Today, we will discuss tariffs and VAT on imports from China to the EU. EU import tariffs are taxed according to product classification, goods value and the origin of the goods. I suggest that when importing from China to the EU, we must understand the relevant import taxes. If we do not know the import tariffs in the early stage and buy products directly from China, we may buy EU anti-dumping products against China (we will pay tariffs several times higher than the products). The prep work is very important to us on import tariffs.

This article mainly shares how to check import duties, VAT ,Calculation of Customs Duties and anti-dumping products list from China.

This article has three main sections:

Section 1: Import duties from China to the EU

Section 2: VAT in the EU

Section 3: Calculation of Customs Duties

Section 4: The List of EU anti-dumping products against China

EU members include the following:

Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain , Sweden, United Kingdom.

Section 1: Import duties from China to the EU

First of all , we need to know how to check import customs duties ? What is the import duty rate ? Normally, Import tax rates are based on the products from China. The EU gives preferential policies to many Chinese products and even zero tariffs. So choosing a product is very important from China to the EU.

Note: Import customs duties may change at any time. Please check the import duties before importing from China. If you don’t know how to check it, you can contact us to help you out.

1. How to check the goods code(HS code)

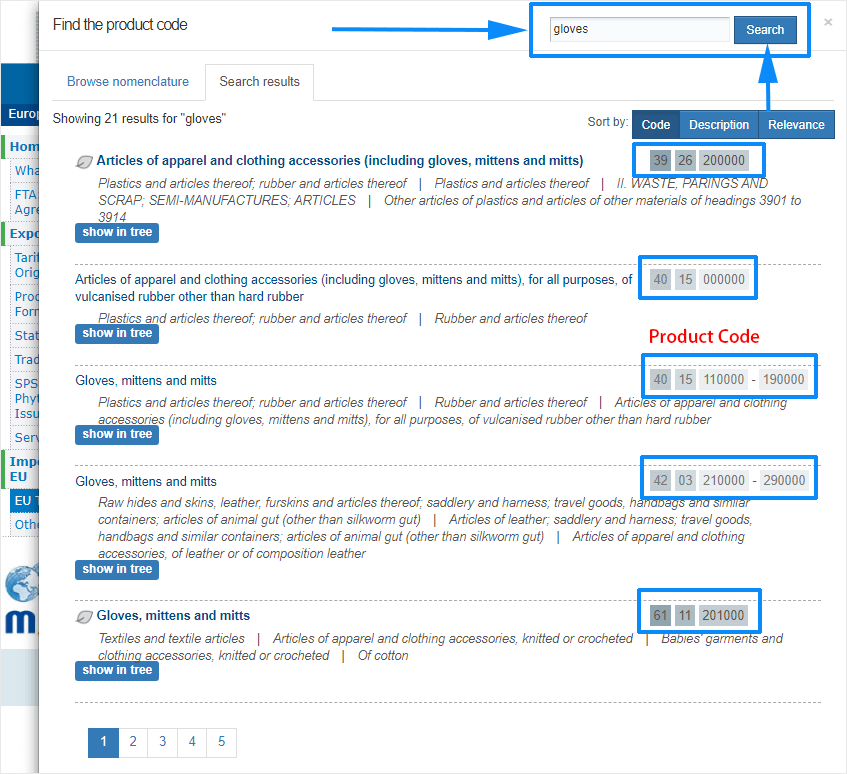

We can check the exact import tariff rates if knowing the code of the goods. The tax rate is different for each product, and the HS code determines how much tax you have to pay.

