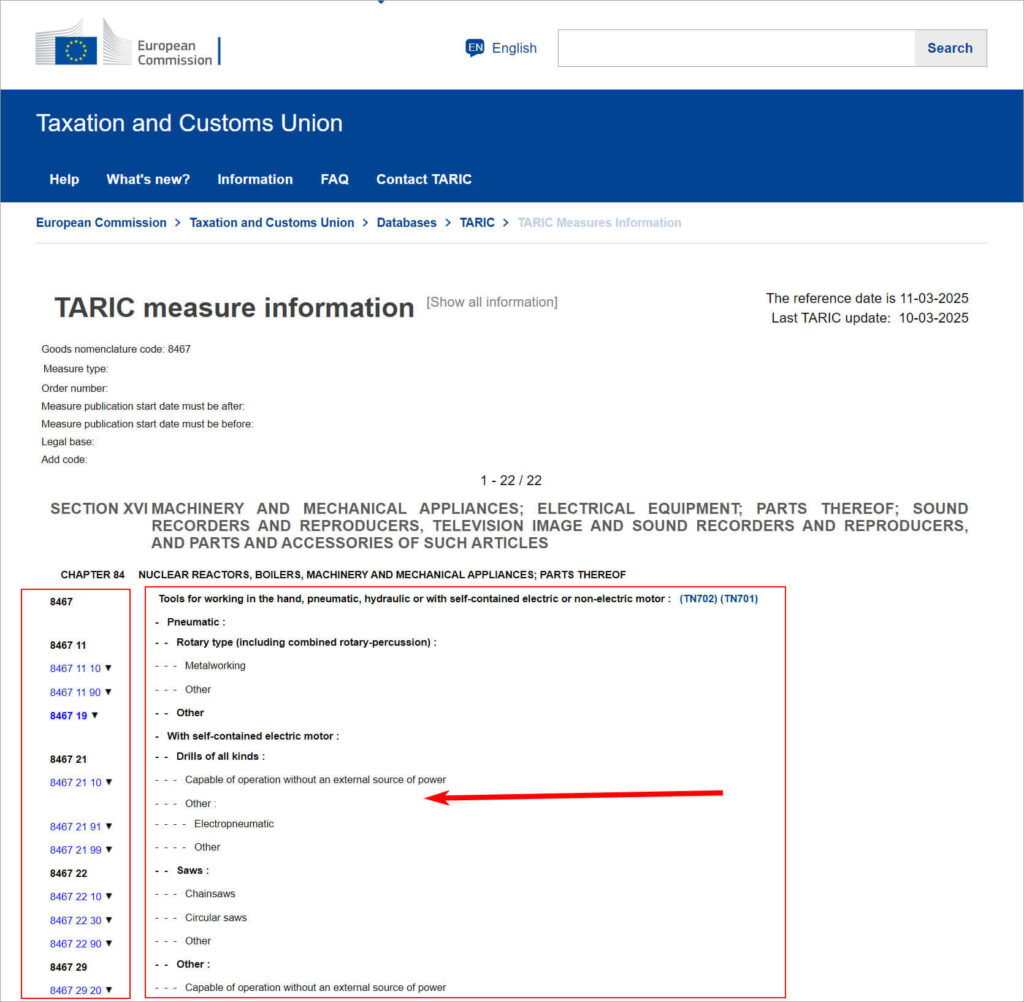

Importing Power Tools from China to EU: HS Codes, Tariff Rates, and Duty Calculation

The EU is one of the world’s major power tools markets, with a market size of approximately 12 billion EUR in 2022, emphasizing quality, safety, and environmental standards. The Low Voltage Directive (2014/35/EU) and EMC Directive (2014/30/EU) ensure tools meet safety and electromagnetic compatibility standards, while the RoHS Directive (2011/65/EU) restricts hazardous substances. European brands such as Bosch (2022 tool sales approximately 4 billion EUR), Hilti, and Stanley Black & Decker dominate, but Chinese-made tools are sold under European brands or private labels, such as Aldi and Lidl’s own-brand tools. Demand growth focuses on cordless tools (lithium battery-powered, 50% of the market) and smart tools (such as Bluetooth-enabled sanders), with environmental trends driving low-energy designs.

The EU’s total imports under HS 8467 were approximately 3.9 billion EUR, with imports from China at about 1.8 billion EUR, accounting for 46%. Specific subcategories:

- HS 846781 (drills): Total imports of 500 million EUR, with China at 55%, valued at 275 million EUR, mainly cordless drills, reflecting DIY and construction demand.

- HS 846711 (circular saws, blade diameter >200mm): Total imports of 300 million EUR, with China at 40%, valued at 120 million EUR, commonly used in construction and woodworking.

- HS 846721 (grinding tools with wheels): Total imports of 250 million EUR, with China at 45%, valued at 112.5 million EUR, including angle grinders and sanders.

- Battery-powered tools: Such as impact wrenches, with imports of about 200 million EUR in 2022, China at 50%, valued at 100 million EUR, reflecting environmental trends and cordless demand.

- Trend Analysis: From 2018 to 2022, China’s exports to the EU grew by 10%. Influenced by the US-China trade war, some US orders shifted to the EU. After supply chain disruptions during the 2020 pandemic, imports rebounded, reaching a record high in 2022.

Table: EU Power Tool Imports from China

| HS Code | Total Imports (million EUR) | Imports from China (million EUR) | China’s Share (%) | Main Product Types |

| 8467 (Total) | 3900 | 1800 | 46 | Hand-held tools |

| 846781 (Drills) | 500 | 275 | 55 | Cordless drills |

| 846711 (Saws) | 300 | 120 | 40 | Construction circular saws |

| 846721 (Grinders) | 250 | 112.5 | 45 | Angle grinders, sanders |

| Battery Tools | 200 | 100 | 50 | Impact wrenches, etc. |

China is the primary source of EU power tool imports, accounting for 46%, driven by low costs and supply chain efficiency. The growing demand for battery-powered tools may further increase imports in the future.

Detailed Table of Power Tools, HS Codes, and Tariff Rates

| No. | Item Name | HS Code (CN) | EU Tariff Rate (%) | Description & Remarks |

| 1 | Hand-held Drill | 84672110 | 2.7% | Power <1000W, for domestic or professional drilling |

| 2 | High-power Drill | 84672190 | 2.7% | Power >1000W, with impact function |

| 3 | Chain Saw | 84672210 | 2.7% | Hand-held, for wood cutting |

| 4 | Circular Saw | 84672230 | 2.7% | Circular blade, for straight cuts in wood or metal |

| 5 | Reciprocating Saw | 84672290 | 2.7% | Other hand-held saws, such as reciprocating or jigsaw |

| 6 | Band Saw | 84672290 | 2.7% | Portable band saw, under “other” category |

| 7 | Angle Grinder | 84672951 | 2.7% | Power <2000W, for metal or stone grinding |

| 8 | Die Grinder | 84672959 | 2.7% | Straight grinder, for precision work |

| 9 | Bench Grinder | 84672985 | 2.7% | Stationary, for tool sharpening |