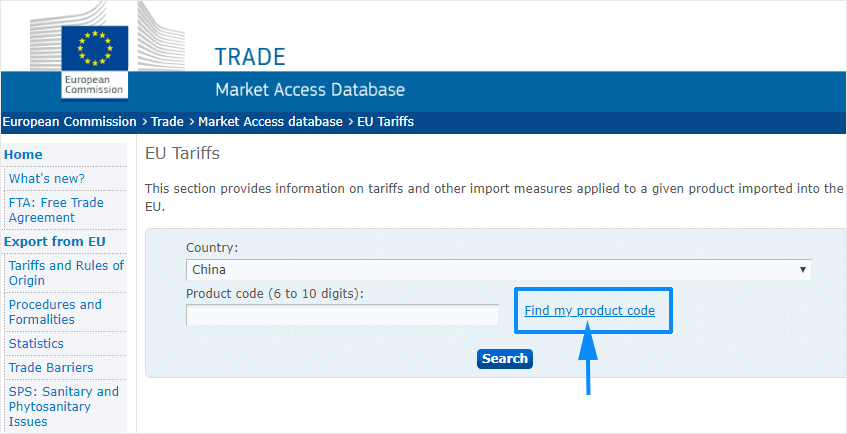

Open the website of the HS code: https://madb.europa.eu/madb/euTariffs.htm , then click the “Find my product code”

Enter your product name ,then click “Search”

There are a lot of product codes shown in your search. The same product, the product code will be different (because the materials are different). So you can choose the right product code for your goods.

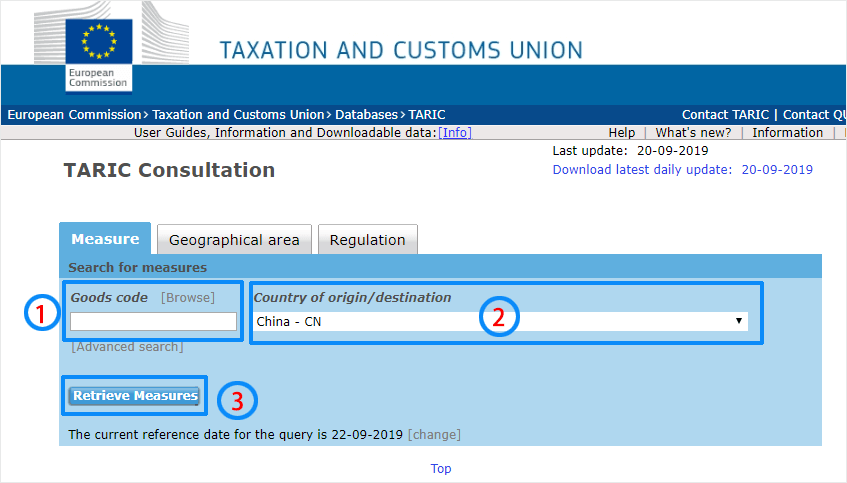

2. Check the Customs duty rate

There are two ways to check import tariffs, which are officially owned by the European Union. The search result data is the same.

1.) Import customs duty rate 1

2.) Import customs duty rate 2

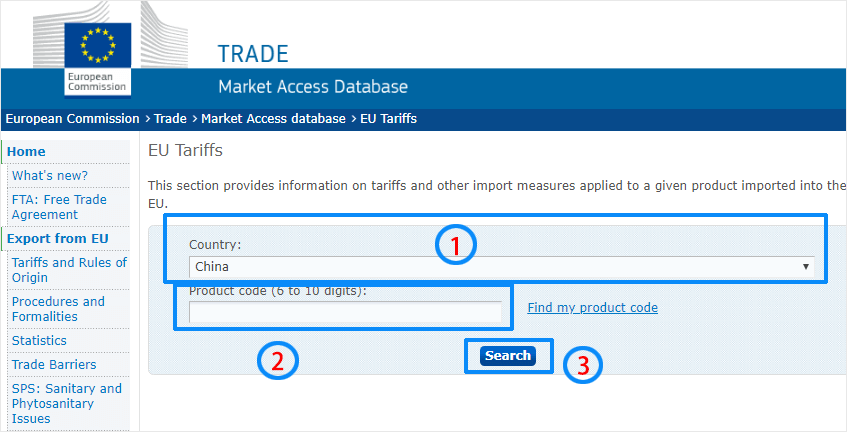

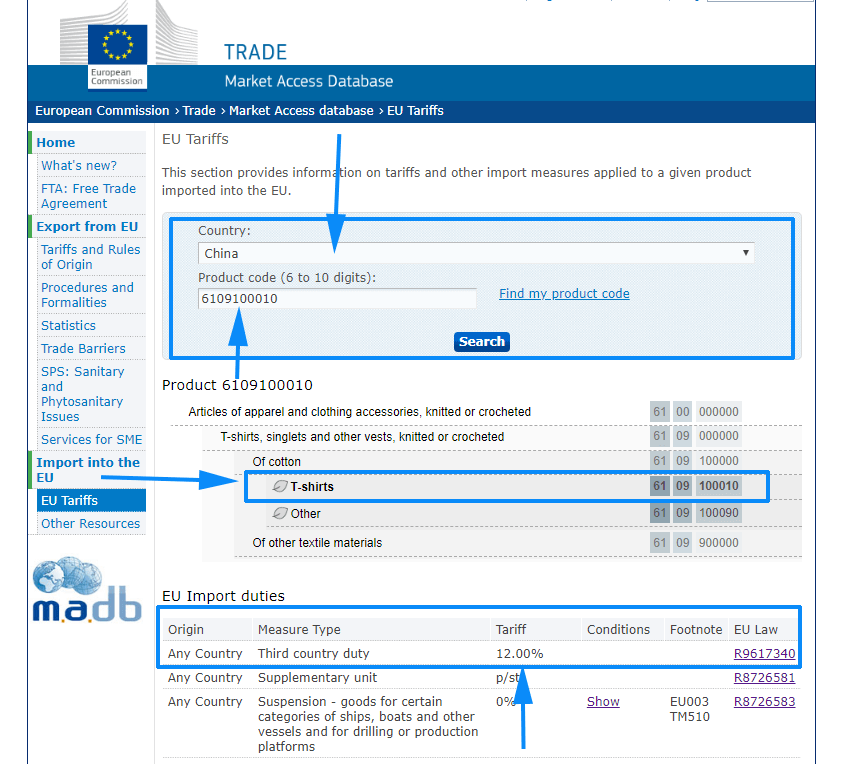

Fill in the Goods code and Country of origin: China, then click Search.

3. Example Customs duty rates in the EU

Let us check at the most popular product tariffs as below:

| Goods Name | Goods Code (HS) | Customs Duty Rate |

| T-shirt | 6109100010 | 12% |

| Jackets | 6203429000 | 12% |

| Briefs and Panties | 6108000000 | 12% |

| Sports Footwear | 6402200000 | 17% |

| Hat | 6504000000 | 0% |

| Bags & Suitcases | 4202000000 | 3% |

| Yoga mat | 4016910000 | 2.50% |

| Binoculars | 9005100000 | 4.20% |

| Scarf | 5800000000 | 8% |

| Toy | 9503003000 | 0% |

| Vacuum Flasks | 9617000000 | 6.70% |

| Gloves | 6116000000 | 8% |

| Towel | 4803000000 | 0% |

| Furniture | 9403200000 | 0% |

| LED Bulb | 8539500000 | 3.70% |

| Candle | 3406000000 | 0% |

| Toothbrush | 9603210000 | 3.70% |

| Helmet | 6506910000 | 2.70% |

Section 2: VAT in the EU

List of VAT rates applicable to Member States in the EU. Products exported to the EU are subject to relevant import customs duties and VAT taxes (usually imposed on the CIF of the goods), and VAT must be paid in accordance with the regulations of different importing countries. The average VAT is around 21%.

| Member States | Code | Super-reduced Rate |

Reduced Rate |

Standard Rate |

Parking Rate |

| Belgium | BE | – | 6 / 12 | 21 | 12 |

| Bulgaria | BG | – | 9 | 20 | – |

| Czech Republic | CZ | – | 10 / 15 | 21 | – |

| Denmark | DK | – | – | 25 | – |

| Germany | DE | – | 7 | 19 | – |

| Estonia | EE | – | 9 | 20 | – |

| Ireland | IE | 4.8 | 9 / 13.5 | 23 | 13.5 |

| Greece | EL | – | 6 / 13 | 24 | – |

| Spain | ES | 4 | 10 | 21 | – |

| France | FR | 2.1 | 5.5 / 10 | 20 | – |

| Croatia | HR | – | 5 / 13 | 25 | – |

| Italy | IT | 4 | 5 / 10 | 22 | – |

| Cyprus | CY | – | 5 / 9 | 19 | – |

| Latvia | LV | – | 12 | 21 | – |

| Lithuania | LT | – | 5 / 9 | 21 | – |

| Luxembourg | LU | 3 | 8 | 17 | 14 |

| Hungary | HU | – | 5 / 18 | 27 | – |

| Malta | MT | – | 5 / 7 | 18 | – |

| Netherlands | NL | – | 9 | 21 | – |

| Austria | AT | – | 10 / 13 | 20 | 13 |

| Poland | PL | – | 5 / 8 | 23 | – |

| Portugal | PT | – | 6 / 13 | 23 | 13 |

| Romania | RO | – | 5 / 9 | 19 | – |

| Slovenia | SI | – | 9.5 | 22 | – |

| Slovakia | SK | – | 10 | 20 | – |

| Finland | FI | – | 10 /14 | 24 | – |

| Sweden | SE | – | 6 / 12 | 25 | – |

| United Kingdom | UK | – | 5 | 20 | – |

Tips: About more VAT info in the EU,please download this file: VAT rates-EU 2019

Section 3: Calculation of Customs Duties

The customs duties you need to pay is based on the CIF price including shipping. Customs duties are paid according to the following.

1.) Goods Value

2.) Country of origin

3.) Product classification

4.) Shipping costs

For example, if you want to import gloves from China to the UK, the customs duties for gloves is 8%, and VAT is 20% in the UK.

The value of the product is 1000 euros, the freight is 200 euros, the tariff you need to pay is 96 euros, and the VAT is 240 euros. The total tax is 336 euros.

Note: Customs duties are not included: customs clearance fees, shipping, insurance, destination fees.

Now you can calculate all the expenses when you import products from China. Using this way ,we can accurately estimate the cost price of the product.

Section 4: The List of EU anti-dumping products against China

In recent years, China’s foreign trade has developed rapidly, with many types of export products, large quantities, and strong competitiveness in terms of price. Especially the trade surplus of European and American countries, so China has become one of the main targets of anti-dumping.

China is one of the countries that have suffered the most anti-dumping. What are the EU anti-dumping products against China? I will sort out a list of anti-dumping products for your reference.

- Chamois Leather

- Electric Bicycles/Bicycles

- Steel Products

- Aluminium Radiators

- Persulphates

- Pneumatic Tyres

- Lever Arch Mechanisms

- Ironing Boards

- Oxalic Acid

- Tartaric Acid

- Tungsten Electrodes

- Hot-rolled SteelSheet Piles

- Threaded Tube or Pipe CastFittings

- Ceramic Tableware and Kitchenware

- Steel Ropes and Cables

- Organic Coated Steel Products

- Aluminium Foil in Rolls

- Seamless Pipes and Tubes of Stainless steel

- Seamless pipes and tubes of iron or steel

- Hand Pallet Trucks and Their Essential Parts

- Corrosion Resistant Steels

- Cast Iron Articles

- Citric acid

- Ceramic Tiles

- Open Mesh Fabrics of Glass Fibres

- Barium Carbonate

- Coated Fine Paper

- Certain hot-rolled flat products of iron,non-alloy or other alloy steel

- Cold rolled flat steel products

- Okoumé plywood

Tip: It’s best to avoid these anti-dumping products when we choose a product from China. We can choose the same products from other countries to reduce the customs duties .

Conclusion:

I think you can also accurately calculate the tariffs on products trough these above sections on EU import duties and VAT. If you still don’t know how to calculate customs duties and related fees after reading this article, please contact us and we will reply to all your questions within 24 hours.

At the same time, we provide purchasing, transportation (air, sea and express), customs clearance and duties services in Europe (One-stop service from China to EU and Door to Door). Kindly email us if you are interested.

We would like to quote the exact shipping cost inlcuded the customs & duties to you after getting your product name, product images, Goods value, packing list, destination and shipping method.

Welcome to leave a message & comments here ,we will get back to you within 24 hours .

I am looking for 2.4 x 1.2m OSB 3 T&G boards 18mm thickness. Shipped to Merseyside U.K. L374AN

Thanks

Martin